Member LoginDividend CushionValue Trap |

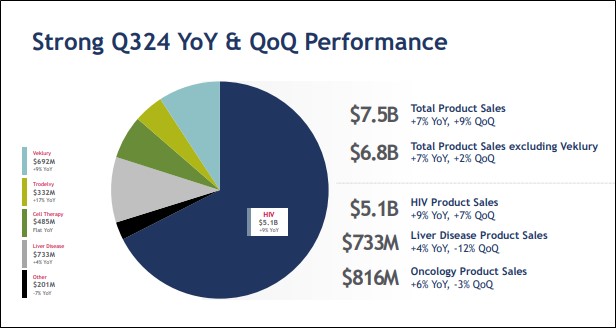

Gilead Raises Revenue and Non-GAAP Diluted EPS Guidance

To gain access to the members only content, click here to subscribe. You will be given immediate access to premium content on the site.

|