|

|

Recent Articles

-

Tesla Remains a Net Cash Rich, Free Cash Flow Generating Powerhouse

Tesla Remains a Net Cash Rich, Free Cash Flow Generating Powerhouse

Feb 4, 2025

-

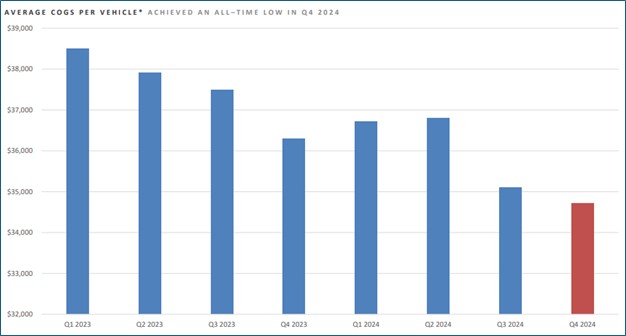

Image: Tesla continues to attack costs with average cost of goods sold per vehicle reaching an all-time low in the fourth quarter of 2024. Image Source: Tesla.

In the fourth quarter, Model 3/Y production fell 8% on a year-over-year basis, while other models production advanced 25%. Model 3/Y deliveries increased 2%, while other models deliveries advanced 3%. Tesla’s quarterly net cash provided by operating activities increased 10%, to $4.8 billion, while capital spending increased 21%, to $2.8 billion, resulting in free cash flow of $2.03 billion, down 2% on a year-over-year basis. Free cash flow for the full year 2024 was $3.58 billion, down 18% on a year-over-year basis. Tesla ended the calendar year with $36.6 billion in cash, cash equivalents and investments. Though free cash flow faced pressure during 2024, the company remains a net cash rich, free-cash-flow generating powerhouse.

-

Altria Expects Modest Earnings Growth in 2025, Shares Yield 7.8%

Altria Expects Modest Earnings Growth in 2025, Shares Yield 7.8%

Feb 2, 2025

-

Image Source: Altria.

Altria ended the year with $3.1 billion in cash and cash equivalents and $24.9 billion in debt. Looking to 2025, Altria expects to deliver full-year adjusted diluted earnings per share in a range of $5.22-$5.37, which reflects a growth rate of 2%-5% from a base of $5.12 in 2024. Management expects 2025 capital expenditures to be between $175-$225 million. Though Altria’s 2025 outlook came in lower than expected, we like the firm’s pricing power and income generation potential with a forward estimated yield of 7.8%.

-

ASML Holding’s Bookings Soar in Fourth Quarter

ASML Holding’s Bookings Soar in Fourth Quarter

Feb 1, 2025

-

Image Source: TradingView.

We continue to like ASML as an idea in the ESG Newsletter portfolio, and the company’s bookings number for the fourth quarter was solid, helping to alleviate some concerns that arose by its weak third-quarter bookings result. The company’s first-quarter outlook for net sales came in ahead of what the Street was looking for, and we liked that ASML reiterated its total net sales expectation for 2025 to be between €30 billion and €35 billion.

-

IBM’s Generative AI Book of Business Doing Well

IBM’s Generative AI Book of Business Doing Well

Feb 1, 2025

-

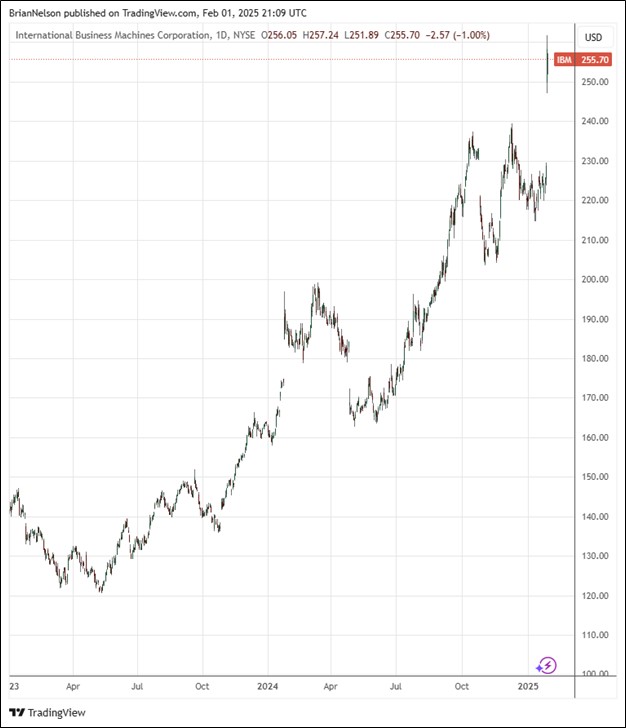

Image Source: TradingView.

For the full year 2024, IBM generated net cash from operating activities, excluding IBM financing receivables, of $13.9 billion and hauled in $12.7 billion in free cash flow for the year, up $1.5 billion, and exceeding dividends paid of $6.1 billion. IBM ended the fourth quarter with $14.8 billion in cash and marketable securities, and debt, including IBM Financing debt of $12.1 billion, totaled $55 billion, down $1.6 billion from the end of 2023. For full year 2025, IBM expects full-year constant currency revenue growth of at least 5% and free cash flow of $13.5 billion for the full year, both measures exceeding the consensus forecast. Shares of IBM yield 2.6% at the time of this writing.

|