|

|

Recent Articles

-

Verizon’s Dividend Is Nice But Its Debt Keeps Us on the Sidelines

Verizon’s Dividend Is Nice But Its Debt Keeps Us on the Sidelines

Apr 22, 2025

-

Image Source: TradingView.

Looking to 2025, Verizon expects total wireless service revenue growth between 2-2.8%, while adjusted EBITDA growth is targeted in the range of 2-3.5%, with adjusted earnings per share growth of 0-3%. Cash flow from operations is expected in the range of $35-$37 billion with capital spending expected in the range of $17.5-$18.5 billion, resulting in free cash flow of $17.5-$18.5 billion. Verizon ended the first quarter with total unsecured debt of $117.3 billion, compared to $117.9 billion on a sequential basis. Though Verizon has an attractive dividend yield of 6.3%, we continue to remain on the sidelines due to its enormous debt load.

-

Lockheed Martin Reaffirms 2025 Outlook

Lockheed Martin Reaffirms 2025 Outlook

Apr 22, 2025

-

Image: Lockheed Martin’s shares have been on a wild ride the past few years.

During the first quarter, Lockheed paid cash dividends of $796 million while it repurchased 1.7 million shares for $750 million. Looking to all of 2025, management expects sales in the range of $73.75-$74.75 billion, business segment operating profit of $8.1-$8.2 billion, and diluted earnings per share of $27.00-$27.30. For 2025, cash flow from operations is targeted at $8.5-$8.7 billion with capital spending expected at $1.9 billion, resulting in free cash flow in the range of $6.6-$6.8 billion for the year. We continue to like Lockheed Martin as a core idea in the simulated Dividend Growth Newsletter portfolio. Shares yield 2.9% at the time of this writing.

-

Netflix’s Operating Margin Continues to Delight

Netflix’s Operating Margin Continues to Delight

Apr 22, 2025

-

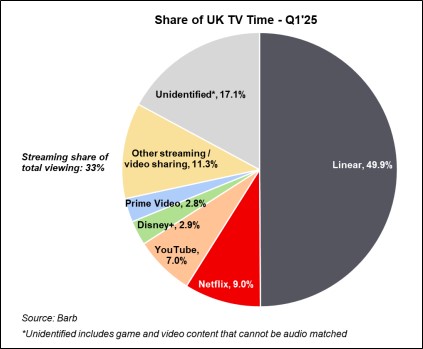

Image: Netflix has a long runway of growth given market share opportunities.

Looking to the second quarter, Netflix expects revenue growth of 15.4% (17% on a foreign exchange neutral basis) as the company benefits from recent price changes and ongoing strength in membership and advertising sales. The company expects an operating margin of 33.3% in the quarter, roughly 6 percentage points better on a year-over-year basis. Netflix continues to expect 2025 revenue in the range of $43.5-$44.5 billion and an operating margin of 29% based on foreign exchange rate levels at the start of the year. We like Netflx’s market share growth opportunities and view shares as relatively immune to tariff pressures and broader macroeconomic uncertainty. Our fair value estimate stands at $1,060 per share.

-

Dividend Increases/Decreases for the Week of April 18

Dividend Increases/Decreases for the Week of April 18

Apr 18, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

|