|

|

Recent Articles

-

PepsiCo Experiencing Subdued Growth, Business Disruptions Due to Geopolitical Tensions

PepsiCo Experiencing Subdued Growth, Business Disruptions Due to Geopolitical Tensions

Oct 8, 2024

-

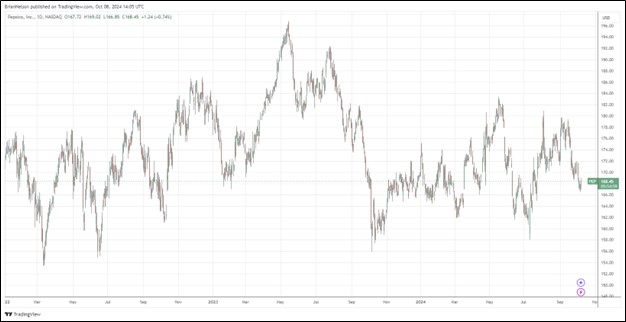

Image: PepsiCo has traded sideways for most of the past couple years.

For 2024, PepsiCo expects a low-single-digit increase in organic revenue (was previously approximately 4% in organic revenue growth) and at least an 8% increase in core constant currency earnings per share. PepsiCo is targeting total cash returns to shareholders of $8.2 billion for the year, comprising $7.2 billion in dividends and the balance in share repurchases. As it relates to core earnings per share, management is targeting at least $8.15, a 7% increase compared to 2023 core earnings per share of $7.62. Though PepsiCo’s results weren’t great with subdued category trends in North America and business disruptions from geopolitical tensions, we still like shares as a key diversifier in the portfolio of the Best Ideas Newsletter.

-

Constellation Brands’ Beer Business Continues to Propel Results

Constellation Brands’ Beer Business Continues to Propel Results

Oct 4, 2024

-

Image Source: Constellation Brands.

Looking to fiscal 2025 guidance, Constellation Brands expects net sales growth of 4%-6% led by Beer net sales growth of 6%-8%, offset in part by net sales declines of 4%-6% for Wine and Spirits. Operating cash flow is targeted at $2.8-$3 billion, while capital spending is expected in the range of $1.4-$1.5 billion, including major investments in its Mexico beer operations. Free cash flow is expected at $1.4-$1.5 billion. On a comparable basis, management is targeting earnings per share at $13.60-$13.80 for the fiscal year versus $12.38 in fiscal 2024.

-

Dividend Increases/Decreases for the Week of October 4

Dividend Increases/Decreases for the Week of October 4

Oct 4, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Nike In the Midst of a CEO Transition, Withdraws Full Year Guidance

Nike In the Midst of a CEO Transition, Withdraws Full Year Guidance

Oct 2, 2024

-

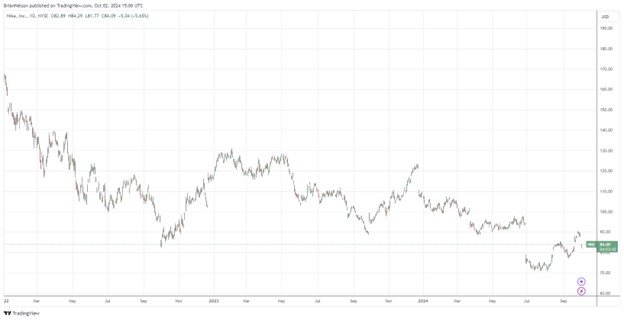

Image: Nike’s shares have been under pressure as the firm continues to underperform.

Nike is in the midst of a management transition with Elliott Hill returning to the company in the capacity of President and CEO effective October 14. Looking to the second quarter of fiscal 2025, Nike expects revenue to be down in the 8%-10% range and gross margins to be down roughly 150 basis points, pointing to higher promotions and channel mix headwinds. Though Nike has a storied brand, unmatched by rivals, it has fallen on difficult times, and we’re staying on the sidelines with respect to shares. Shares yield 1.7% at the time of this writing.

|