|

|

Recent Articles

-

Toll Brothers Notes Strong Start to Spring Selling Season

Toll Brothers Notes Strong Start to Spring Selling Season

Mar 31, 2024

-

Toll Brothers raised its full-year fiscal 2024 guidance across key metrics, and the company noted that it has seen a "marked increase in demand coinciding with the start of the spring selling season." Though we don’t include any homebuilder in the simulated newsletter portfolios, it’s good to see things are progressing well at Toll Brothers.

-

Broadcom a Key Beneficiary of AI Investment

Broadcom a Key Beneficiary of AI Investment

Mar 31, 2024

-

Broadcom recently reported better than expected first-quarter results for fiscal 2024. During the quarter, the company generated cash flow from operations of $4.8 billion and spent just $122 million in capital equipment, translating into tremendous free cash flow generation, well in excess of the $2.4 billion it paid in dividends in the quarter. We see Broadcom as a key beneficiary of AI investment and are keeping a close eye on the firm.

-

General Mills Doing a Lot of Things Right, Shares Yield ~3.4%

General Mills Doing a Lot of Things Right, Shares Yield ~3.4%

Mar 30, 2024

-

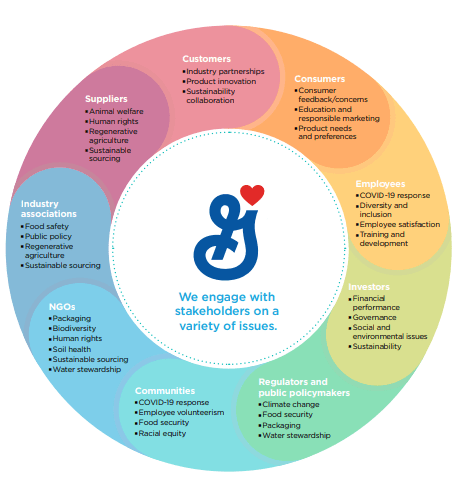

Image Source: General Mills.

General Mills has a long history, and the company’s ESG standards are admirable. Management is committed to the concept that the G in General Mills stands for “Good.” In 2022, for example, 29 million meals were enabled by donations of General Mills food across the globe. Roughly 87% of renewable energy was sourced for its global operations, while 92% of the company’s packaging is recyclable or reusable, as measured by weight. As for people, 50% of its Board of Directors are women, while 33% are ethnically diverse. During 2022, $90 million was contributed to charities by the company and its Foundation worldwide.

-

In the News: Inflation, Walgreens, SPACs/IPOs, and Marine Insured Losses

In the News: Inflation, Walgreens, SPACs/IPOs, and Marine Insured Losses

Mar 29, 2024

-

Inflation comes in-line with expectations regarding the critical PCE price index release for February. Walgreens remains in the doghouse following the firm's recent dividend cut. SPACs and IPOs are alive and well with Redditt hitting the market and Trump Media & Technology garnering interest. The tanker Dali collided into Baltimore's Francis Scott Key Bridge, causing loss of life and billions in estimated insured damages.

|