|

|

Recent Articles

-

Keeping the Horse Before the Cart: Valuentum’s Economic Castle™ Rating

Keeping the Horse Before the Cart: Valuentum’s Economic Castle™ Rating

Jan 5, 2025

-

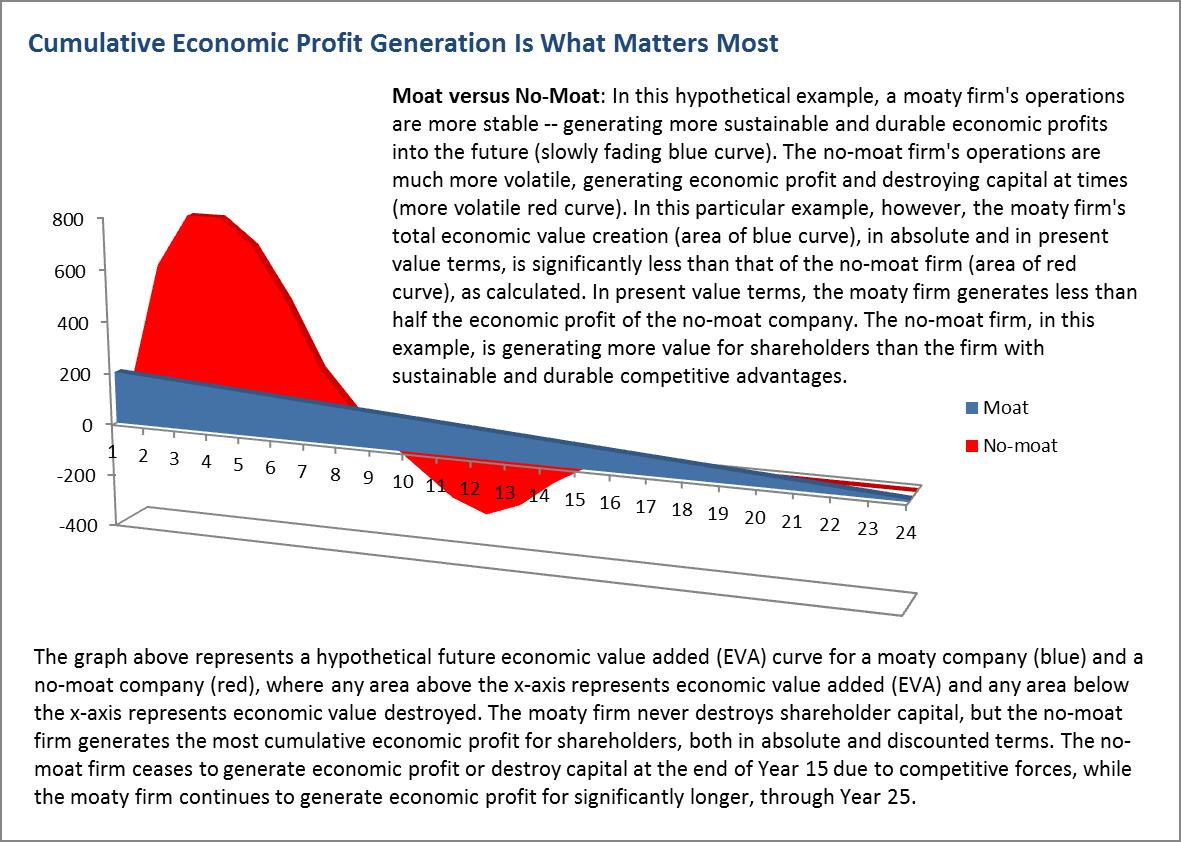

Image shown: An examination of the problem that might arise by focusing exclusively on companies that have economic moats, or sustainable and durable competitive advantages.

Without an economic castle, an economic moat doesn’t matter. Let's examine Valuentum's Economic Castle™ rating.

-

Dividend Increases/Decreases for the Week of January 3

Dividend Increases/Decreases for the Week of January 3

Jan 3, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

FedEx Lowers Fiscal 2025 Guidance Again, Plans to Separate FedEx Freight

FedEx Lowers Fiscal 2025 Guidance Again, Plans to Separate FedEx Freight

Jan 1, 2025

-

Image: FedEx’s shares have come roaring back since its bottom in the back half of 2022.

Looking to fiscal 2025, FedEx revised its revenue and earnings forecasts lower again. Revenue is now expected to be “approximately flat” year over year compared to the prior forecast calling for a low single-digit percentage increase. Diluted earnings per share before mark-to-market retirement plans accounting adjustments is now targeted in the range of $16.45-$17.45 compared to its prior forecast of $17.90-$18.90. Also excluding costs related to its business optimization initiatives, management is targeting diluted earnings per share of $19.00-$20.00 per share, down from $20.00-$21.00 per share previously. FedEx announced it will separate FedEx Freight as a new publicly-traded company, hoping to garner a higher multiple placed on the spinoff, but we’re not interested in shares of the company or its spinoff at this time. Shares yield 2%. Our favorite ideas remain in the newsletter portfolios.

-

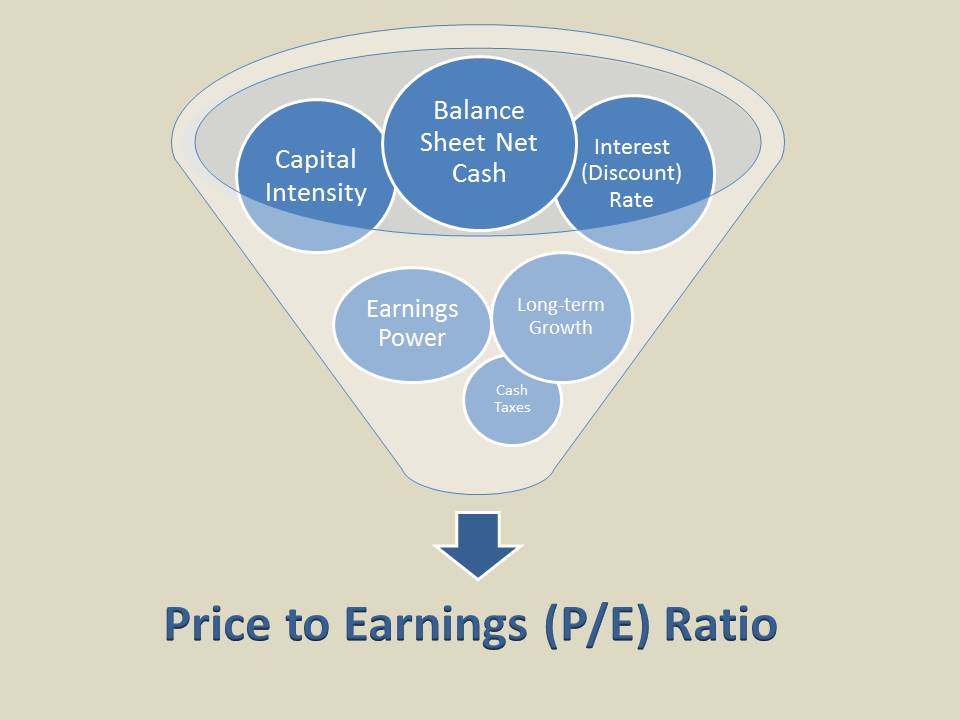

The Price-to-Earnings Ratio Demystified

The Price-to-Earnings Ratio Demystified

Jan 1, 2025

-

Let's examine the price-to-earnings (P/E) ratio. The key takeaways are: 1) without using a discounted cash-flow model, the P/E ratio that should be applied to a company's future expected earnings stream can never be appropriately calculated, and by extension, 2) when investors assign an arbitrary price-to-earnings multiple to a company’s earnings (based on historical trends or industry peers or the market multiple), they are essentially making estimates for all of the drivers behind a discounted cash-flow model in one fell swoop (and sometimes hastily). As earnings for next year are often within sight and can be estimated with some confidence (though this certainly varies among firms), calculating the price-to-earnings ratio via a discounted cash-flow process, in our opinion, is of far greater importance than worrying about whether a firm will beat or miss earnings in its next fiscal year. Because the P/E ratio is a discounted cash-flow model that considers the long-term qualitative dynamics of a particular entity, cash-flow analysis remains the first and most important pillar of our Valuentum Buying Index. And finally, investors cannot ignore valuation analysis or the future. Valuation is an important driver behind stock prices, and it is based on future expectations that can only be estimated. This is just a fact of the markets.

|