|

|

Recent Articles

-

Best Buy’s Free Cash Flow Comes Up Short in Covering Dividend

Best Buy’s Free Cash Flow Comes Up Short in Covering Dividend

Apr 2, 2024

-

Image Source: Mike Mozart.

For fiscal 2024, Best Buy generated ~$1.47 billion in operating cash flow and spent $795 million in capital spending, resulting in free cash flow of $675 million, below what it paid in dividends on the year ($801 million). That didn’t stop Best Buy from upping its dividend 2%, however, and the company continues to buy back stock. Best Buy yields ~4.6% at the time of this writing, but capital spending and volatile operating cash flow are two considerations top of mind for income-oriented investors.

-

RTX Ends Year with Record Backlog, Shares Yield ~2.4%

RTX Ends Year with Record Backlog, Shares Yield ~2.4%

Apr 2, 2024

-

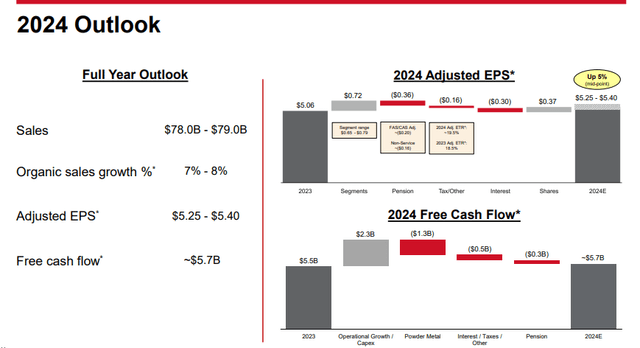

Image Source: RTX.

With the Russia-Ukraine war and the Israel-Hamas wars still raging, geopolitical tensions continue to be elevated, playing into the hands of defense contracts such as RTX. With an attractive commercial portfolio to boot, RTX is poised to continue to capitalize on both original equipment and higher-margin after-market commercial aerospace sales, too. We’re fans of RTX, and the firm looks to be moving past a costly recall associated with its Pratt & Whitney geared turbofan engines. Shares yield ~2.4% at this time.

-

Colgate-Palmolive Strong Pricing Expansion to Drive Base Business Earnings Expansion

Colgate-Palmolive Strong Pricing Expansion to Drive Base Business Earnings Expansion

Apr 1, 2024

-

Image Source: Colgate-Palmolive.

Looking to the full year 2024, Colgate-Palmolive expects its net sales growth to come in the range of 1%-4%, and that includes a modest headwind from foreign exchange. Organic revenue growth is expected to be in its targeted range of 3%-5% for the year, and management expects gross margin expansion and a double-digit earnings-per-share increase on a GAAP basis. On a base business basis, the company is anticipating a mid- to high-single digit earnings per share increase. All things considered, we liked Colgate-Palmolive’s fourth quarter results, and the firm’s ~2.2% forward estimated dividend yield isn’t too shabby.

-

Mondelez Expects Organic Growth to Slow in 2024

Mondelez Expects Organic Growth to Slow in 2024

Apr 1, 2024

-

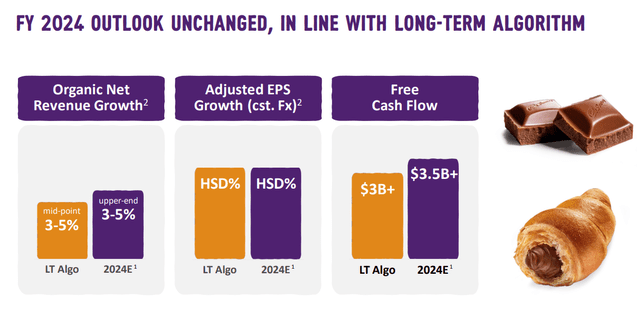

Image Source: Mondelez.

Looking ahead to 2024, Mondelez expects organic net revenue growth of 3%-5%, high-single-digit adjusted earnings per share on a constant currency basis, and the company is looking to haul in free cash flow greater than $3.5 billion. The organic revenue growth outlook for 2024 is meaningfully below the 14.7% mark it put up in 2023, with management pointing to geopolitical uncertainty as the cause. Nonetheless, we’re huge fans of Mondelez’s collection of valuable brands, and its ~2.4% dividend yield is worth a look.

|