Member LoginDividend CushionValue Trap |

Nelson: I'm Not Worried About This Market

publication date: Oct 8, 2020

|

author/source: Brian Nelson, CFA

Dear members: Dear members:---

First of all, I wanted to share a heartfelt thank you to all that sent kind words regarding the passing of my brother. My inbox was overflowing with your love and kindness. Len was a great person and my best friend. Without him, I don't think Valuentum would have come into existence. Your words have been very comforting to me and my family during this difficult time. Thank you again.

---

With that said, I continue to be bullish on the markets over the long haul. We maintain our view that longer-duration enterprise free cash flows are worth more than they were prior to the COVID-19 market collapse, and valuation adjustments are being reset higher as a result of lower discount rates and higher inflationary expectations. These dynamics are explained extensively in the second edition of Value Trap, so I won't elaborate much here. We expect competitively advantaged business models with pricing power to experience outsize earnings expansion in such an environment.

---

I expect Donald Trump to fully recover from his bout with COVID-19. Politically, his experience with COVID-19 might even give him a leg up in the race, as there's now a very high probability that he will be resistant from reinfection going forward, unlike Democratic nominee Joe Biden (who has not contracted the disease, and the outcome, if he did, remains tenuous). When it comes to uncertainty, Trump may be the less uncertain consideration for those undecided, especially if a vaccine may not become available until sometime next year. It's an interesting perspective, but many voters are on the fence.

---

As I'm writing this, the S&P is trading at ~3,440, just shy of what I consider to be a fair value estimate range, and we maintain our bullish stance on the areas of large cap growth and big cap tech. Our newsletter portfolios are heavily weighted toward these areas, including Apple (AAPL), Microsoft (MSFT), Intel (INTC), Facebook (FB), Alphabet (GOOG), PayPal (PYPL), Visa (V), Cisco (CSCO), Oracle (ORCL) and the like. These are just flat-out great companies that generate strong returns on invested capital, throw off lots of free cash flow and boast impenetrable balance sheets.

---

These are well-known companies, but it shows that you don't have to go looking for obscure companies in emerging markets to outperform. In fact, the returns of non-US and emerging market equities have substantially trailed the returns of US equities during the past decade or so. According to MarketWatch, from March 2009 through February 19, 2020, the annualized return of US equities was 7.8 percentage points higher than international equities and 8.1 percentage points higher than emerging market equities.

---

I think a lot of investors think they have to find areas of underfollowed companies to generate alpha. That's a myth. For one, lesser-known and underfollowed small cap "value" stocks have underperformed the market considerably during the past decade or so. It's not about finding underfollowed and obscure names, per se, as it is about anticipating expectations revisions. Expectations revisions are ubiquitous. You can beat the market with just a handful of names in the US, as we have shown time and time again.

---

We continue to steer clear of the financials and energy arenas, which have fallen about 19% and 50% year-to-date, respectively. We're not interested in considering the worst sectors at the worst times, hoping for a dead-cat bounce or a turnaround based on mean reversion. Mean reversion doesn't have to happen. Just because a stock or sector is beaten down doesn't mean that it is a bargain, or that it is due to bounce back; its value could still be worth considerably less than its price.

---

I think the framework behind quantitative thinking has a lot of investors confused. For example, the quant value factor won't make a comeback because of mean reversion; if it ever makes a comeback, it will because the holdings that fit its arbitrary profile will have come into market favor on the basis of their future fundamental trajectories and intrinsic values. Investing is about buying strong, undervalued assets opportunistically and letting returns compound over time as price convergences to intrinsic value and beyond.

---

The following is probably worth repeating, too: We're not in a bubble. In many respects, our newsletter holdings, which have done great with many of them soaring this year, may actually be less risky than they were prior to the COVID-19 collapse and far less riskier than those of the beaten down financials and energy spaces. From my perspective, there may be little reason to have exposure to such out-of-favor areas as financials and energy. Investors don't operate in a vacuum. What the market does and what the market thinks simply matters. After all, it is through the buying and selling of shares that price discovery occurs, and the market has to agree with us for ideas to eventually be proven right.

---

All things considered, not much has changed since our last update. I think the newsletter portfolios--Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, High Yield Dividend Newsletter portfolio--are well-positioned for this market environment, our new options idea generation has been great, the Exclusive ideas have had tremendous success rates (we just closed another two winners recently), and we continue to add tremendous value in providing our work in full transparency for readers. Thanks for tuning in.

---

Here are some of my recent articles you may have missed.

---

From February 15 through June 11, or through the course of the worst of the COVID-19 meltdown and its abrupt recovery, we estimate that the Best Ideas Newsletter portfolio exceeded the market return by about 7.8 percentage points.

---

At Valuentum, we seek to identify strong, competitively-advantaged companies that are underpriced [with solid cash-based sources of intrinsic value (net cash, strong expected free cash flows)] whose share prices are either 1) also advancing, 2) have strong relative pricing strength, or 3) have just started to begin to advance toward an intrinsic value estimate (with a nice growing dividend to boot, where applicable). Third-level thinking is our foundation at Valuentum, and it continues to serve investors well.

---In investing, it's okay to admit that there are some things that investors can't know. It's not a poor reflection of one's analytical ability or a possible shortcoming of one's experience, but rather quite the contrary: Understanding and accepting that some things are "unknowable" is a sign of the quality of one's judgment. Quite simply, certain critical components of the equity evaluation process are more "unknowable" than others. The intelligent investor recognizes the variance (fair value estimate ranges) and the magnitude of the "unknowable" between companies and generally tries to identify entities that have the least "unknowable" characteristics as possible or situations where the "unknowable" might actually be weighted in their favor (an asymmetric fair value distribution).

---

Richard Thaler in his groundbreaking book Nudge, co-written with Cass Sunstein, talked about the role of the choice architect. A choice architect is basically someone or some organization that has the responsibility for organizing the context and content in which people make decisions. At Valuentum, we can never provide personalized buy/sell advice, but in providing publishing services, we've opted for the healthy option for members, and that sometimes means you won't find a large selection of dessert options. This isn't a shortcoming of our service (i.e. we know desserts are tempting), but rather a key positive attribute. As we've shown time and time again, you don't need to look far to beat the market return (or, by comparison, to have a healthy diet). If something is not on the menu at Valuentum, it means the chef has something better cooking in the kitchen. Here's to your long-term financial health!

---

To my amazement, the equal-weighted hypothetical returns of our top 10 COVID-19 ideas not only exceeded the market return over the simulated measurement period by a huge margin, but because of the impeccable timing of their release, they also did better than the returns of a backfilled index from the start of the year that--get this--was filled with stocks that in April were already "outperforming the S&P 500 since the start of 2020." I sincerely hope this provides some perspective of just how awesome our research and idea generation has been this year. If I had a mic, I would drop it!

---

Have you ever wondered why so many trust the TV for financial advice or stock tips? You guessed it: It comes back to "brain science" or the concept of familiarity. When we see a celebrity or our favorite stock guru on the television, it arouses our emotions and connects us with the idea, making the experience more memorable. The brain tends to treat our favorite newscaster or celebrity as a trusted, familiar friend, and therefore we translate those feelings into expertise and a "valid" endorsement.

---

Valuation multiples tend to trigger the reflexive side of our brain, and we process the multiples through anchoring, in most cases. On the other hand, enterprise valuation, or the process required to answer the second set of questions in this article correctly, shows that our reflexive process can be quite incorrect at times. In fact, cognitive biases such as anchoring can completely trip us up into missing out on truly undervalued companies while baiting us into value traps.

---

For every Amazon that made it, there are hundreds, maybe thousands, from the dot-com era that didn't. Very few remember Pets.com or etoys.com, both of which went belly up during the dot-com meltdown. For every Tesla, there is a DeLorean Motor Co. We might have completely forgotten about DeLorean were it not for the blockbuster movie, Back To The Future, that immortalized its futuristic sports car. For every streaming enterprise like Netflix, there is a Napster that failed. Most of us probably don't even remember the original Napster, which encountered legal troubles before closing shop shortly after the dot-com bust. For every Alphabet, there's an AltaVista or Netscape. For every Apple, there is a Palm or Blackberry. Who remembers how popular the Palm Pilot and Blackberry were? How about the Motorola Razr? For every Facebook, there is a Myspace or Friendster. As investors, we underestimate the role of luck in a company's long-term success. In February 2000, a month before the dot-com market crash, a fledgling Amazon raised $672 million in convertible notes to European investors. If the company hadn't done so, there'd likely be no Amazon today, and one of the wealthiest men in the world, Jeff Bezos, might have just been a mere footnote in stock market history. Amazon would have been insolvent in 2001-2002 just like many of its other dot-com peers.

---

We have to be on high alert about how our minds work. PBS is premiering a four-part series examining about how easily our minds are being hacked, and why it is so important to "think slow." Tune in (5). When it comes to the active versus passive debate, does the analysis suffer from parameter risk? With respect to empirical, evidence-based analysis, does the analysis have the entire construct wrong? When it comes to short-cut multiples, are we falling into the behavioral trap of thinking on autopilot? I hope that you found this article helpful, and don't let your mind get hacked!

---

The skills to successfully invest for long-term capital gains or long-term dividend growth are much different than those required for generating high yield dividend income. Income investing is a much different proposition. However, the skills do center on a similar equity evaluation process, but one that requires an acknowledgement and heightened awareness of considerably greater downside risks. Income investing, or high yield dividend income investing, should at times be considered among the riskiest forms of investing, as many high dividend-yielding securities tend to trade closer to the characteristics of junk-rated bonds than they do most net cash rich and free cash flow generating powerhouses that we like so much in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

---

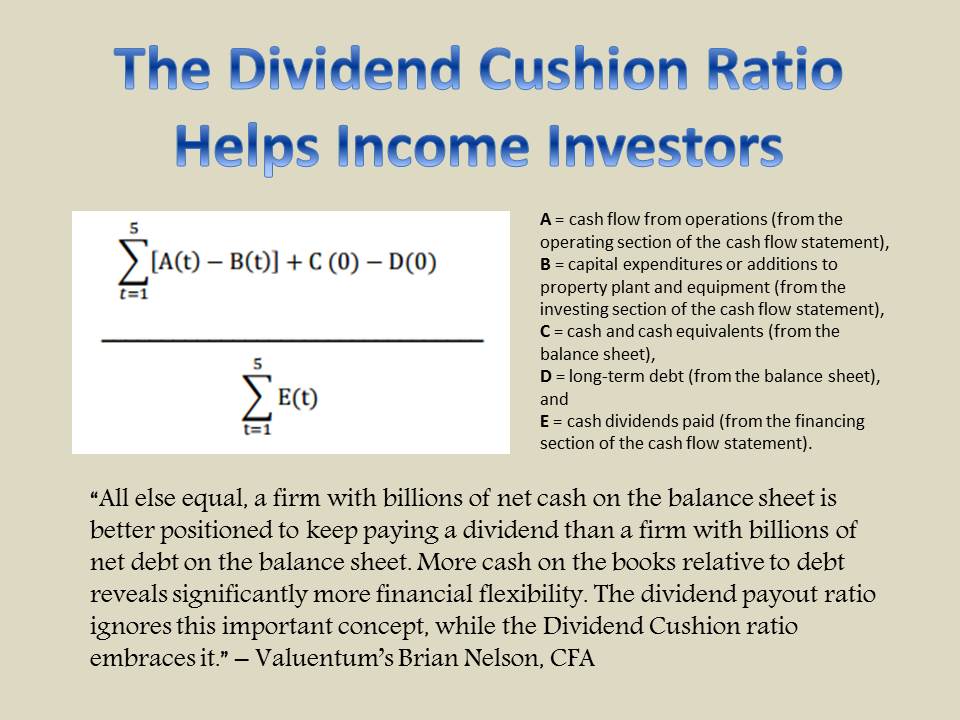

Management's willingness to pay is critical, so an understanding of how dividend growth has been the past few years is very important, but when we look for fantastic dividend growth ideas for the future, we also want to make sure that the management team has the capacity to keep raising the dividend--meaning there's so much more to dividend growth assessments than backward-looking analysis. For starters, we want our long-term dividend growth ideas to have strong competitively-advantaged business models, solid secular growth trends or recession-resistant characteristics, impressive balance sheets (sometimes and preferably with hefty net cash positions) and growing future expected free cash flows (strong Dividend Cushion ratios).

---

There are three primary benefits of a well-executed dividend growth strategy, one that is carried out with prudence and care and one that pays careful attention to the intrinsic value of the stock and its critical cash-based components. Albert Einstein is reported to have called compound interest the "eighth wonder of the world," but dividend growth investing has the potential to offer long-term investors so much more! Let's explain.

---

"When I left as director in the equity and credit department at Morningstar in 2011, I thought I knew a whole heck of a lot about investing. I felt like I was one in the top 5-10 in the world as it relates to the category of practical knowledge of enterprise valuation (maybe include Koller at McKinsey, Mauboussin at Counterpoint, and Damadoran at Stern on this list). After all, I oversaw the valuation infrastructure of a department that used the process extensively, and the firm was among just a few that used enterprise valuation systematically. Then, at Valuentum, our small team would go on to build/update 20,000+ more enterprise valuation models. There can always be someone else out there, of course, but I don't think anybody has worked within the DCF model as much as I have across so many different companies. That said, through the past near-10 years managing Valuentum's simulated newsletter portfolios, I've also learned a number of things to become an even better portfolio manager." -- Brian Nelson, CFA

---

To some degree, each investor has to pick their own preference. With widely-diversified index investing, firm-specific risk is largely eliminated as such investors are taking on only systematic risk. On the other hand, investors seeking portfolio concentration are taking on firm-specific risk, in addition to systematic risk. This could either help mitigate broader market movements or exacerbate them. I hope this was helpful, and may today's nearly all-green Best Ideas Newsletter portfolio brighten your spirits. Let us look to even better times ahead.

---

It's Here!

The Second Edition of Value Trap! Order today!

----

Tickerized for holdings in the DIA.

---

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

---

Brian Nelson owns shares in SPY, SCHG, DIA, VOT, and QQQ. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment