|

|

Recent Articles

-

Berkshire Hathaway’s Cash Balance Swells, Ownership Stake in Apple Substantially Reduced

Berkshire Hathaway’s Cash Balance Swells, Ownership Stake in Apple Substantially Reduced

Aug 26, 2024

-

Image: Berkshire Hathaway reduced its equity stake in Apple by a sizable margin.

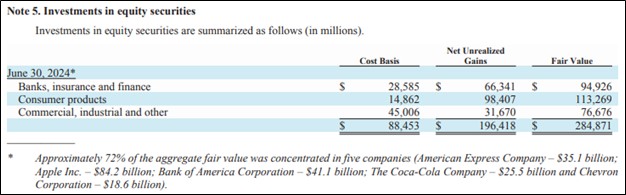

Berkshire Hathaway continues to execute well across its business portfolio, free cash flow continues to move in the right direction, while Buffett remains prudent with his portfolio management decisions. Shareholders’ equity at the end of June was $608 billion, implying that shares are trading at a 1.6x book value, not cheap. Still, we like shares as a key holding in the Best Ideas Newsletter portfolio.

-

Chevron Lacks Dividend Coverage with Traditional Free Cash Flow

Chevron Lacks Dividend Coverage with Traditional Free Cash Flow

Aug 26, 2024

-

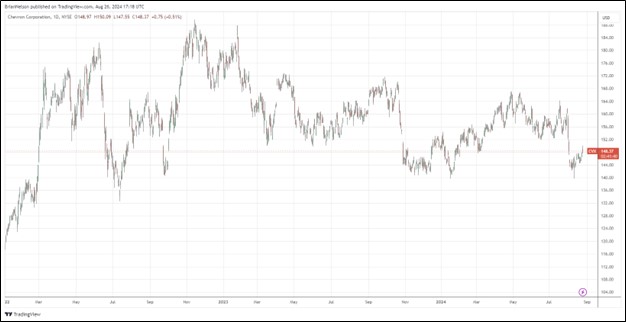

Image: Chevron’s shares have been choppy during the past few years.

During the second quarter, Chevron returned $6 billion in cash to shareholders, including $3 billion for each of dividends and share repurchases, and more than $50 billion during the past two years. The second quarter marked the ninth straight quarter of over $5 billion cash returned to shareholders. Chevron ended June with $4 billion in cash and cash equivalents and total debt of $23.2 billion. Through the first six months of the year, traditional free cash flow, as measured by cash flow from operations less all capex, was $5 billion, shy of the $6 billion it paid as dividends over the same time period. We prefer ExxonMobil, which has much better dividend coverage than Chevron.

-

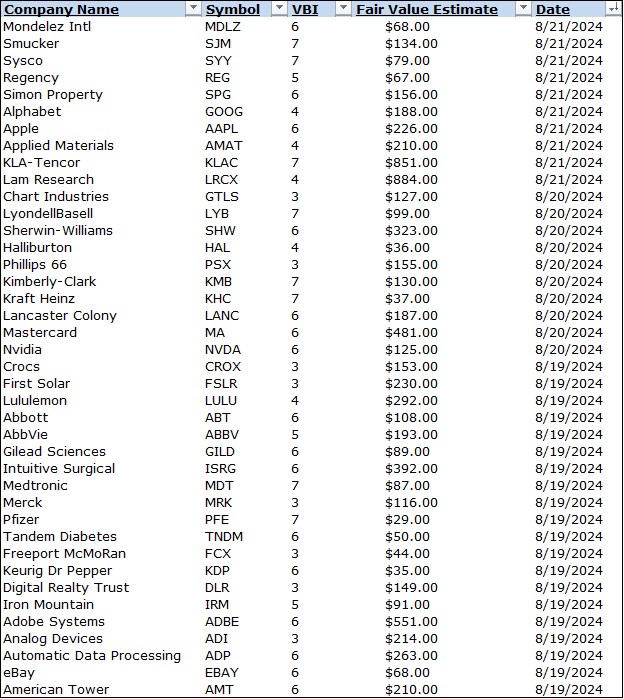

Latest Report Updates

Latest Report Updates

Aug 25, 2024

-

Check out the latest report updates on the site.

-

Dividend Increases/Decreases for the Week of August 23

Dividend Increases/Decreases for the Week of August 23

Aug 23, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

|