|

|

Recent Articles

-

Cisco Raises Fiscal 2025 Outlook Again

Cisco Raises Fiscal 2025 Outlook Again

May 15, 2025

-

Image: Cisco put up excellent fiscal third quarter results.

Looking to the fourth quarter of fiscal 2025, Cisco’s revenue is expected to be between $14.5-$14.7 billion, with non-GAAP earnings per share targeted in the range of $0.96-$0.98. For all of fiscal 2025, revenue is expected to be in the range of $56.5-$56.7 billion (was $56-$56.5 billion) and non-GAAP earnings per share in the range of $3.77-$3.79 (was $3.68-$3.74). We continue to like Cisco as a holding in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. The high end of our fair value estimate range stands at $74 per share.

-

UnitedHealth CEO Steps Down; Company Suspends Guidance

UnitedHealth CEO Steps Down; Company Suspends Guidance

May 13, 2025

-

Image Source: TradingView.

UnitedHealth Group announced that its CEO Andrew Witty will step down for personal reasons. Taking his place is Stephen Hemsley, who served as the company CEO from 2006-2017. UnitedHealth also suspended its recently-lowered 2025 outlook “as care activity continued to accelerate while also broadening to more types of benefit offerings than seen in the first quarter, and the medical costs of many Medicare Advantage beneficiaries new to UnitedHealthcare remained higher than expected.” Though the company expects to return to growth in 2026, we’re putting the company under review while we reevaluate our fair value estimate for shares. UnitedHealth remains an idea in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

-

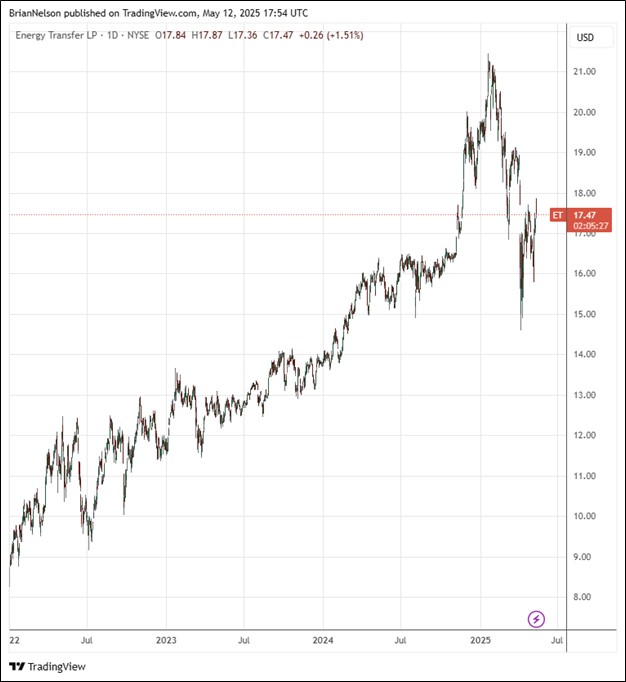

Energy Transfer’s Distributions Covered By Free Cash Flow

Energy Transfer’s Distributions Covered By Free Cash Flow

May 12, 2025

-

Image Source: TradingView.

Energy Transfer’s distributable cash flow attributable to partners, as adjusted, for the three months ended March 31 was $2.31 billion, compared to $2.36 billion in last year’s quarter. Total distributions to be paid to partners was $1.1 billion in the quarter. Free cash flow in the quarter, calculated as cash flow from operations less all capital spending, was $1.69 billion, which covered distributions paid during the period. We continue to like Energy Transfer as an idea in the High Yield Dividend Newsletter portfolio.

-

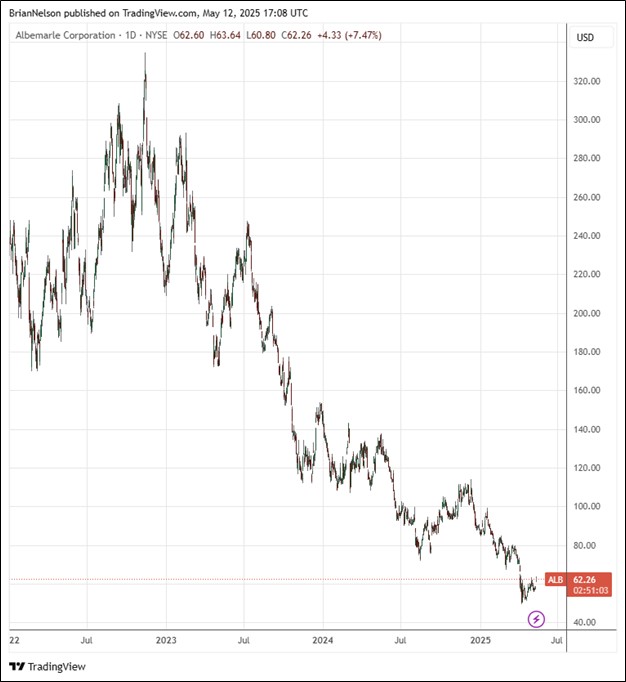

Albemarle Continues to Navigate a Low Lithium Price Environment

Albemarle Continues to Navigate a Low Lithium Price Environment

May 12, 2025

-

Image Source: TradingView.

Albemarle’s cash flow from operations in the quarter came in at $545 million, which included a $350 million customer prepayment. The firm reiterated its view that it has line of sight to breakeven free cash flow assuming current lithium pricing. Albemarle also maintained its full-year 2025 outlook considerations. At year-end 2024 average lithium market price of $9/kg LCE, net sales are targeted in the range of $4.9-$5.2 billion, with adjusted EBITDA in the range of $0.8-$1.0 billion. Though Albemarle continues to struggle with a low lithium price environment, we were encouraged by commentary regarding free cash flow, and the stock remains an idea in the ESG Newsletter portfolio.

|