|

|

Recent Articles

-

Republic Services Continues to Price Ahead of Inflation

Republic Services Continues to Price Ahead of Inflation

Apr 30, 2025

-

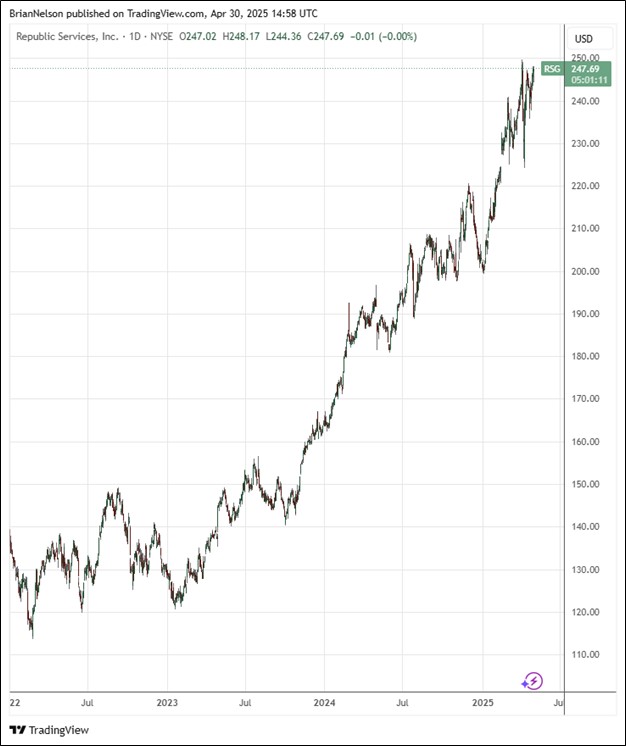

Image: Republic Services’ shares have done quite well the past few years.

Republic Services reported net income of $1.58 per diluted share in the first quarter, up from $1.44 per share in last year’s quarter. Adjusted EBITDA came in at $1.27 billion, while its adjusted EBITDA margin expanded 140 basis points from the prior year. The garbage hauler generated cash flow from operations of $1.025 billion and adjusted free cash flow of $727 million. In the quarter, cash returned to shareholders was $226 million, which included $45 million of share repurchases and $181 million of dividends paid. We continue to like Republic Services in the newsletter portfolios.

-

What Causes Fair Value Estimates to Change?

What Causes Fair Value Estimates to Change?

Apr 29, 2025

-

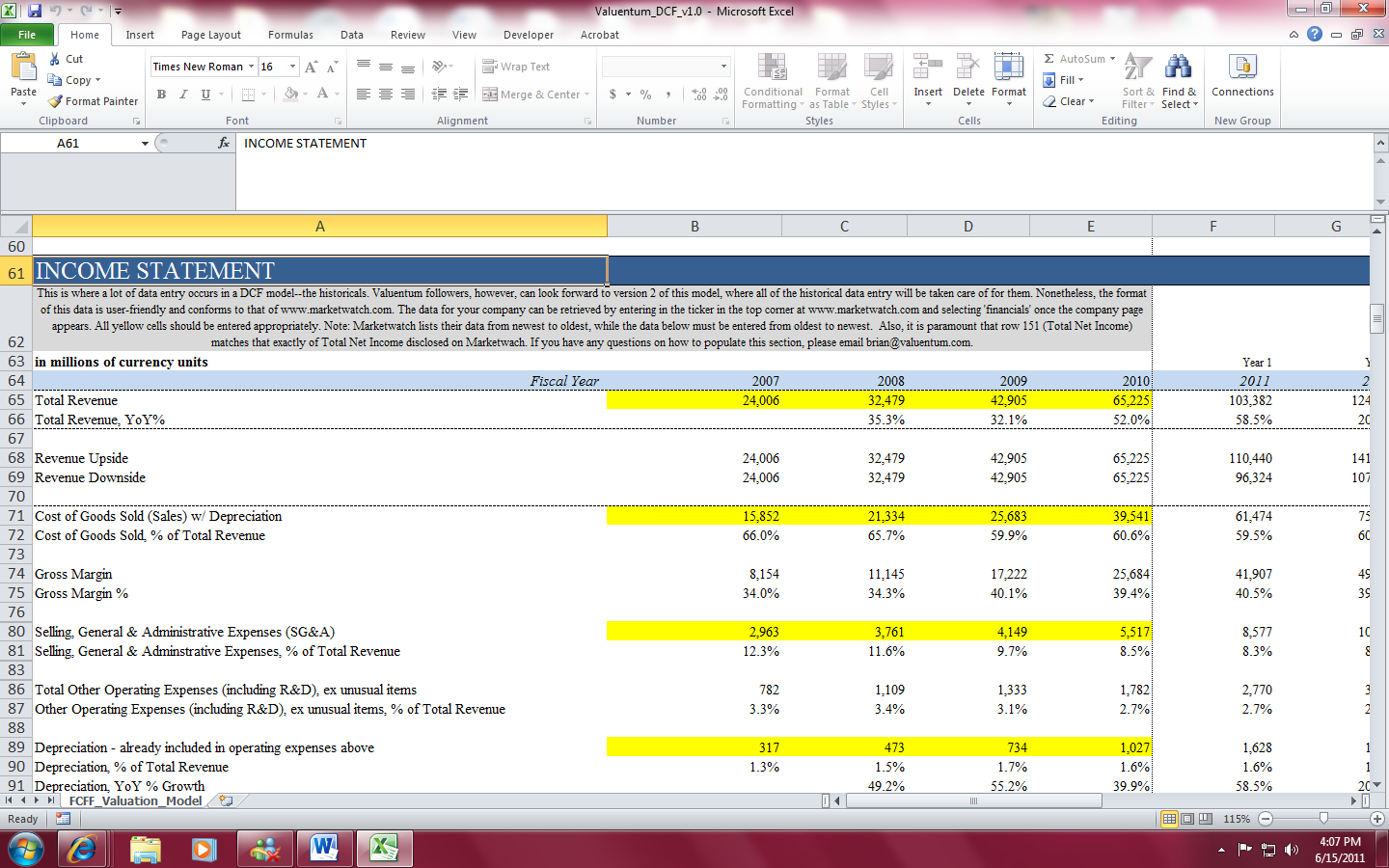

Image: A screenshot of the discounted cash-flow learning tool for individual investors.

So you noticed a fair value estimate changed, and you weren’t sure why? This article is for you.

-

Alphabet Remains a Top Consideration for Long Term Capital Appreciation

Alphabet Remains a Top Consideration for Long Term Capital Appreciation

Apr 28, 2025

-

Image Source: TradingView.

Alphabet raised its dividend 5%, and spent $2.4 billion on dividends during the three months ended March 31. The Board of Directors also authorized the repurchase of up to an additional $70 billion of its Class A and Class C shares. As of March 31, total cash, cash equivalents, and marketable securities totaled $95.3 billion, while long-term debt totaled $10.9 billion at the end of the quarter. Net cash provided by operating activities was $36.2 billion in the quarter, while the firm spent $17.2 billion in capital expenditures, resulting in free cash flow of ~$19 billion. We continue to like Alphabet as a top consideration in the Best Ideas Newsletter portfolio.

-

Domino’s Pizza Misses First Quarter U.S. Same Store Sales Consensus Estimate

Domino’s Pizza Misses First Quarter U.S. Same Store Sales Consensus Estimate

Apr 28, 2025

-

Image Source: Domino's.

Excluding foreign currency impacts, Domino’s income from operations increased 1.4% on a year-over-year basis in the quarter. Net cash provided by operating activities was $179.1 million in the quarter with the firm spending $14.7 million in capital expenditures, resulting in free cash flow of $164.4 million in the period, up 59.1% from last year’s quarter. During the first quarter of 2025, Domino’s repurchased 115,280 shares for a total of $50 million. It still has $764.3 million in remaining authorized amount for share repurchases. We continue to like the long-term picture at Domino’s, and the company remains an idea in the Best Ideas Newsletter portfolio.

|