|

|

Recent Articles

-

Costco’s Business Humming Along Nicely, But Stock Is Not Cheap

Costco’s Business Humming Along Nicely, But Stock Is Not Cheap

Jan 1, 2025

-

Image Source: Costco.

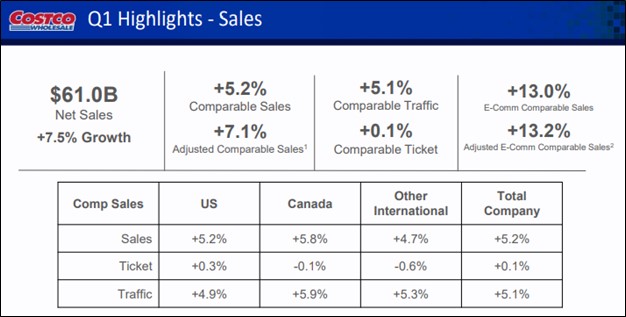

During the fiscal first quarter, Costco's membership income grew 7.8% year-over-year, while paid memberships grew 7.6% year-over-year, to 77.4 million. Total cardholders increased 7.2% year-over-year, to 138.8 million. Its worldwide renewal rate remained healthy at 90.4%. Net income for the quarter came in at $3.82, after excluding a $0.22 per share tax benefit related to stock-based compensation, beating the consensus forecast by a few pennies per share. Excluding discrete tax-related benefits occurring in both the most recently reported quarter and the same period last year, net income and diluted earnings per share advanced 9.9% and 9.8%, respectively. Costco’s fiscal first quarter was solid, but with the company trading at 50x forward earnings, we’re looking elsewhere.

-

How Does 37% Sound?

How Does 37% Sound?

Dec 29, 2024

-

Image: The Schwab U.S. Large Cap Growth ETF (SCHG) is up more than 37% so far in 2024.

So what’s the playbook for 2025? You can probably guess that I think large cap growth and big cap tech will continue to lead the markets to new heights. 2024 was a boring year, if a 37% return can be considered boring for large cap growth. Frankly, with the market focusing on macro data and the Fed during 2024, there wasn’t much material to write about. We all already know the story: Inflation is under control, the job market remains healthy, the Fed is cutting, and artificial intelligence will be the name of the game this decade.

-

Nike’s Revenue Under Considerable Pressure; Turnaround Will Take Time

Nike’s Revenue Under Considerable Pressure; Turnaround Will Take Time

Dec 27, 2024

-

Image: Nike’s shares have been under considerable pressure as sales results disappoint.

Nike’s outlook for the near term doesn’t provide us with much confidence. As we have noted before, Nike has a storied brand that is unmatched by rivals, but it may take more than a new CEO to turn things around. Competition remains fierce and the promotional environment intense, while consumer discretionary spending remains a big wild card. We like Nike, but we continue to stay on the sidelines until we start to see some improvement on the top line, not just better than feared results.

-

Alert: Changes to the Newsletter Portfolios

Alert: Changes to the Newsletter Portfolios

Dec 27, 2024

-

Image Source: Mike Cohen cc by 2.0.

We are making some changes to the newsletter portfolios. We continue to believe that large cap growth and big cap tech is the place to be, and we’ll be further tilting the portfolios in that direction.

|