|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of May 9

Dividend Increases/Decreases for the Week of May 9

May 9, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Magnificent 7 Earnings Reports Not Bad Thus Far

Magnificent 7 Earnings Reports Not Bad Thus Far

May 6, 2025

-

Shortly after Trump's Liberation Day, where the President unveiled lofty tariffs on numerous countries, we released our wait-and-see outlook for the equity markets, which thus far has proven to be the right move, with the markets largely recovering from the depths reached in April. The S&P 500, for example, is down just 3.3% year-to-date, excluding dividends. A lot has happened since Liberation Day, including easing of tariffs to a 10% baseline for most, if not all, countries, with the key exception of China, where tariffs remain extremely elevated and prohibitive. Many countries are now reportedly negotiating trade agreements with the White House, and we expect China to be added to that list soon, even if a full US/China trade agreement won't be completed in the near term, as full-scale trade deals take time to mold. Thus far, we have been impressed by earnings this season, particularly by the Magnificent 7.

-

Vertex Raises Bottom End of 2025 Revenue Guidance Range

Vertex Raises Bottom End of 2025 Revenue Guidance Range

May 6, 2025

-

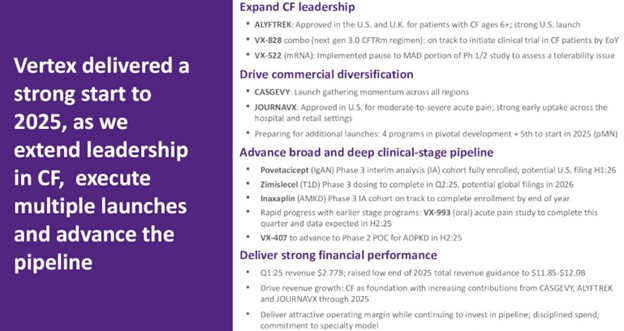

Image Source: Vertex Pharma.

Vertex’s reported results were impacted by an intangible asset impairment charge of $379 million associated with VX-264, but the company’s non-GAAP net income still fell to $1.1 billion in the first quarter compared to $1.2 billion in last year’s quarter as a result of higher operating expenses. Looking to the balance of 2025, however, Vertex raised the low end of its revenue guidance range to be between $11.85-$12 billion, up from $11.75-$12 billion previously. The company ended the quarter with $11.4 billion in cash and cash equivalents and no traditional debt. Though Vertex’s first quarter results came in lower than expected, we continue to like the long term story at the company, particularly in pain management, and the stock remains key biotech exposure in the Best Ideas Newsletter portfolio.

-

Booking Holdings' Free Cash Remains Robust

Booking Holdings' Free Cash Remains Robust

May 6, 2025

-

Image Source: Booking Holdings.

Looking to the second quarter of 2025, Booking Holdings expects revenue growth of 10%-12% and adjusted EBITDA growth of 13%-16%. For full year 2025, on a constant currency basis, management expects gross bookings growth in the mid to high-single digits, with revenue advancing by the mid to high-single digits, too. Adjusted EBITDA is targeted for high-single-digits to low-double-digits growth, while adjusted earnings per share is targeted in the low to mid-teens. We continue to like Booking Holdings as an idea in the Best Ideas Newsletter portfolio.

|