|

|

Recent Articles

-

Dividend Growth Idea Home Depot Hikes Payout Nearly 8%!

Dividend Growth Idea Home Depot Hikes Payout Nearly 8%!

Feb 20, 2024

-

Image: Home Depot is working through some soft sales trends following robust home improvement spending during the pandemic, but the company’s free cash flow generation remains top notch.

On February 20, Dividend Growth Newsletter portfolio holding Home Depot reported mixed fourth quarter results that showed revenue pressure in the period, but the company still beat expectations on both the top and bottom lines. We’re huge fans of Home Depot’s resilience through the ups and downs of the real estate market, and the company’s pace of dividend growth remains solid. Our fair value estimate of Home Depot stands at $369 per share, modestly higher than where it is trading, and the company has a strong 1.4x Dividend Cushion ratio, which speaks to future dividend expansion.

-

Energy Transfer’s Lofty Distributions Are Much More Sustainable These Days

Energy Transfer’s Lofty Distributions Are Much More Sustainable These Days

Feb 19, 2024

-

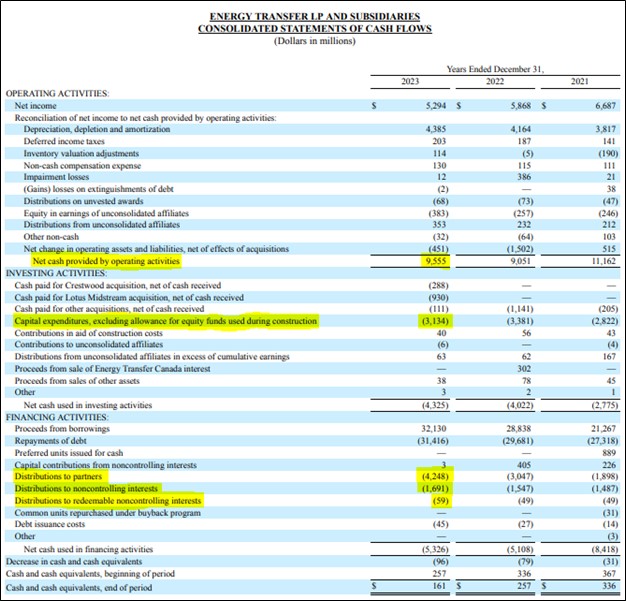

Image: Energy Transfer covered its distributions with traditional free cash flow in 2023, and the company offers investors an elevated distribution yield.

Energy Transfer reported mixed fourth-quarter results on February 14, but the company’s traditional free cash flow metrics continue to hold up well, providing support to its lofty distribution. Years ago, pipeline entities were spending much more than they reasonably could to be able to sustain their distributions at prior levels, and many have readjusted both their capital spending trajectories as well as their distributions over the years. These days, pipeline entities such as Energy Transfer, with their geographically diversified portfolio of assets, are in much better shape to sustain their payouts. Units of Energy Transfer yield ~8.7% at the time of this writing.

-

Tanger’s External Growth Activity Looks Encouraging

Tanger’s External Growth Activity Looks Encouraging

Feb 17, 2024

-

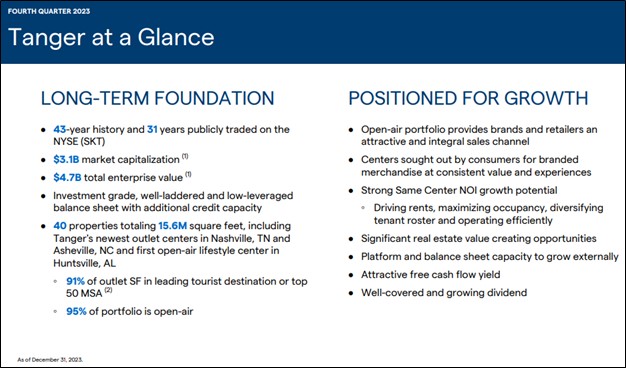

Image Source: Tanger Inc.

Tanger Inc. is an owner and operator of outlet and open-air retail shopping destinations, and the REIT has done a great job of late, with shares advancing more than 50% during the past year. While traditional real estate equities have languished, Tanger has managed to keep moving in the right direction. The REIT reported better than expected fourth-quarter results February 15, and its ~3.6% dividend yield isn’t too shabby. For investors looking to take a leap into retail REITs, Tanger may be among the top considerations.

-

Digital Realty Trust Has Bucked Broader REIT Sector Weakness

Digital Realty Trust Has Bucked Broader REIT Sector Weakness

Feb 17, 2024

-

Image: Digital Realty Trust has outperformed the broader REIT sector by quite the margin since the beginning of 2023.

Real estate investors have had a difficult time the past year, with shares of the Vanguard Real Estate Index ETF falling roughly 6% versus a 22%+ return on the S&P 500, both measured on a price-only basis. Data center REIT Digital Realty, however, has bucked the trend of the broader real estate sector’s weakness advancing 20% over the same time period on a price only basis. Digital Realty’s fourth-quarter results and guidance for 2024, released February 15, weren’t great, but the company is much better positioned than other REITs, in our view. Shares yield ~3.6% at the time of this writing.

|