|

|

Recent Articles

-

Phillips 66 Hovering Near All-Time Highs, Shares Yield ~2.7%

Phillips 66 Hovering Near All-Time Highs, Shares Yield ~2.7%

Mar 20, 2024

-

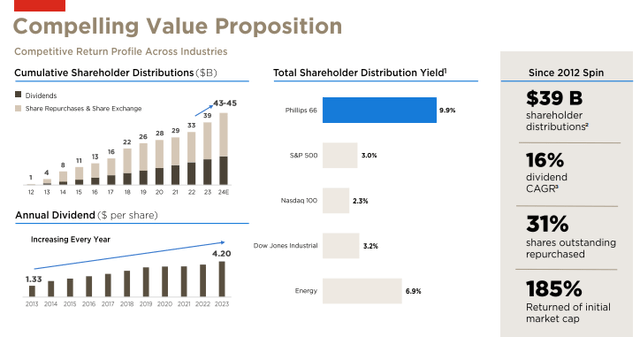

Image: Phillips 66 continues to be very shareholder friendly returning cash in the form of share repurchases and dividends.

Though crack spreads can be quite volatile at times, there’s a lot to like about Phillips 66. The company is targeting 2025 mid-cycle adjusted EBITDA of $14 billion, up from $10 billion in 2022. Cost savings should remain ongoing, with its target calling for a total of $1.4 billion in savings, implying the company has $200 million more in savings to go. We like its investment-grade (A3/BBB+) balance sheet and target for 2025 mid-cycle adjusted operating cash flow of $10+ billion, up from $7 billion in 2022, with expectations that it will return more than half of operating cash flow to shareholders. Phillips 66 is a quality income idea for investors seeking exposure to the energy space.

-

Hasbro Is Down But Not Out, Shares Yield ~5.3%

Hasbro Is Down But Not Out, Shares Yield ~5.3%

Mar 19, 2024

-

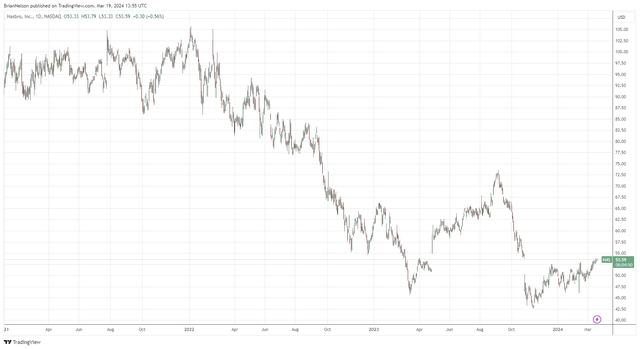

Image: Hasbro’s shares have faced considerable pressure during the past few years.

Hasbro's recently reported fourth-quarter results weren't great and showed revenue declining 23% as it experienced material weakness in its Consumer Products segment (-25%) and Entertainment division (-49%) in the quarter. On an adjusted basis, backing out large impairment charges, the firm’s operating loss came in at $50 million in the quarter, while it recorded adjusted net earnings of $0.38 per share. Hasbro continues to navigate a difficult demand environment for physical toys, but the company’s free cash flow remains robust and was in excess of cash dividends paid during 2023. Shares yield ~5.3% at the time of this writing.

-

Latest Report Updates

Latest Report Updates

Mar 17, 2024

-

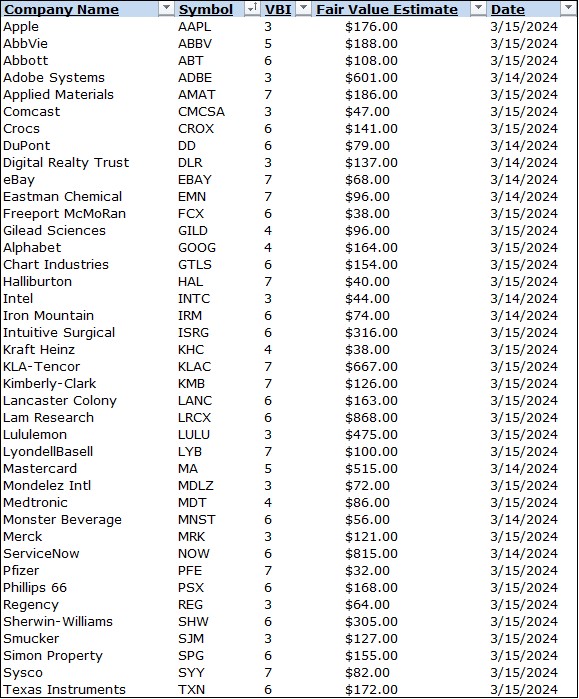

Check out the latest report updates on the website.

-

Altria Selling Portion of ABI Stake, Raises 2024 Guidance

Altria Selling Portion of ABI Stake, Raises 2024 Guidance

Mar 15, 2024

-

Image: Altria’s shares reacted positively to news that it would sell a portion of its stake in Anheuser-Busch Inbev.

On March 14, Altria Group announced that it would be selling in a secondary offering 35 million of its ~197 million shares of Anheuser-Busch Inbev it owns to unlock value for shareholders. The cigarette maker noted that it would use the proceeds of the sale for accelerated share buybacks to the tune of a $2.4 billion increase to its existing $1 billion repurchase program, a move that we like quite a bit as it helps to reduce total dividend obligations paid to shareholders given Altria’s outsized dividend yield. The cigarette maker also raised its earnings guidance because of the sale, and we continue to like Altria as a high yield dividend income idea.

|