|

|

Recent Articles

-

Carnival Corp. Experiencing Strong Demand

Carnival Corp. Experiencing Strong Demand

Sep 30, 2024

-

Image: Carnival’s shares have traded sideways since the beginning of 2024.

We like the demand momentum behind Carnival’s business, but its balance sheet keeps us on the sidelines. The company ended the quarter with $1.5 billion in cash and $28.9 billion in long-term debt. Fitch rates the company’s debt as non-investment grade with a BB credit rating. S&P rates its debt at BB and Moody’s B1. The company’s economic returns aren’t that much greater than its cost of capital either, even during good times. Carnival’s shares have been roughly flat year-to-date.

-

DOJ Antitrust Lawsuits Targeting Our Top Two Ideas: V and GOOG

DOJ Antitrust Lawsuits Targeting Our Top Two Ideas: V and GOOG

Sep 30, 2024

-

Image: Alphabet's and Visa's shares have performed remarkably well since the beginning of 2023.

We received a number of questions regarding the DOJ's investigation into anticompetitive practices for two of the top ideas in the Best Ideas Newsletter portfolio. Antitrust news with respect to Alphabet’s ad search business and Visa’s debit card business is nothing surprising, but it speaks to the positives and dominance behind their business models, something we like quite a bit. Any outcome of an antitrust lawsuit is uncertain and could result in a settlement and potential other action, including divestitures.

-

Costco’s Shares Remain Pricey

Costco’s Shares Remain Pricey

Sep 27, 2024

-

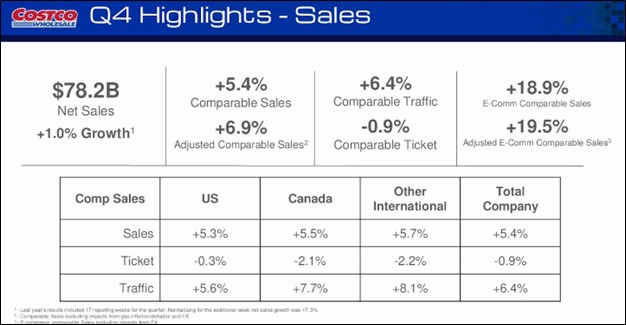

Image Source: Costco.

We liked Costco’s fiscal 2024 fourth quarter performance, despite the slight miss on the top line. Based on its adjusted comp performance in the period, we think Costco is gaining share against other big box retailers, too. The only problem with Costco, however, at the moment is its valuation, which remains elevated, with shares trading at 45-50 times next year’s earnings. Costco is a great company, but our fair value estimate is substantially below its share price, meaning we won’t be interested in shares unless they drop significantly.

-

Dividend Increases/Decreases for the Week of September 27

Dividend Increases/Decreases for the Week of September 27

Sep 27, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

|