|

|

Recent Articles

-

Latest Report Updates

Latest Report Updates

May 17, 2024

-

Check out the latest report updates on the website.

-

Dividend Increases/Decreases for the Week of May 17

Dividend Increases/Decreases for the Week of May 17

May 17, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

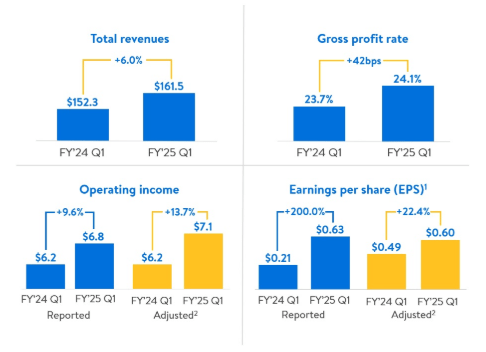

Walmart Winning Business as Consumers Remain Cost Conscious

Walmart Winning Business as Consumers Remain Cost Conscious

May 16, 2024

-

Image Source: Walmart.

Walmart is doing a fantastic job connecting with the consumer and delivering where it matters, both with respect to convenience and savings. Its e-commerce business contributed ~280 basis points to Walmart U.S.’s comp in the most recently reported quarter, for example. Traction with respect to store-fulfilled pickup and delivery are two main considerations driving Walmart’s comp resilience, while consumers continue to enjoy buying in bulk via Sam’s Club. We like Walmart’s positioning in the current retail environment as the firm continues to attract the cost-conscious consumer amid a step change in consumer goods inflation the past couple years.

-

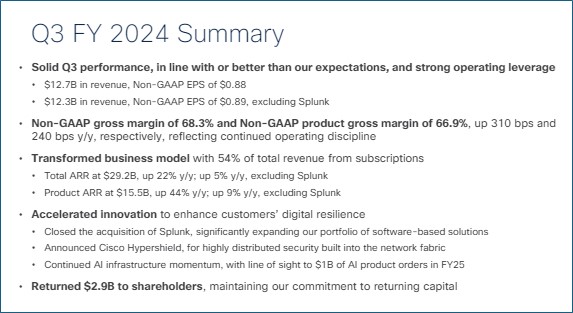

Cisco Still Looks Cheap, Shares Yield ~3.2%

Cisco Still Looks Cheap, Shares Yield ~3.2%

May 16, 2024

-

Image Source: Cisco.

Shares of Cisco are trading at an attractive 13.4x multiple of current fiscal year earnings, while shares yield ~3.2% on a forward estimated annualized basis. We like its position in the newsletter portfolios.

|