|

|

Recent Articles

-

Alphabet Puts Up Excellent Second Quarter Results

Alphabet Puts Up Excellent Second Quarter Results

Jul 24, 2025

-

Image Source: TradingView.

In Alphabet’s second quarter, total operating income increased 14%, as its operating margin came in at 32.4% benefiting from strength in the top line and “continued efficiencies in the expense base." Net income increased to $28.2 billion, up from $23.6 billion in the same quarter of 2024, while diluted earnings per share increased to $2.31 from $1.89 in the year-ago period. Alphabet ended the quarter with $95.1 billion in total cash and marketable securities and long-term debt of $23.6 billion. Through the first six months of the year, free cash flow was $24.3 billion. We like Alphabet as one of the top ideas in the Best Ideas Newsletter portfolio.

-

NextEra Energy’s Outlook for the Next Few Years Looks Solid

NextEra Energy’s Outlook for the Next Few Years Looks Solid

Jul 23, 2025

-

Image Source: NextEra Energy.

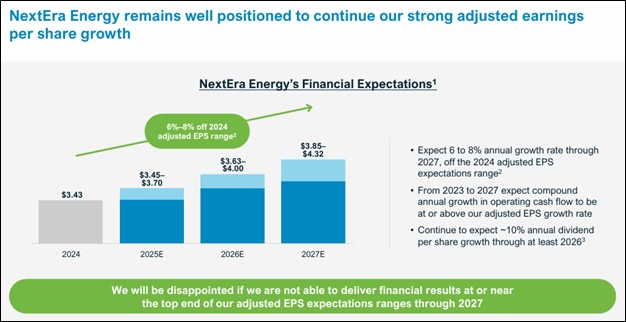

NextEra’s long-term outlook remains unchanged. For 2025, NextEra Energy expects adjusted earnings per share to be in the range of $3.45-$3.70. For 2026 and 2027, NextEra expects adjusted earnings per share to be in the ranges of $3.63-$4.00 and $3.85-$4.32, respectively. The company also expects to increase its dividends per share at a roughly 10% rate per year through at least 2026, off a 2024 base. We continue to like NextEra Energy as our utility exposure and think it makes sense as a key position in the ESG Newsletter portfolio.

-

Philip Morris’ Smoke-Free Portfolio Continues to Gain Traction

Philip Morris’ Smoke-Free Portfolio Continues to Gain Traction

Jul 23, 2025

-

Image Source: TradingView.

Looking to 2025, Philip Morris is targeting reported diluted earnings per share in the range of $7.24-$7.37 versus $4.52 last year. Adjusted diluted earnings per share is expected in the range of $7.43-$7.56 versus $6.57 last year. Adjusted diluted earnings per share, excluding currency, is budgeted in the range of $7.33-$7.46 versus $6.57 last year. In the second quarter, Philip Morris’ smoke-free business accounted for 41% of total net revenue, as it continues to benefit in part from rampant ZYN adoption. In the U.S., “ZYN reaccelerated its offtake growth to approximately 36% in June, and 26% in Q2 overall as measured by Nielsen." We continue to like Philip Morris’ smoke-free business and have no qualms with it as a idea in the High Yield Dividend Newsletter portfolio.

-

Lockheed Martin Announces Program Losses

Lockheed Martin Announces Program Losses

Jul 23, 2025

-

Image Source: TradingView.

Looking to 2025, Lockheed Martin reiterated its sales guidance in the range of $73.75-$74.75 billion, but it cut its business segment operating profit expectations for the year to the range of $6.6-$6.7 billion from $8.1-$8.2 billion. Diluted earnings per share for 2025 is now expected in the range of $21.70-$22.00, down from the range of $27.00-$27.30 previously. Lockheed maintained its cash flow from operations guidance for 2025 in the range of $8.5-$8.7 billion. It also maintained its free cash flow guidance for the year in the range of $6.6-$6.8 billion. We didn’t like the announced pre-tax losses on programs but were encouraged that Lockheed stuck with its annual free cash flow outlook. Lockheed Martin remains an idea in the Dividend Growth Newsletter portfolio.

|