Member LoginDividend CushionValue Trap |

Recent Data Indicates US Consumer Spending Holding Up Well, Online Sales Surging

publication date: Dec 30, 2020

|

author/source: Callum Turcan

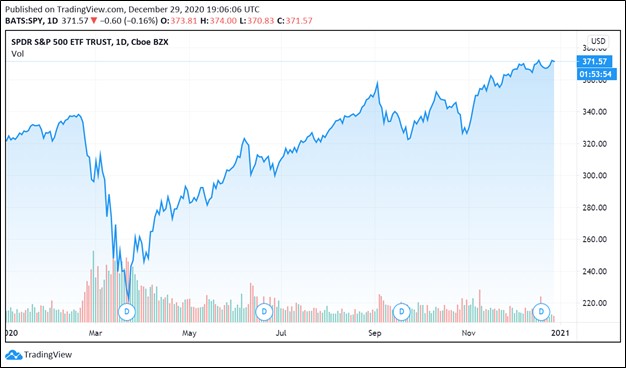

Image Shown: As of this writing, the S&P 500 (SPY) appears ready to end 2020 on a high note, supported by the resilience of the US consumer. By Callum Turcan The ongoing coronavirus (‘COVID-19’) pandemic accelerated the shift towards e-commerce, and that change has long legs. Retailers that previously invested in their digital operations and omni-channel sales capabilities were able to capitalize on this shift while those that relied heavily on foot traffic were hurt badly. Numerous retailers went under in 2020 including J.C. Penney Company Inc (JCPNQ) and Neiman Marcus. Holiday season shopping data indicates that US consumer spending was frontloaded and grew modestly in 2020, aided by surging e-commerce sales, which advanced nearly 50% on a year-over-year basis. The recent passage of additional fiscal stimulus measures in the US supports the outlook for the domestic economy going forward. Omni-Channel Sales Capabilities Key According to data provided by Mastercard Inc (MA), US retail sales ex-auto grew by 3.0% during the October 11 to December 24 period versus the same period last year. Please note US retail sales ex-auto grew by 2.4% year-over-year during the November 1 to December 24 period, indicating demand was frontloaded as holiday promotions were launched earlier in the year to avoid bottlenecks. The COVID-19 pandemic has aggressively driven up demand for e-commerce and home delivery fulfillment options, and retailers wanted to better position themselves to meet demand. E-commerce sales during the October 11 to December 24 period were up a whopping 49.0% year-over-year according to data provided by Mastercard. Some retail categories were big winners while others were big losers during this past holiday shopping season. Apparel, department stores, jewelry, and other luxury items all posted year-over-year declines in sales during the October 11 to December 24 period according to data provided by Mastercard. Though e-commerce sales advanced year-over-year for the apparel, department stores, and jewelry categories during this period, that was apparently not enough to offset the material drop off in foot traffic. According to data provided by third-party research firms Sensormatic Solutions and Placer.ai, foot traffic during the Black Friday shopping event was about half levels seen last year based on their estimations. The retail category winners include electronics & appliances, furniture & furnishings, grocery, and home improvement according to data provided by Mastercard, as each category posted year-over-year sales growth during the October 11 to December 24 period. E-commerce sales for items in the furniture & furnishings and home improvement categories were both up by double-digits. Additionally, according to third-party research firm Digital Commerce 360, US e-commerce sales of groceries appear to have surged higher in 2020 as households sought to socially distance. Companies that invested heavily in their omni-channel sales capabilities were much better positioned to meet demand in 2020 than those that had to quickly catch up. Home delivery, buy-online pickup in-store, and buy-online curbside pickup were popular fulfillment options. These fulfillment options will likely continue to be popular going forward, in our view, as households have adopted new ways of shopping. Greater scale in this space can have a powerful impact on a retailer’s margins, especially given the incremental costs of fulfilling these types of transactions (particularly home delivery) compared to traditional means (going to the store, picking out the item, and lining up at a cashier to pay in person). We added Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) to the Dividend Growth Newsletter portfolio November 27 (link here) to gain exposure to two retailers with strong omni-channel sales capabilities. Home Depot also provides exposure to the very healthy housing and home improvement market, as existing home sales and prices have also been robust. Many consumers are finding that pre-COVID-19 living and at-home working quarters have been inadequate and are upgrading to larger homes or renovating existing ones to accommodate their needs. Both Dick's Sporting Goods and Home Depot have put up tremendous fundamental performance of late in the face of meaningful headwinds related to the outbreak of COVID-19. We covered Dick’s Sporting Goods’ stellar performance in this article here and Home Depot’s stellar performance in this article here, alongside analysis covering Lowe’s Companies Inc (LOW). E-commerce/digital demand at retail bellwethers Walmart (WMT) and Target (TGT) has also been very strong (see here and here, respectively) as consumers change their shopping habits, perhaps permanently in many instances. Fiscal Stimulus Considerations President Trump recently signed an omnibus bill into law that included the fiscal 2021 federal discretionary budget (worth ~$1.4 trillion) along with $900 billion in emergency fiscal stimulus measures. That fiscal stimulus package includes, among other things, enhanced unemployment benefits of $300 per week, direct cash transfers to households under a certain income threshold of up to $600 per individual and child, additional funding for the Paycheck Protection Program (‘PPP’), and boosted Supplemental Nutrition Assistance Program (‘SNAP’) benefits. The bill also included additional funding for schools and school meal programs, broadband investment, COVID-19 vaccine distribution, transportation programs, childcare, and the airline industry (JETS) received additional emergency funds as well as part of this rescue package. Fiscal stimulus measures will support US household income levels and ultimately consumer spending going forward. In our view, the outlook for the US economy is bright, supported by stimulus measures embarked on by the Fed (to reduce borrowing costs for consumers and businesses while maintaining capital market stability) and the Treasury (fiscal stimulus measures, though the latest rescue package is significantly smaller than the CARES Act passed back in March 2020). As COVID-19 vaccines are currently being distributed around the US and around the world, global health authorities should be able to eventually put an end to the pandemic. That in turn should allow the global economy to recover as households return to pre-pandemic activities. Our fair value estimate range for the S&P 500 of 3,530-3,920 based on normalized economic conditions and dovish Fed/Treasury actions, released June 12 when the S&P 500 was trading ~3,000, remains unchanged. We remain bullish on stocks for the long run. It is possible that the direct cash payments to US households, under certain income thresholds, will be raised up to $2,000 per person and possibly per child as well, depending on how things turn out. The US House just passed a bill that would boost the direct cash transfers up to $2,000, and President Trump has publicly signaled he supports the measure as has a number of Republican senators, though it is not clear how the bill will fare in the US Senate. We are keeping a close eye on this situation. Concluding Thoughts We are optimistic that global health authorities will bring the COVID-19 pandemic under control, perhaps sooner than many expect, which will help get the worldwide economy back on track. Enabling households to return to pre-pandemic activities should help stimulate the economy and create numerous jobs in the process, helping bring unemployment levels back down, too. Before then, fiscal emergency rescue packages and efforts taken by government bodies will help support the US economy in the near term, as Fed and Treasury officials will do whatever it takes to prevent any permanent economic damage from COVID-19, in our view. Retailers that invested heavily in their digital operations and omni-channel sales capabilities should continue to perform well going forward. Our best ideas are included in the Dividend Growth Newsletter portfolio, the Best Ideas Newsletter portfolio, the High Yield Dividend Newsletter portfolio, and the Exclusive publication. ----- Tickerized for holdings in the SPDR S&P Retail ETF (XRT). Related airlines: JETS, ALK, LUV, AAL, ACDVF, DAL, UAL, HA, SAVE, GOL, CPA, RYAAY, AZUL, ICAGY, EJTTF, DLAKF, DLAKY, AFRAF, DRTGF, WZZAF, AERZY, FNNNF, NWARF, AIBEF, QUBSF, ESYJY, LTM, SKYW, MESA, ANZFF, CEA, ZNH, AIRYY, ALGT, KLMR, JAPSY Related: JCPNQ, MA, V, HD ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment