|

|

Recent Articles

-

Waste Management Grows Adjusted Operating EBITDA Double Digits in Second Quarter

Waste Management Grows Adjusted Operating EBITDA Double Digits in Second Quarter

Jul 29, 2025

-

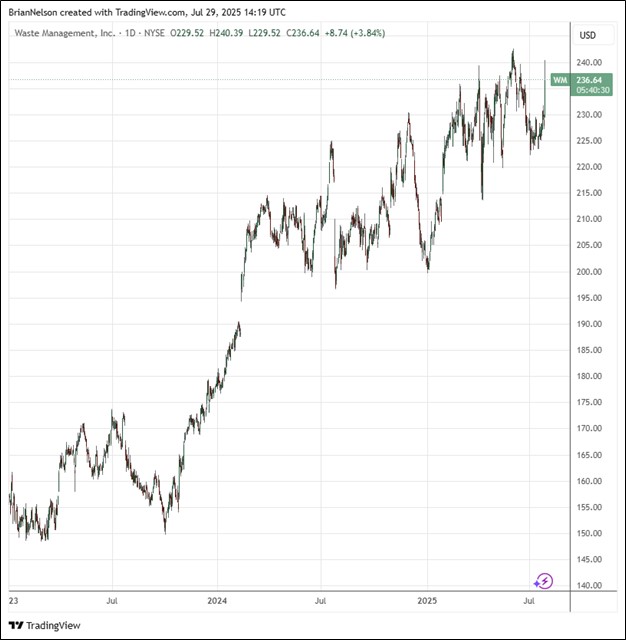

Image Source: TradingView.

Through the first six months of the year, Waste Management generated $2.75 billion of net cash provided by operating activities, with free cash flow for the first half of the year coming in at $1.29 billion. Looking to all of 2025, management affirmed its adjusted operating EBITDA guidance midpoint of $7.55 billion, while it raised its free cash flow guidance by $125 million, to the range of $2.8-$2.9 billion. Total company revenue is targeted in the range of $25.275-$25.475 billion for the full year, with an adjusted operating EBITDA margin now expected in the range of 29.6%-29.9%, a modest increase from prior guidance. Waste Management is on track to achieve the upper end of its targeted synergies related to WM Health Solutions of $80-$100 million in 2025. We like Waste Management, but don’t include shares in any newsletter portfolio.

-

IBM Expects to Generate $13.5+ Billion in Free Cash Flow in 2025

IBM Expects to Generate $13.5+ Billion in Free Cash Flow in 2025

Jul 29, 2025

-

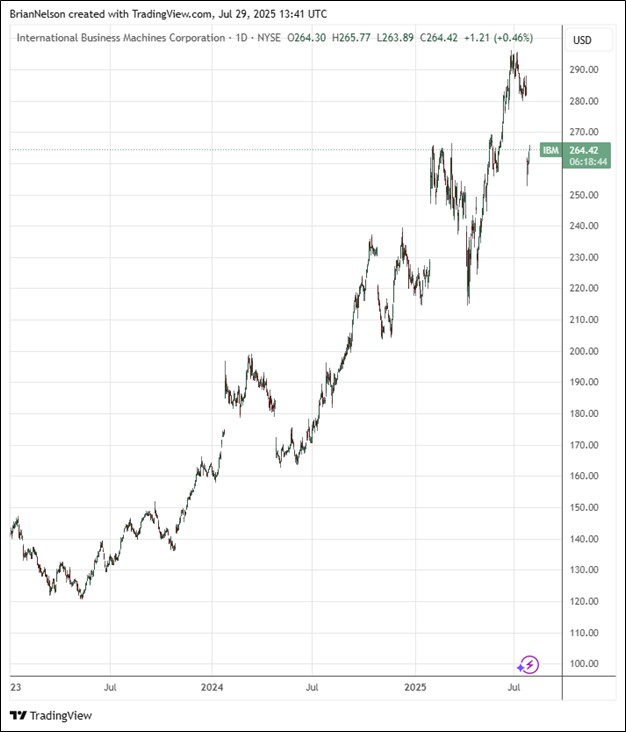

Image Source: TradingView.

Year-to-date, IBM’s net cash from operating activities was $6.1 billion, with free cash flow coming in at $4.8 billion. IBM ended the second quarter with $15.5 billion of cash and marketable securities against debt, including IBM Financing debt of $11.7 billion, of $64.2 billion, up $9.2 billion year to date. Looking to full year 2025 expectations, IBM continues to expect constant currency revenue growth of at least 5%, and the firm now expects to generate more than $13.5 billion in free cash flow for the full year. We like IBM’s focus on free cash flow, but we don’t include shares in any newsletter portfolio.

-

Dividend Increases/Decreases for the Week of July 25

Dividend Increases/Decreases for the Week of July 25

Jul 25, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Chipotle Now Expects Flat Comps for 2025

Chipotle Now Expects Flat Comps for 2025

Jul 24, 2025

-

Image Source: Valuentum.

Looking to 2025, Chipotle now expects flat full year comparable restaurant sales (was low to mid-single digits) and plans to open 315-345 new company-owned restaurants with over 80% having a Chipotlane. We like Chipotle’s long-term restaurant growth potential and believe its negative comps registered in the second quarter are temporary. Shares remain an idea in the Best Ideas Newsletter portfolio.

|