|

|

Recent Articles

-

Apple Reports Best Quarter Ever Despite Declining iPhone, China Sales

Apple Reports Best Quarter Ever Despite Declining iPhone, China Sales

Jan 31, 2025

-

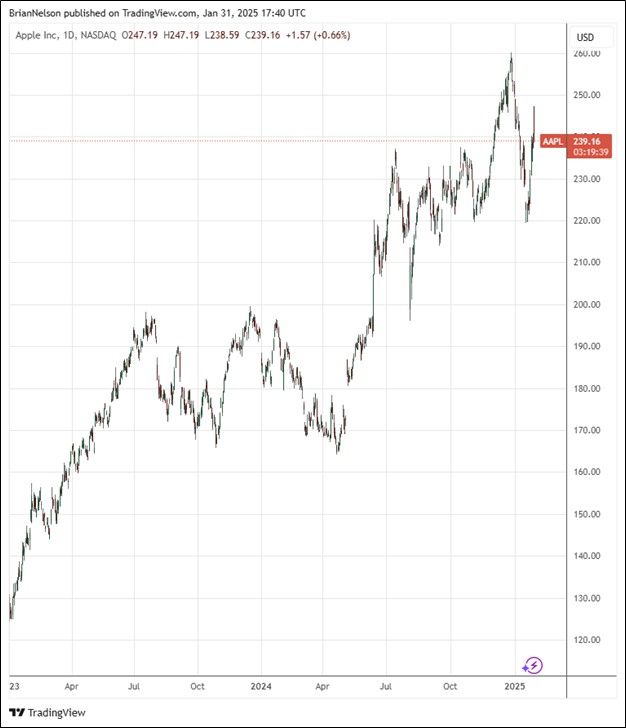

Image Source: TradingView.

During the quarter, Apple returned to shareholders $3.9 billion in dividends and equivalents and $23.3 billion in share repurchases. Looking to the March quarter, management expects total company revenue to grow low to mid-single-digits year-over-year, with Services revenue to grow low double-digits year-over-year. It expects its gross margin to be between 46.5%-47.5%, about in line with the December quarter. We continue to be fans of Apple’s large installed base (2.35 billion active devices) and growing, high-margin Services business, and the company remains a key holding in the newsletter portfolios.

-

Visa’s Free Cash Flow Margins Are Incredible

Visa’s Free Cash Flow Margins Are Incredible

Jan 31, 2025

-

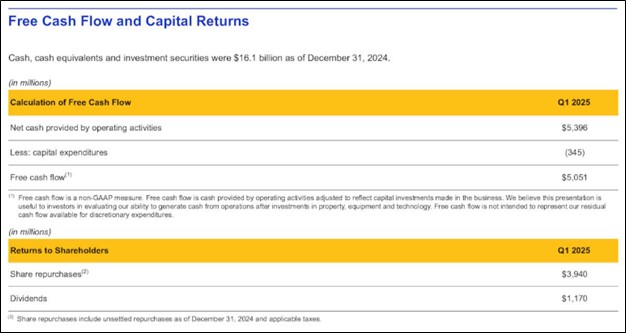

Image Source: Visa.

Visa’s cash and investment securities were $16.1 billion at the end of the calendar year versus short-and long-term debt of $20.6 billion. For the three months ended December 31, operating cash flow was $5.4 billion, up from $3.6 billion in the year ago period. Capital spending came in at $345 million in the quarter, with the firm hauling in free cash flow of $5.05 billion, revealing a free cash flow margin of 53%. Looking to full year 2025, management is targeting low double-digit growth in net revenue and low-teens earnings per share growth. We continue to like Visa as a top weighting in the Best Ideas Newsletter portfolio. The high end of our fair value estimate range stands at $365 per share.

-

Dividend Increases/Decreases for the Week of January 31

Dividend Increases/Decreases for the Week of January 31

Jan 31, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Meta Platforms’ Earnings Surge in Fourth Quarter

Meta Platforms’ Earnings Surge in Fourth Quarter

Jan 30, 2025

-

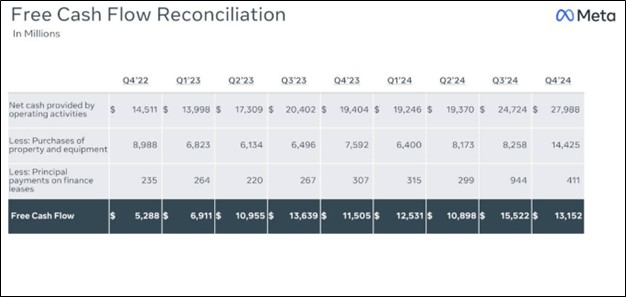

Image Source: Meta Platforms.

Meta Platforms’ earnings growth was phenomenal in the fourth quarter, and we like its ability to drive strong free cash flow, despite higher capital spending. Total dividend and dividend equivalent payments were $1.27 billion and $5.07 billion for the fourth quarter and full year 2024, respectively. Though Meta is not a big dividend payer, we like its dividend growth prospects and include shares in the Dividend Growth Newsletter portfolio.

|