|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of January 24

Dividend Increases/Decreases for the Week of January 24

Jan 24, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Procter & Gamble on Track to Deliver on Fiscal Year Guidance

Procter & Gamble on Track to Deliver on Fiscal Year Guidance

Jan 23, 2025

-

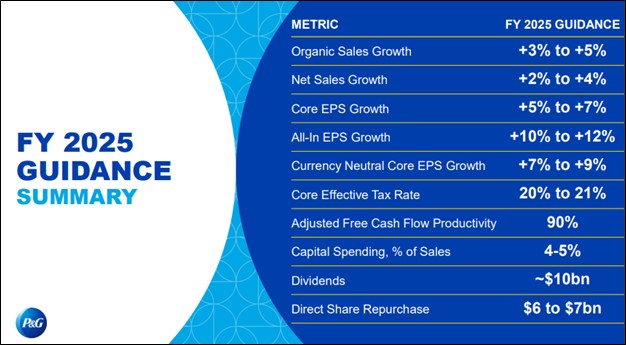

Image Source: Procter & Gamble.

Looking to fiscal 2025 guidance, all-in sales growth is expected in the range of 2%-4% versus the prior year. Organic growth for the fiscal year is targeted in the range of 3%-5%. P&G reiterated its core earnings per share growth for the fiscal year to be in the range of 5%-7%, equating to a range of $6.91-$7.05, or a 6% increase at the midpoint. In fiscal 2025, P&G expects to pay around $10 billion in dividends and repurchase $6-$7 billion of common shares. At the time of this writing, shares of P&G yield ~2.5%.

-

Kinder Morgan Is Now Covering Cash Dividends Paid with Free Cash Flow

Kinder Morgan Is Now Covering Cash Dividends Paid with Free Cash Flow

Jan 23, 2025

-

Image: Kinder Morgan’s shares have been on a tear after the midstream energy giant reports healthier free cash flow that covers cash dividends paid.

Kinder Morgan is doing a much better job covering dividends with traditional free cash flow these days. For the three months ended December 31, 2024, cash flow from operations was $1.51 billion, with capital expenditures coming in at $772 million, resulting in free cash flow of $738 million, which was in excess of the company’s cash dividends paid of $642 million in the quarter. For the year ended December 31, 2024, free cash flow was $3 billion, which was in excess of cash dividends paid of $2.6 billion, resulting in free cash flow after cash dividends paid of $449 million.

-

Netflix Records Biggest Quarter of Net Adds in Its History

Netflix Records Biggest Quarter of Net Adds in Its History

Jan 22, 2025

-

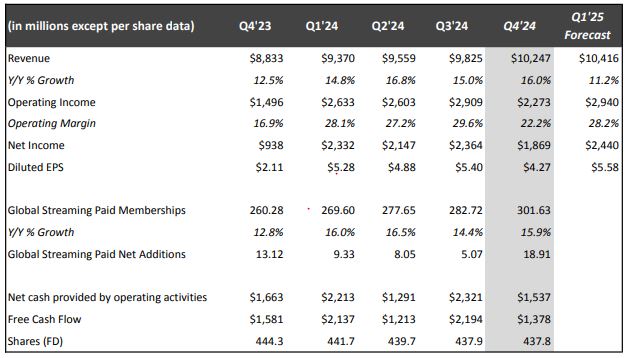

Image Source: Netflix.

Looking to 2025, Netflix expects revenue to be between $43.5-$44.5 billion (12%-14% year-over-year growth), up $500 million from its prior forecast (despite foreign currency headwinds) and an operating margin of 29%, up one percentage point from its prior forecast and two percentage points higher than the 27% operating margin in 2024. Management noted that the return in 2025 of its biggest shows (Squid Game, Wednesday and Stranger Things) gives it optimism heading into the new year.

|