|

|

Recent Articles

-

KB Home’s Outlook for 2025 Better Than Expected

KB Home’s Outlook for 2025 Better Than Expected

Jan 14, 2025

-

Image: KB Home’s shares have done well since the beginning of 2023.

Looking to fiscal 2025, KB Home's housing revenue is expected in the range of $7.00-$7.5 billion, compared to the consensus forecast of $6.89 billion, with the average selling price in the range of $488,000-$498,000. Homebuilding operating income as a percentage of revenues is targeted at roughly 10.7%, which assumes no inventory-related charges. For the year, housing gross profit margin is targeted in the range of 20.0%-21.0% and assumes no inventory-related charges. Selling, general, and administrative expenses as a percentage of housing revenues is expected in the range of 9.6%-10.0%. We liked KB Home’s fourth quarter results and outlook for fiscal 2025 and what they imply with respect to the health of the housing market. KB Home doesn’t make the cut for any newsletter portfolio, however.

-

Walgreens Reports Better Than Feared Results, Shares Yield 8.5%

Walgreens Reports Better Than Feared Results, Shares Yield 8.5%

Jan 13, 2025

-

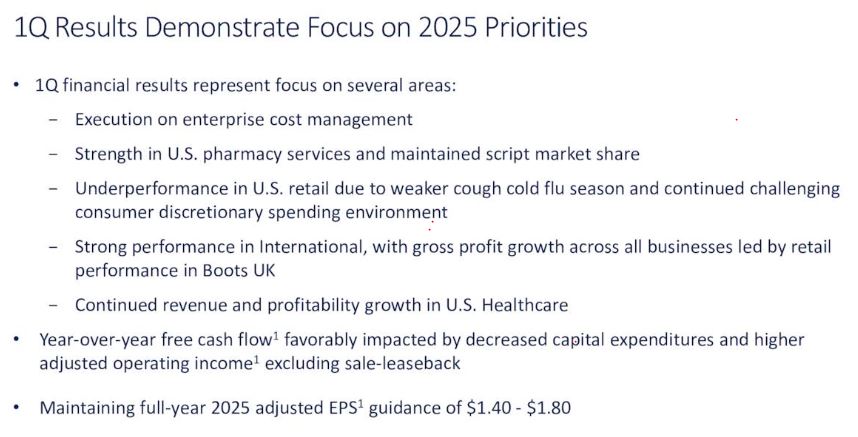

Image Source: Walgreens.

Looking to 2025, Walgreens maintained its adjusted earnings per share guidance of $1.40-$1.80 (consensus was at $1.53), noting “growth in U.S. Healthcare and International segments more than offset by a decline in U.S. Retail Pharmacy, a higher adjusted effective tax rate, and lower contributions from sale-leaseback and Cencora earnings.” Shares of Walgreens are trading at just 7.4x current fiscal year earnings, while boasting a yield of 8.5% at the time of this writing. Though improving, free cash flow continues to be negative at Walgreens, however, and while its dividend is far from safe after its dividend cut, the company is working aggressively to get things back on track.

-

Delta Delivers Most Profitable December Quarter in Its History

Delta Delivers Most Profitable December Quarter in Its History

Jan 11, 2025

-

Image Source: Colin Brown.

We liked Delta’s fourth quarter results and outlook for 2025, but we’re not interested in adding any airline to the newsletter portfolios. Airline economics are notoriously difficult to forecast, and their operating results are heavily levered to volatile jet fuel prices. Swings in the economic environment can also have a large impact on performance given the operating leverage inherent to their business models. Delta is currently riding an upswing in demand, but we remain cautious on shares given the volatility innate to an airline’s business model. We remain on the sidelines.

-

Dividend Increases/Decreases for the Week of January 10

Dividend Increases/Decreases for the Week of January 10

Jan 10, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

|