|

|

Recent Articles

-

Latest Report Updates

Latest Report Updates

Feb 16, 2024

-

Check out the latest report updates on the website.

-

Dividend Increases/Decreases for the Week of February 16

Dividend Increases/Decreases for the Week of February 16

Feb 16, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Cisco Looks Cheap at 13x Forward Non-GAAP Earnings But Fundamentals Are Deteriorating

Cisco Looks Cheap at 13x Forward Non-GAAP Earnings But Fundamentals Are Deteriorating

Feb 15, 2024

-

Image: Cisco has ratcheted down expectations during the past couple quarters, and its shares have been choppy for the better part of a year now.

We’re not liking what we’re seeing from Cisco Systems these days, and this is a change from our generally more upbeat view during the past several months. Revenue is under pressure, guidance continues to come in lower than expectations, its balance sheet will weaken as a result of its pending deal for Splunk, and free cash flow trends haven’t been as strong as they used to be. The company is adjusting its cost structure with layoffs as it continues to work to transform its business model to be more recurring, but the near term will likely continue to be challenging for the company. If free cash flow does not meaningfully improve in the next couple quarters, we’ll look to remove Cisco from the newsletter portfolios, despite its attractive ~13x forward non-GAAP earnings multiple.

-

Coca Cola’s Pricing Strength Continues to Power Results

Coca Cola’s Pricing Strength Continues to Power Results

Feb 14, 2024

-

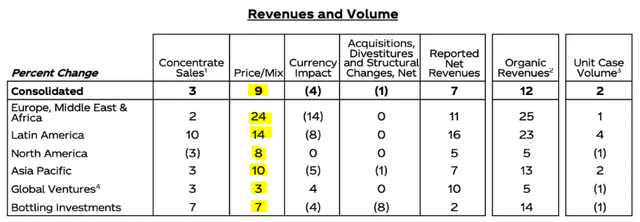

Image: Coca-Cola’s pace of price/mix expansion continues to drive strong performance.

On February 13, Coca-Cola reported strong fourth quarter results that exceeded expectations on both the top and bottom lines. The standout metric in the quarter was organic revenue growth, which advanced an impressive 12% in the quarter thanks to a solid 9 percentage-point increase in price/mix and 3 percentage-point expansion in concentrate sales. The company’s outlook for 2024 was strong as well, with the company targeting organic revenue expansion of 6%-7% for the year, and we like the momentum behind Coca-Cola’s performance. The Dividend King continues to deliver for investors, and while shares are trading above our fair value estimate, investors can do a lot worse than investing in Coca-Cola, in our view.

|