Member LoginDividend CushionValue Trap |

Johnson & Johnson Beats Estimates, Adjusts Guidance in Light of COVID-19

publication date: Apr 16, 2020

|

author/source: Callum Turcan

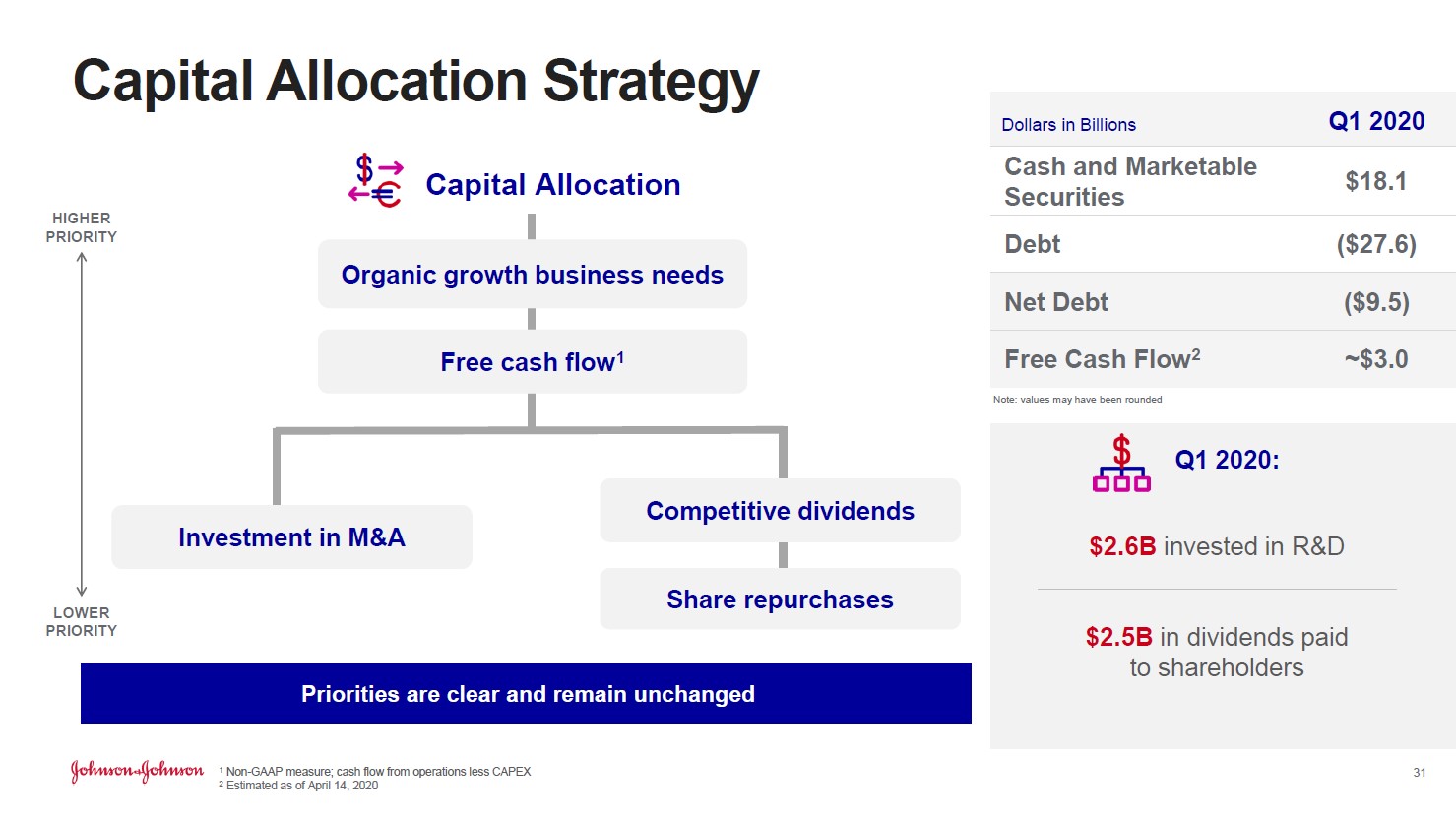

Image Source: Johnson & Johnson – First Quarter 2020 Earnings IR Presentation By Callum Turcan On April 14, Best Ideas Newsletter and Dividend Growth Newsletter portfolio holding Johnson & Johnson (JNJ) increased its quarterly dividend by over 6% sequentially to $1.01 per share which represents the firm’s 58th consecutive annual increase. We view this payout boost in the face of the ongoing coronavirus (‘COVID-19’) pandemic as a sign of management’s confidence in Johnson & Johnson’s future free cash flows, which we appreciate. Shares of JNJ now yield ~2.8% as of this writing at the new annualized payout rate. Additionally, Johnson & Johnson also posted its first-quarter 2020 earnings report on April 14 which beat both consensus top- and bottom-line expectations by wide margins. The company’s GAAP revenues rose by over 3% year-over-year to $20.7 billion and its adjusted (non-GAAP) sales growth (classified as ‘operational sales’) almost reached 5% due to strength at its ‘pharmaceutical’ and ‘consumer health’ divisions offsetting a decline at its ‘medical devices’ division, a product of hospitals forgoing elective surgeries as global healthcare systems focus on managing the pandemic. We sincerely hope everyone, their families, and their loved ones are staying safe out there. On an adjusted (non-GAAP) basis, the company’s diluted EPS rose by almost 10% to $2.30 in the first quarter. We’ll have more to say when Johnson & Johnson publishes its 10-Q filing with the SEC, as the firm did not provide its cash flow and balance sheet statements in its earnings press release. In Johnson & Johnson’s IR presentation covering its first-quarter 2020 earnings report, the company included a slide (shown down below) that noted the company had $18.1 billion in cash, cash equivalents, and marketable securities on hand versus $27.6 billion in debt, reflecting a net debt position of $9.5 billion. Free cash flow, as defined by management, came in at ~$3.0 billion last quarter which covered $2.5 billion in dividend obligations according to the slide.

Image Shown: A look at Johnson & Johnson’s cash flow and balance sheet performance last quarter, keeping in mind we are still waiting for the firm to publish its 10-Q filing covering this period. Image Source: Johnson & Johnson – First Quarter 2020 Earnings IR Presentation Guidance Change Looking ahead, management adjusted Johnson & Johnson’s 2020 guidance for the full-year in order to take into account the impact the pandemic is having on the company’s operations and sales. During the firm’s quarterly conference call, management noted that Johnson & Johnson’s medical device segment was responsible for a material part of this forecast change due in large part to a decline in elective surgeries in healthcare markets around the world (as noted previously).

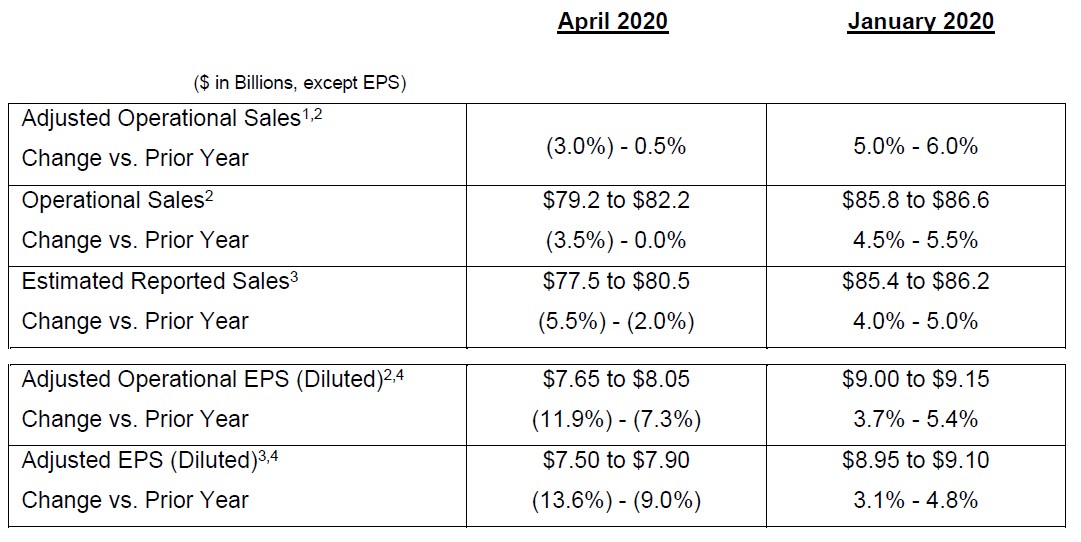

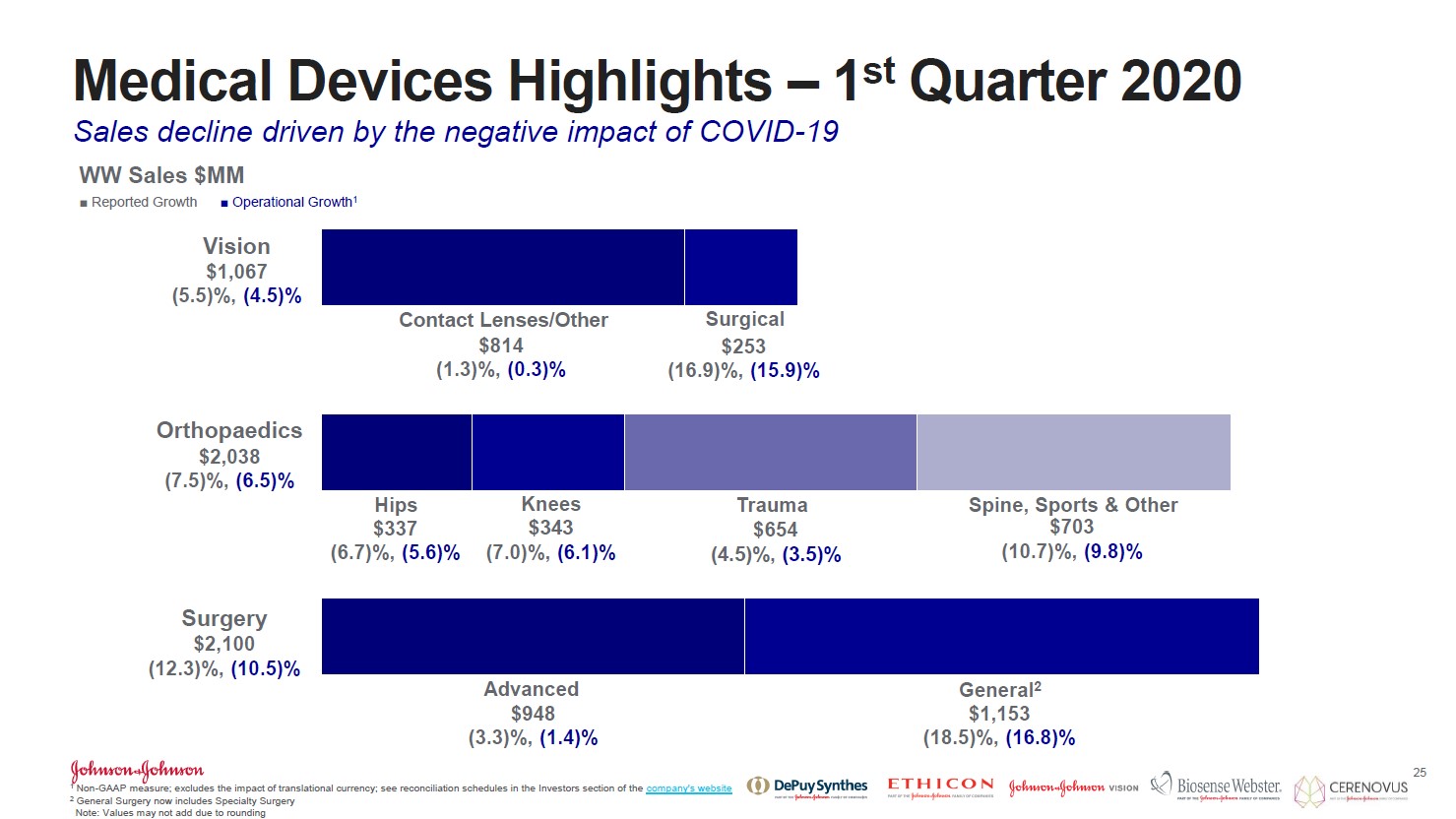

Image Shown: Johnson & Johnson’s updated guidance for 2020 reflects the negative impact the pandemic is expected to have on its financials. Image Source: Johnson & Johnson – First Quarter 2020 Earnings Press Release Here’s some key commentary from management during the call covering the issue (emphasis added): So let’s move on to Medical Devices, which is at the core of our guidance change and remains the most uncertain… Consistent with what we experienced in the first quarter, we expect our medical device business to be negatively impacted as many procedures continued to be deferred and hospital resources are diverted to address the pandemic. We are assuming the most significant negative impact occurs in the second quarter, a lingering impact but signs of stabilization in the third quarter and then some recovery in the fourth quarter… …we have a broad portfolio in medical devices… approximately one-third of our medical device business supports urgent procedures that aren’t candidates for deferral, in other words, non-elective such as events that address trauma, stroke and critical surgeries associated with cancer… we are assuming declines in urgent procedures as well. Individuals are spending less time outdoors engage[d] in physical activity, which we expect to impact procedures even urgent ones, particularly in a market like trauma… …We believe hospital systems will have capacity to makeup deferred procedures from earlier in the year, but we suspect it could take time for patients to get comfortable scheduling an elective procedure, hospitals and surgeons may still be recovering from peak COVID-19 impacts… These assumptions are our best estimates at this time. And again, we are not assuming a recurrence or significant mutation of COVID-19. There’s not much Johnson & Johnson can do on this front but continue to meet the fluctuating needs of the global healthcare industry. In the upcoming graphic down below, Johnson & Johnson provides a snapshot of its medical device segment’s performance during the first quarter of 2020, keeping in mind management expects sales in the division to continue coming under fire in the second quarter before starting to stabilize in the third quarter and then recover in the fourth.

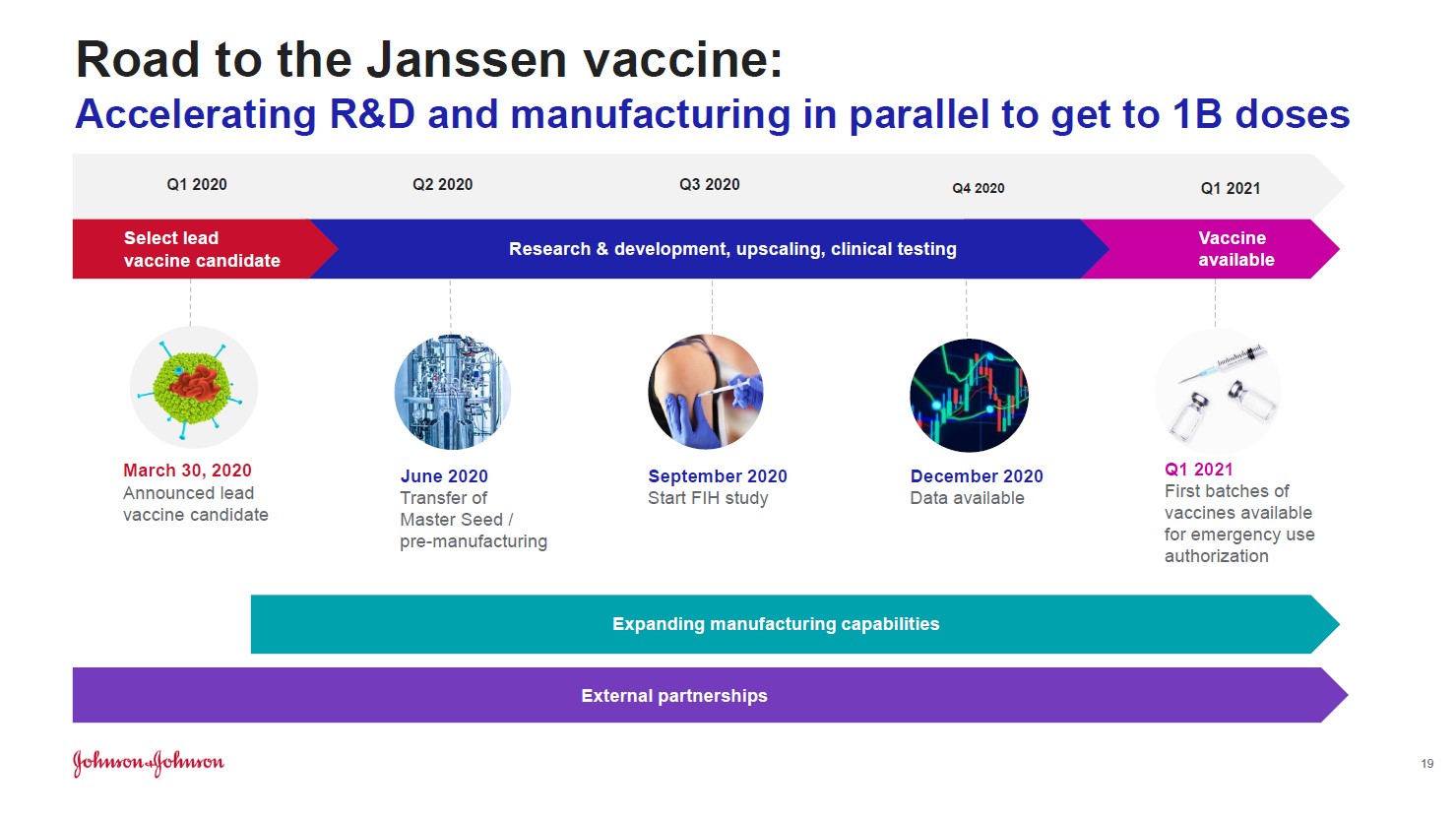

Image Shown: A decline in elective surgeries due to the COVID-19 pandemic will pressure Johnson & Johnson’s 2020 performance given its large medical devices segment. Image Source: Johnson & Johnson – First Quarter 2020 Earnings Press Release COVID-19 Vaccine Johnson & Johnson has committed $1.0 billion towards developing a vaccine for COVID-19 with its partners and is concurrently ramping up its manufacturing capacity so that if a vaccine is discovered and proved successful via human trials (set to start up in September 2020), the company could quickly ramp up and produce over 1 billion vaccine doses with production starting by the first quarter of 2021. The data from its human trials is expected to be available by December 2020. During Johnson & Johnson’s quarterly earnings call, Paul Stoffels, M.D. (the firm’s Vice Chairman of the Executive Committee and Chief Scientific Officer) had this to say in response to an analyst’s question regarding the potential COVID-19 vaccine: …production capacity would be ready to go at 600 million to 900 million in the first quarter [of 2021] going up to 1 billion in the course of the year, north of 1 billion by the end of the year. So – and that’s on an annual basis. So we will have 4 manufacturing sites going on one by one bringing the whole capacity up to 1 billion in the course of the year. Many companies are racing to be the first to come up with a COVID-19 vaccine, and Johnson & Johnson is arguably one of the leading firms in the field. In the upcoming graphic down below, Johnson & Johnson provides a timetable for what to expect over the next year in terms of its COVID-19 vaccine program.

Image Shown: Johnson & Johnson is racing to get hundreds of millions of COVID-19 vaccine doses ready by the first half of 2021. Image Source: Johnson & Johnson – First Quarter 2020 Earnings IR Presentation Please note that there’s a chance Johnson & Johnson’s leading vaccine candidate (and its two backups) won’t be successful, but the company is giving it a shot, and we appreciate its strategy as the world is desperately in need of a vaccine. Concluding Thoughts Johnson & Johnson’s stock is holding up well in the face of ongoing market turbulence. Over the past year, shares of JNJ are up over 7% as of the end of normal trading activity on April 14, while the S&P 500 (SPY) is down 5%, and that’s before taking dividend considerations into account. Our fair value estimate for JNJ sits at $148 per share and there’s room for upside, as the top end of our fair value estimate range for Johnson & Johnson sits at $178 per share. We continue to like Johnson & Johnson in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Medical Devices Industry – EW ISRG MDT VAR WAT ZBH Health Care Services Industry – DVA EHC HCA UNH UHS Pharmaceuticals (Big) Industry – ABT ABBV AMGN AZN BMY LLY GSK MRK NVS NVO PFE SNY Pharmaceuticals (Biotech/Generic) Industry – ALXN AGN BHC BIIB BMRN GILD MYL REGN TEVA VRTX ZTS Household Products Industry – CHD CLX CL ENR HELE JNJ KMB PG Related: XLV, STT, MNK, ENDP, CAH, MCK, ABC, WMT, RAD, CVS, IBB Related (vaccine/treatment): MRNA, INO, NVAX, BNTX, APDN, VXRT, TNXP, EBS, PFE, JNJ, DVAX, IMV, IBIO, REGN, SNY, GSK, ABBV, TAK, HTBX, SNGX, PDSB, SRNE Tickerized for our healthcare and biotech ETF coverage. ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. The Health Care Select Sector SPDR ETF (XLV) and Johnson & Johnson (JNJ) are both included in Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment