|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of February 7

Dividend Increases/Decreases for the Week of February 7

Feb 7, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Chipotle's Long-term Growth Prospects Are Impressive

Chipotle's Long-term Growth Prospects Are Impressive

Feb 6, 2025

-

Image Source: Valuentum.

During the fourth quarter of 2024, Chipotle bought back ~$330 million of stock, and as of the end of last year, the company had $1 billion remaining available under share repurchase authorizations. Looking to 2025, management expects full year comparable restaurant sales growth in the low to mid-single digit range and plans for 315-345 new company-owned restaurant openings with over 80% having a Chipotlane. At the end of 2024, Chipotle had 3,746 total restaurants, and the firm is targeting as many as 7,000 restaurants in North America alone. We like Chipotle’s long-term growth potential, and the firm remains a holding in the Best Ideas Newsletter portfolio.

-

Alphabet’s Cash Flow Soars in Fourth Quarter

Alphabet’s Cash Flow Soars in Fourth Quarter

Feb 5, 2025

-

Image Source: TradingView.

Google Search and other revenue advanced 12.5% in the quarter on a year-over-year basis, while YouTube ads increased 13.8%. Total Google advertising revenue increased 10.6% in the quarter year-over-year. Total Google Services revenue edged 10.2% higher, while Google Cloud revenue increased 30% from the same period last year. Alphabet ended the quarter with $95.7 billion in total cash and marketable securities and long-term debt of $10.9 billion, good for a robust net cash position. Net cash provided by operating activities soared to $39.1 billion in the quarter versus $18.9 billion in the year-ago period. Free cash flow in the quarter was $24.8 billion, up from $7.9 billion in last year’s quarter. We continue to like Alphabet as a top weighting in the Best Ideas Newsletter portfolio.

-

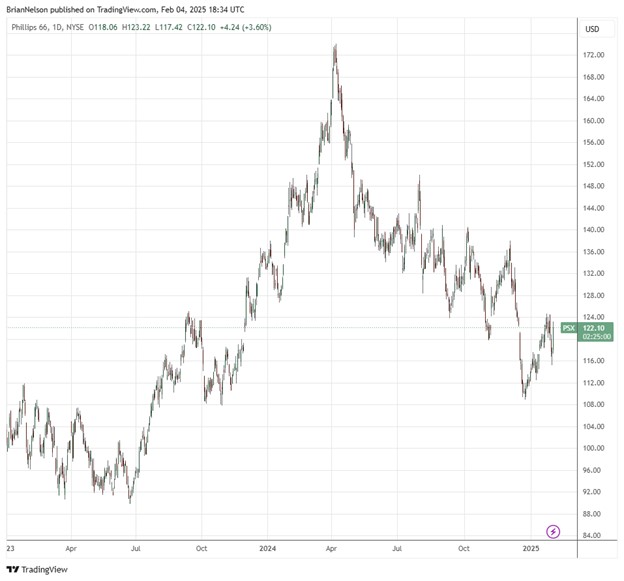

Phillips 66 Outlines Strategic Priorities

Phillips 66 Outlines Strategic Priorities

Feb 4, 2025

-

Image Source: TradingView.

Looking forward to its strategic priorities through 2027, Phillips 66 plans to return greater than 50% of operating cash flow to shareholders, achieve 2% higher than industry average crude utilization, target annual adjusted controllable costs of $5.50 per barrel in Refining, grow Midstream and Chemicals mid-cycle adjusted EBITDA $1 billion in total by 2027, and maintain financial strength and flexibility by reducing total debt to $17 billion. Though the quarterly performance was messy, we continue to like Phillips 66. Shares yield 3.9% at the time of this writing.

|