|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of April 25

Dividend Increases/Decreases for the Week of April 25

Apr 25, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Chipotle’s Comparable Restaurant Sales Fall in First Quarter

Chipotle’s Comparable Restaurant Sales Fall in First Quarter

Apr 24, 2025

-

Image Source: Valuentum.

During the first quarter, Chipotle opened 57 company-owned restaurants with 48 of them including a Chipotlane. Management noted that “Chipotlanes continue to perform well and are helping enhance guest access and convenience, as well as increase new restaurant sales, margins, and returns,” but comparable restaurant sales still faced headwinds due to lower transactions, offset in part by an increase in the average check. For 2025, management anticipates full year comparable restaurant sales growth in the low single digit range and for the firm to add 315-345 new company-owned restaurants with over 80% having a Chipotlane. Though Chipotle’s first quarter results weren’t great, we continue to like its long-term story.

-

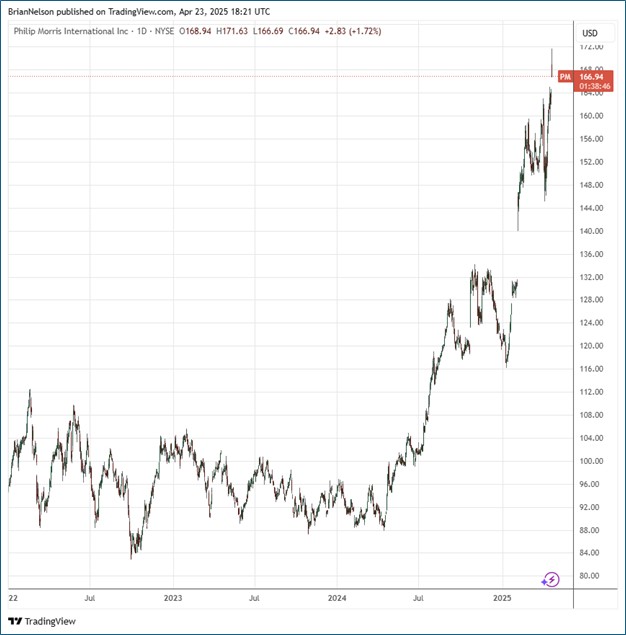

Philip Morris Hits Record High!

Philip Morris Hits Record High!

Apr 23, 2025

-

Image Source: TradingView.

Looking to all of 2025, Philip Morris’ net revenue growth is targeted around 6-8% on an organic basis, with organic operating income growth to be between 10.5%-12.5%. The tobacco giant expects reported diluted earnings per share in the range of $7.01-$7.14, with adjusted diluted earnings per share targeted at $7.36-$7.49 (up 12%-14%) and adjusted diluted earnings per share, excluding currency, expected to be between $7.26-$7.39 (up 10.5%-12.5%). 2025 operating cash flow is targeted to be more than $11 billion at prevailing exchange rates, with capital expenditures of around $1.5 billion, which includes further investments in ZYN capacity in the U.S. We're huge fans of Philip Morris' stock.

-

Tesla’s Revenue Falls in First Quarter, Pulls 2025 Outlook

Tesla’s Revenue Falls in First Quarter, Pulls 2025 Outlook

Apr 23, 2025

-

Image Source: Tesla.

Tesla’s non-GAAP net income attributable to common shareholders dropped 39% in the first quarter, while non-GAAP earnings per share fell 40%. Net cash provided by operating activities increased to $2.2 billion in the first quarter, while capital expenditures fell 46%, to $1.5 billion, resulting in free cash flow of $664 million in the period. Tesla’s cash and investments balance increased $0.4 billion at the end of the quarter, to $37 billion. Due to “the impacts of shifting global trade policy on the automotive and energy supply chains,” management pulled its 2025 guidance, noting that it will revisit it in its second quarter update. CEO Elon Musk said that his DOGE work is mostly done and beginning in May, his time allocated to DOGE will drop significantly. We like Tesla, but don’t include it in any newsletter portfolio.

|