|

|

Recent Articles

-

UnitedHealth Group’s 2025 Outlook Remains Robust

UnitedHealth Group’s 2025 Outlook Remains Robust

Jan 17, 2025

-

Image: UnitedHealth Group’s shares have been choppy the past couple years.

UnitedHealth Group reaffirmed its outlook for 2025 that it established in December 2024. Revenues for 2025 are anticipated in the range of $450-$455 billion (the midpoint below consensus of $455.6 billion), net earnings are targeted in the range of $28.15-$28.65, and adjusted net earnings are expected in the range of $29.50-$30.00 per share (the midpoint below consensus of $29.86 per share). Cash flow from operations is anticipated to increase to the range of $32-$33 billion, up materially from 2024. We continue to like UnitedHealth’s growth potential and free cash flow generation, and the company remains a core holding in the Best Ideas Newsletter portfolio.

-

Dividend Increases/Decreases for the Week of January 17

Dividend Increases/Decreases for the Week of January 17

Jan 17, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Taiwan Semiconductor's Results Showcase Strong Growth

Taiwan Semiconductor's Results Showcase Strong Growth

Jan 16, 2025

-

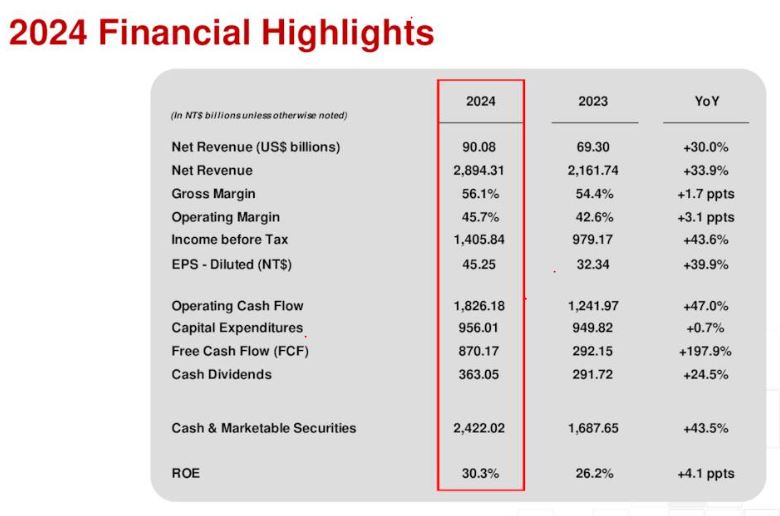

Image Source: TSM.

Looking to the first quarter of 2025, TSM expects revenue to be between US$25-US$25.8 billion based on the exchange rate assumption of 1 U.S. dollar to 32.8 NT dollars. This was above consensus calling for US$24.75 billion in revenue in the quarter. Gross profit margin is targeted between 57% and 59%, while operating profit margin is expected to be between 46.5%-48.5%. All told, we continue to like TSM’s strong top-line growth and free cash flow generation, and the firm remains a core idea in the ESG Newsletter portfolio.

-

Bank Earnings Roundup: C, WFC, GS, JPM

Bank Earnings Roundup: C, WFC, GS, JPM

Jan 15, 2025

-

Image Source: Hakan Dahlstrom.

Citigroup launches a new, multi-year program to repurchase $20 billion in stock, Wells Fargo puts up strong earnings growth in the fourth quarter, Goldman Sachs issued a blockbuster fourth quarter report, while JPMorgan CEO Jamie Dimon warns of inflation and geopolitical risks.

|