|

|

Recent Articles

-

Amazon Guides to Strong Second Quarter Revenue Growth

Amazon Guides to Strong Second Quarter Revenue Growth

May 4, 2025

-

Image: Amazon’s shares are trading near technical support levels.

Looking to the second quarter, Amazon expects sales to be between $159-$164 billion, or to grow 7%-11% compared with the second quarter of last year. The midpoint was above the consensus forecast of $161.1 billion. Operating income is targeted to be between $13-$17.5 billion in the second quarter, compared with $14.7 billion in the second quarter of 2024, with the midpoint of the range coming in below the consensus forecast. Though the operating income guide for the second quarter wasn’t great, we like the momentum behind AWS and Amazon’s strong balance sheet, which houses $41.2 billion in net cash.

-

Apple’s Earnings Set March Quarter Record; Services Revenue Hits All-Time High

Apple’s Earnings Set March Quarter Record; Services Revenue Hits All-Time High

May 4, 2025

-

Image: Apple’s shares remain resilient despite tariff pressures.

On May 1, Apple reported better than expected second quarter results for fiscal 2025 with both revenue and GAAP earnings per share coming in ahead of the consensus forecasts. The iPhone giant reported quarterly revenue of $95.4 billion, up 5% year-over-year, while quarterly diluted earnings per share came in at $1.65, up 8% year-over-year. The board raised its dividend 4% and authorized an additional buyback program to the tune of $100 billion.

-

Dividend Increases/Decreases for the Week of May 2

Dividend Increases/Decreases for the Week of May 2

May 2, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Microsoft’s Cloud Business Performing Better Than Expected

Microsoft’s Cloud Business Performing Better Than Expected

May 1, 2025

-

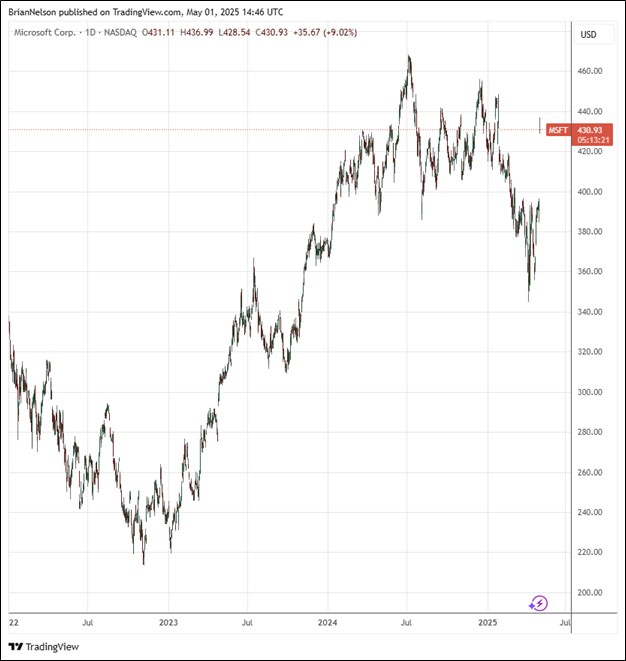

Image: Microsoft’s shares have held up well in this volatile market environment.

In the quarter, Microsoft returned $9.7 billion to shareholders in the form of dividends and share repurchases. Total cash, cash equivalents, and short-term investments totaled $79.6 billion at the end of the quarter, while debt totaled $42.9 billion. Cash flow from operations increased to $37 billion from $31.9 billion in the three months ended March 31, while capital expenditures were $16.7 billion, up from $11 billion in the prior-year quarter. We continue to be huge fans of Microsoft, and the company delivered in its fiscal third quarter results.

|