|

|

Recent Articles

-

Home Depot Sees Softness in Some Larger Discretionary Projects

Home Depot Sees Softness in Some Larger Discretionary Projects

May 14, 2024

-

Image Source: Home Depot continues to experience some softness in sales of big ticket items.

Though Home Depot noted a delayed start to spring and softness in big ticket items, we like the company’s resilience through thick and thin, and it remains a key idea in the Dividend Growth Newsletter portfolio.

-

Energy Transfer Ups Adjusted EBITDA Guidance for 2024

Energy Transfer Ups Adjusted EBITDA Guidance for 2024

May 13, 2024

-

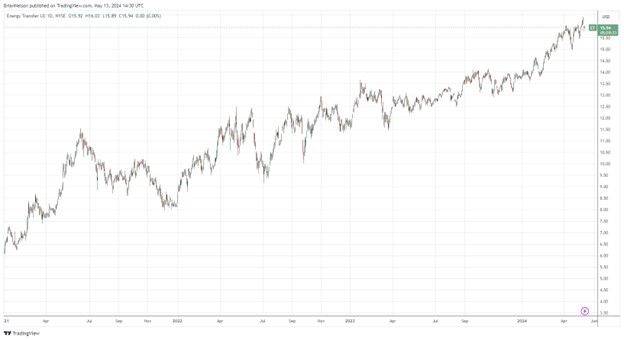

Image: Energy Transfer’s financials are in much better shape than they were years ago.

Energy Transfer's cash flow from operations during the first quarter of 2024 was $3.772 while the firm spent $795 million in capital spending, resulting in traditional free cash flow of ~$2.98 billion, far in excess of distributions paid to partners, noncontrolling interests, and redeemable noncontrollable interests. We like Energy Transfer’s EBITDA growth, free cash flow coverage of the distribution, and improved credit quality. The pipeline operator has come a long way in the past decade.

-

Disney Expects Strong Adjusted EPS Growth, Free Cash Flow

Disney Expects Strong Adjusted EPS Growth, Free Cash Flow

May 13, 2024

-

Image: Disney’s shares have struggled, but management is working hard to get back on track.

Thanks in part to the strength of its fiscal second quarter, Disney expects its adjusted earnings per share to come in at 25% growth for the full year. Management also noted that it remains on track to generate roughly $14 billion in operating cash flow and north of $8 billion in free cash flow during the fiscal year. We think Disney’s turnaround is largely already in its stock price, and we view shares as fairly valued at the time of this writing.

-

Qualcomm’s Dividend Strength Is Undeniable

Qualcomm’s Dividend Strength Is Undeniable

May 10, 2024

-

Image: Qualcomm remains a tremendous free cash flow generator.

For the six months ended March 24, Qualcomm hauled in ~$6.5 billion in operating cash flow and spent $398 million in capex, resulting in $6.1 billion in free cash flow, well ahead of the $1.79 billion it spent on dividends over the same time period. Qualcomm’s forward estimated dividend yield of ~1.9% is quite healthy.

|