|

|

Recent Articles

-

Understanding Stock Splits

Understanding Stock Splits

Mar 22, 2024

-

Let’s dig into how stock splits impact valuation.

-

Dividend Increases/Decreases for the Week of March 22

Dividend Increases/Decreases for the Week of March 22

Mar 22, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Pfizer 6% Dividend Yield Speaks of Considerable Risk, Free Cash Flow Coming Up Short

Pfizer 6% Dividend Yield Speaks of Considerable Risk, Free Cash Flow Coming Up Short

Mar 21, 2024

-

Image: Pfizer’s shares have been under considerable pressure the past few years.

Though we are positive on Pfizer’s turnaround, its Dividend Cushion ratio of 0.3 is not to be taken lightly (any ratio below 1 indicates heightened risk of a dividend cut). Income-oriented investors seeking a turnaround story may be interested in Pfizer, but we’re staying on the sidelines. We’ll continue to monitor developments at the pharma giant, especially as patents on several of its major drugs approach expiration. Shares yield ~6% at the time of this writing.

-

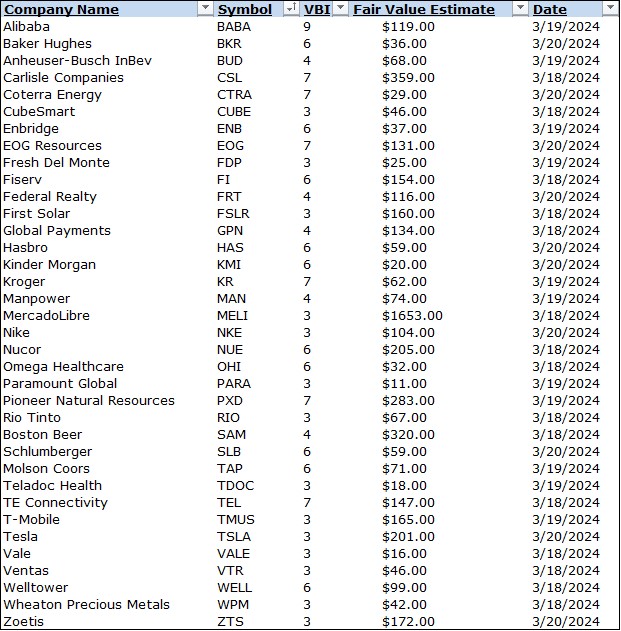

Latest Report Updates

Latest Report Updates

Mar 21, 2024

-

Check out the latest report updates on the website.

|