|

|

Recent Articles

-

The Difference Between Speculation and Investment

The Difference Between Speculation and Investment

Aug 28, 2024

-

In this edited video transcript, Brian Nelson, President of Investment Research at Valuentum, discusses the difference between speculation and investment.

-

Foot Locker Burns Through Cash During First Half of Full Year 2024

Foot Locker Burns Through Cash During First Half of Full Year 2024

Aug 28, 2024

-

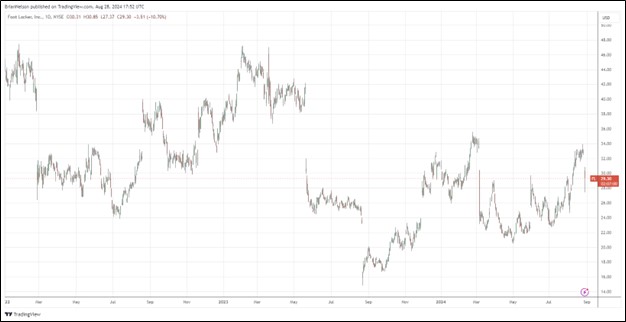

Image: Foot Locker’s shares have been quite volatile the past couple years.

Foot Locker reaffirmed its full-year 2024 non-GAAP earnings per share outlook of $1.50-$1.70 per share. For full year 2024, it also reiterated its sales guidance of -1% to 1% growth and comparable sales growth in the range of 1%-3%. For the twenty-six weeks ended August 3, 2024, cash flow from operations was $126 million, while capital spending was $132 million, resulting in a cash burn. Though Foot Locker has returned to top line growth, we’re not at all interested in shares given its cash-flow performance.

-

Ralph Lauren’s Dividend Is Quite Healthy

Ralph Lauren’s Dividend Is Quite Healthy

Aug 27, 2024

-

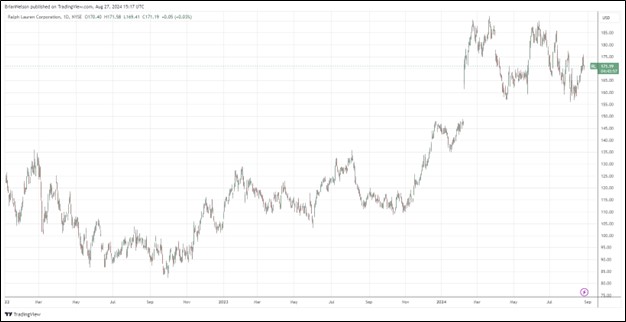

Image: Ralph Lauren’s shares have done quite well since the beginning of 2022.

For fiscal 2025, Ralph Lauren expects revenues to increase in the low-single digits on a constant currency basis, while it continues to expect its operating margin to increase 100-120 basis points in constant currency thanks to gross margin improvement and operating expense leverage. All told, we liked Ralph Lauren’s fiscal first quarter results and we’re particularly fans of its ability to drive strong free cash flow in excess of cash dividends paid. Our fair value estimate stands at $184 per share with the firm sporting a lofty Dividend Cushion ratio of 4.4.

-

Toll Brothers Expects Demand to Remain Solid Into 2025

Toll Brothers Expects Demand to Remain Solid Into 2025

Aug 27, 2024

-

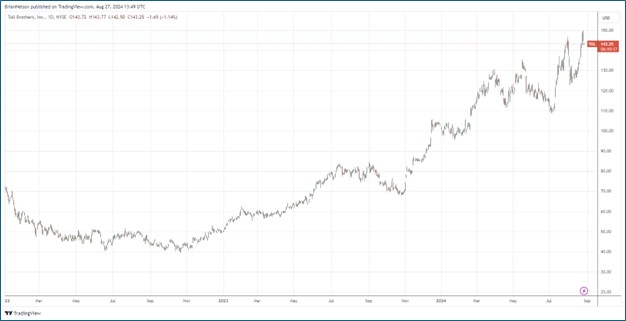

Image: Toll Brothers stock has done quite well during the past couple years.

For its fiscal year 2024 guidance, Toll Brothers expects deliveries of 10,650-10,750 units (was 10,400-10,800) with an average delivered price per home of $975,000. Its adjusted home sales gross margin is targeted at 28.3% for fiscal 2024 (was 28%), while SG&A as a percentage of home sales revenue is expected at 9.4% for the year. Toll Brothers ended its fiscal third quarter with $893.4 million of cash and cash equivalents and $2.8 billion in total debt. Its net debt-to-capital ratio stood at 19.6% at the end of the fiscal third quarter. Though Toll Brothers’ backlog faced declines in its fiscal third quarter, we liked the increased guidance across its key homebuilding metrics.

|