|

|

Recent Articles

-

An Important Measure of Leverage for Dividend-Growth and Income-Oriented Shareholders, One That Is Dividend-Adjusted

An Important Measure of Leverage for Dividend-Growth and Income-Oriented Shareholders, One That Is Dividend-Adjusted

Sep 26, 2024

-

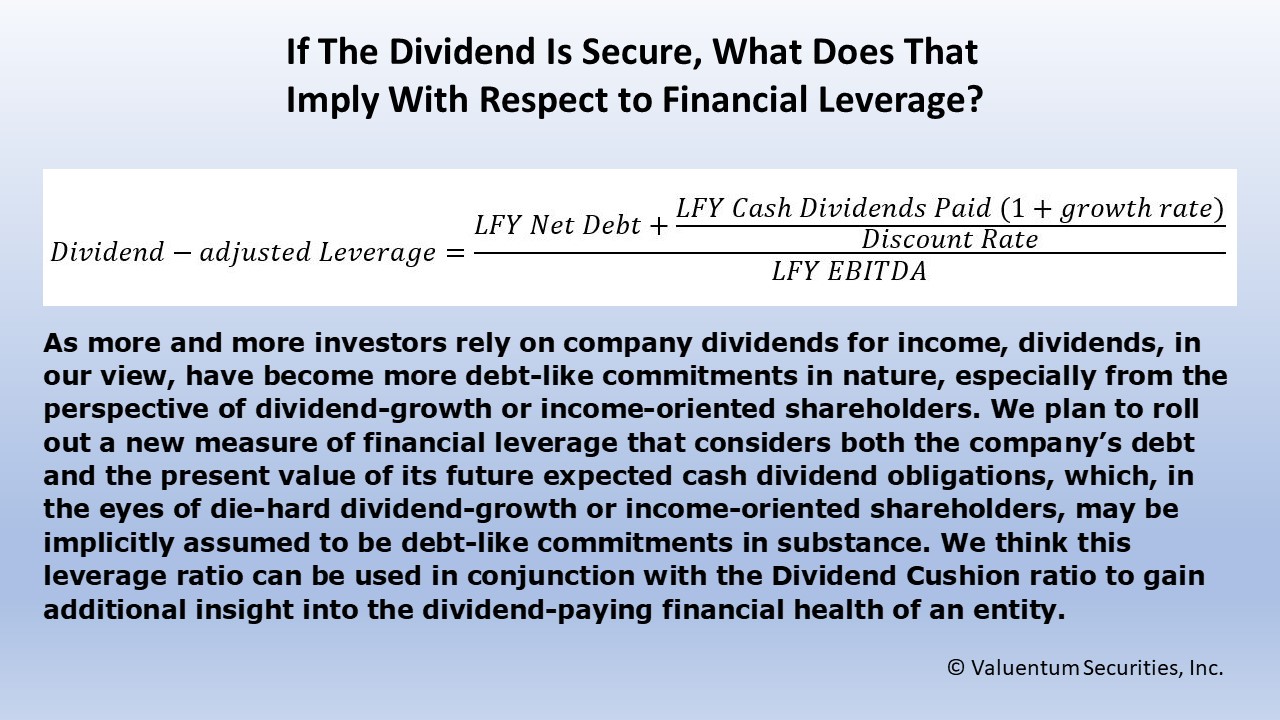

As more and more investors rely on company dividends for income, dividends, in our view, have become more debt-like commitments in nature, especially from the perspective of dividend-growth or income-oriented shareholders. Years ago, we rolled out a measure of financial leverage that considers both the company’s debt and the present value of its future expected cash dividend obligations, which, in the eyes of die-hard dividend-growth or income-oriented shareholders, may be implicitly assumed to be debt-like commitments in substance. We think this leverage ratio can be used in conjunction with the Dividend Cushion ratio to gain additional insight into the dividend-paying financial health of an entity.

-

GE Vernova Is a Great Clean Energy Idea

GE Vernova Is a Great Clean Energy Idea

Sep 23, 2024

-

Image: GE Vernova has performed well since it was spun out of GE.

GE Vernova is one of our favorite clean energy ideas, and its financials speak to continued strength. The high end of our fair value estimate range stands at $243 per share.

-

Incentives Pressuring Lennar’s Homebuilding Gross Margin

Incentives Pressuring Lennar’s Homebuilding Gross Margin

Sep 20, 2024

-

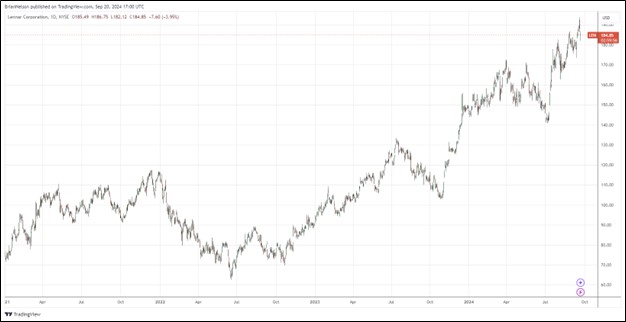

Image: Lennar’s shares have done quite well the past several years.

For the fiscal fourth quarter of 2024, Lennar expects new orders in the range of 19,000-19,300, deliveries of 22,500-23,000 with an average sales price of about $425,000. Lennar ended the fiscal third quarter with $4.04 billion of cash and cash equivalents and $2.26 billion in senior notes and other debts payable, net, good for a nice net cash position on the balance sheet. Though the company’s gross margin guidance for its fiscal fourth quarter came up short, with expectations of it being flat with the fiscal third quarter (22.5% versus consensus of 24.3%), the backdrop for the housing market remains strong and may grow stronger as the Fed engages in a rate-cutting cycle.

-

FedEx Reduces Fiscal 2025 Outlook

FedEx Reduces Fiscal 2025 Outlook

Sep 20, 2024

-

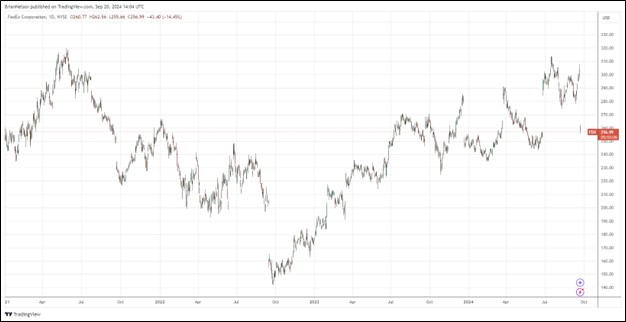

Image: FedEx’s shares have bounced back from the October 2022 lows, but its fiscal 2025 outlook disappointed the Street.

FedEx’s revised outlook left a lot to be desired. The company now expects fiscal 2025 revenue growth to be in the low single digits, compared to a previous expectation of low-to-mid single digits. Earnings per diluted share before the mark-to-market retirement plans accounting adjustments is now expected in the range of $17.90-$18.90 versus a prior forecast of $18.25-$20.25 per share. Also excluding costs related to business optimization initiatives, fiscal 2025 earnings per share is targeted in the range of $20.00-$21.00 per share compared to its prior forecast of $20.00-$22.00 per share, the midpoint below consensus of $20.93 per share. Shares yield 1.8%.

|