|

|

Recent Articles

-

Starbucks' Mixed Results Speak to Cautious Consumer Environment

Starbucks' Mixed Results Speak to Cautious Consumer Environment

Aug 12, 2024

-

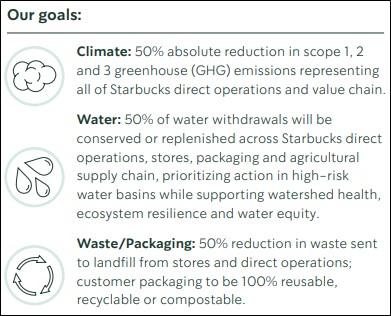

Image Source: Starbucks' Global Impact Report.

Starbucks’ fiscal third quarter results weren’t great. Consolidated revenue fell 1%, comparable store sales dropped, while the firm’s non-GAAP earnings per share faced additional pressures. During the fiscal third quarter, Starbucks opened 526 net new stores, ending the period with 39,477 stores -- broken down into 52% company-operated and 48% licensed. Stores in the U.S. and China made up 61% of its global portfolio. Starbucks is getting squeezed by a cautious consumer and higher labor costs, and while we like the company, we’re just not interested in shares at this time.

-

Eli Lilly Puts Up Strong Second Quarter Results, Raises Outlook

Eli Lilly Puts Up Strong Second Quarter Results, Raises Outlook

Aug 9, 2024

-

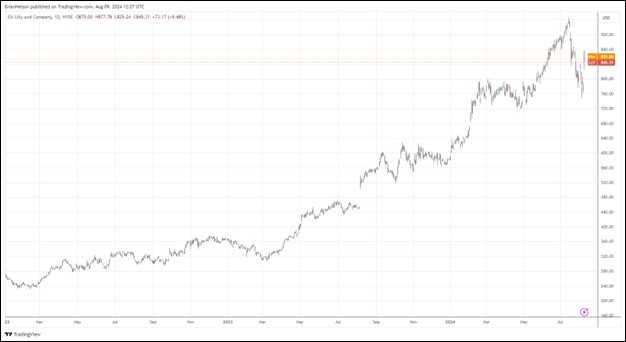

Image: Shares of Eli Lilly have been strong the past few years.

Looking to 2024 full-year guidance, Eli Lilly raised its revenue expectations by $3 billion, upped its reported earnings per share guidance $2.05, to the range of $15.10-$15.60, and increased its non-GAAP earnings per share guidance by $2.60 to the range of $16.10-$16.60, above the consensus forecasts. We continue to like Eli Lilly’s product portfolio, particularly Mounjaro and Zepbound, and we include the Health Care Select Sector SPDR Fund, which includes Eli Lilly as its top weighting, in the Best Ideas Newsletter portfolio.

-

Paper: Value and Momentum Within Stocks, Too

Paper: Value and Momentum Within Stocks, Too

Aug 9, 2024

-

Abstract: This paper strives to advance the field of finance in four ways: 1) it extends the theory of the “The Arithmetic of Active Management” to the investor level; 2) it addresses certain data problems of factor-based methods, namely with respect to value and book-to-market ratios, while introducing price-to-fair-value ratios in a factor-based approach; 3) it may lay the foundation for academic literature regarding the Valuentum, the value-timing, and ultra-momentum factors; and 4) it walks through the potential relative outperformance that may be harvested at the intersection of relevant, unique and compensated factors within individual stocks.

-

Dividend Increases/Decreases for the Week of August 9

Dividend Increases/Decreases for the Week of August 9

Aug 9, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

|