|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of September 20

Dividend Increases/Decreases for the Week of September 20

Sep 20, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Brain Teaser - Reflexive versus Reflective

Brain Teaser - Reflexive versus Reflective

Sep 19, 2024

-

Image: Amy Leonard.

Valuation multiples tend to trigger the reflexive side of our brain, and we process the multiples through anchoring. On the other hand, enterprise valuation, or the process required to answer the questions (in this article) correctly, shows that our reflexive process can be quite incorrect at times. In fact, cognitive biases such as anchoring can completely trip us up into missing out on truly undervalued companies that may have high P/E ratios while baiting us into value traps with low P/E ratios.

-

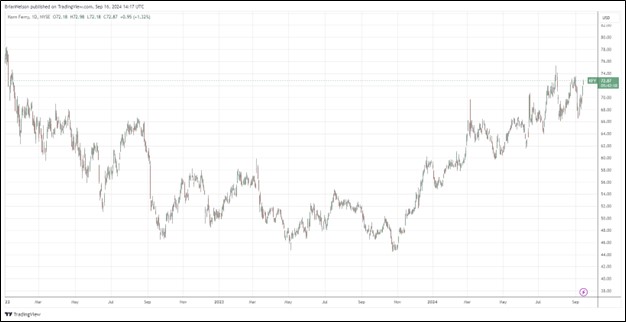

Korn Ferry’s Margin Performance Impressive in Fiscal First Quarter

Korn Ferry’s Margin Performance Impressive in Fiscal First Quarter

Sep 16, 2024

-

Image: Korn Ferry’s shares have bounced nicely since its bottom in late 2023.

Looking to the second quarter of fiscal 2025, Korn Ferry's fee revenue is expected in the range of $655-$685 million, while adjusted diluted earnings per share is expected to be between $1.14-$1.26. Though Korn Ferry faced pressure in Professional Search and RPO during its fiscal first quarter, we liked the improvement in Executive Search fee revenue, as well as its margin expansion, which was material in the period. Our fair value estimate for Korn Ferry stands at $78 per share. Shares yield 2.1%.

-

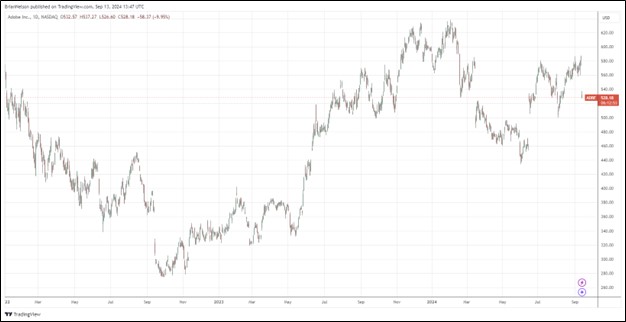

Adobe's Fiscal Fourth Quarter Outlook Comes Up Short of Expectations

Adobe's Fiscal Fourth Quarter Outlook Comes Up Short of Expectations

Sep 13, 2024

-

Image: Adobe’s shares traded down on a weaker than expected fiscal fourth quarter outlook.

Though Adobe’s outlook for the fiscal fourth quarter came up short, we continue to like its net-cash-rich balance sheet and strong free cash flow generation. We’re already quite tech heavy in the simulated newsletter portfolios, so we won’t be considering Adobe for inclusion, but the company is worth watching closely, especially as shares dip following its fiscal third quarter report. The high end of our fair value estimate range stands north of $660 per share.

|