|

|

Recent Articles

-

Disney Achieves Profitability Across Combined Streaming Businesses

Disney Achieves Profitability Across Combined Streaming Businesses

Aug 7, 2024

-

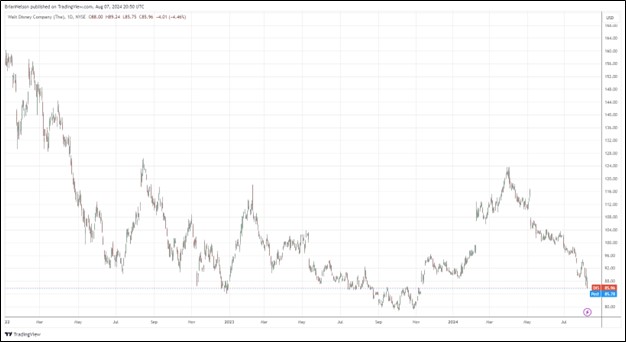

Image: Disney’s shares are under pressure despite marked improvement in earnings.

Disney noted that within its Experiences division, “segment revenue growth was impacted by moderation of consumer demand towards the end of Q3 that exceeded (its) previous expectations.” Though the pace of consumer demand at Disney theme parks remains a big question during the current fiscal fourth quarter, management’s new full year adjusted earnings per share growth target is now 30%, which reveals a company that is making progress from its troubles a couple years ago. We value shares of Disney just shy of $100 each.

-

Amazon's Second Quarter Results Were Mixed But Free Cash Flow Improved Significantly

Amazon's Second Quarter Results Were Mixed But Free Cash Flow Improved Significantly

Aug 7, 2024

-

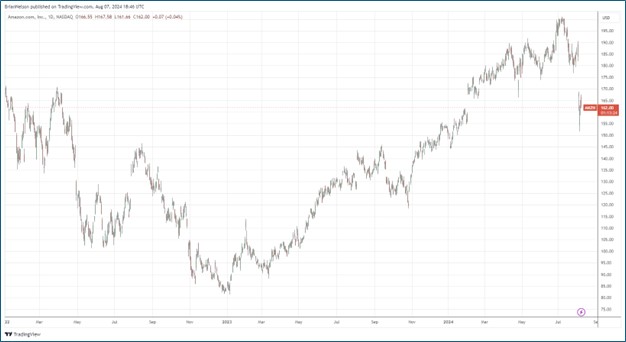

Image: Amazon traded aggressively lower following its second-quarter results.

Though Amazon missed second-quarter revenue consensus estimates, and the midpoint of its third-quarter revenue and earnings guidance came in below the consensus forecasts at the time, we continue to point to aggressive growth at AWS coupled with the firm’s strong free cash flow generation as reasons to not be bearish on the stock. We won’t be adding Amazon to any newsletter portfolio as we are already quite tech-heavy, but the company’s share price slide could provide an entry point on a name with strong fundamental momentum.

-

What to Do During This Market Selloff

What to Do During This Market Selloff

Aug 4, 2024

-

In short, nothing.

-

Apple Beats Expectations, Remains a Free Cash Flow Cow

Apple Beats Expectations, Remains a Free Cash Flow Cow

Aug 2, 2024

-

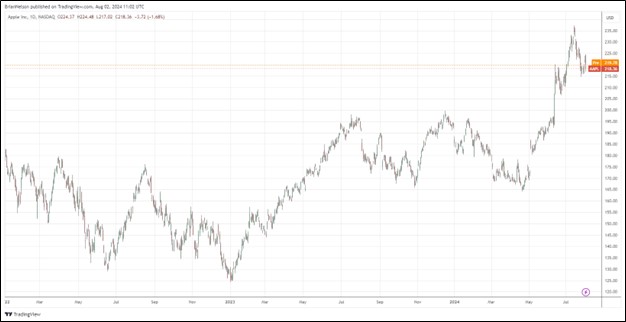

Image: Apple’s shares have done quite well since the beginning of 2022.

We liked Apple’s calendar second quarter (fiscal third quarter) results, as the firm outpaced consensus expectations for both Products and Services revenue. Apple’s balance sheet remains pristine, and its strong free cash flow easily covers its dividend. The company continues to buy back stock, and while there were pockets of weakness in the quarterly report, including revenue in Greater China, we like the company’s positioning in artificial intelligence, as we await a strong upgrade cycle for its next-generation iPhone. Shares yield 0.5% at the time of this writing.

|