Member LoginDividend CushionValue Trap |

CubeSmart’s Financial Flexibility Will Come In Handy

publication date: May 28, 2020

|

author/source: Callum Turcan

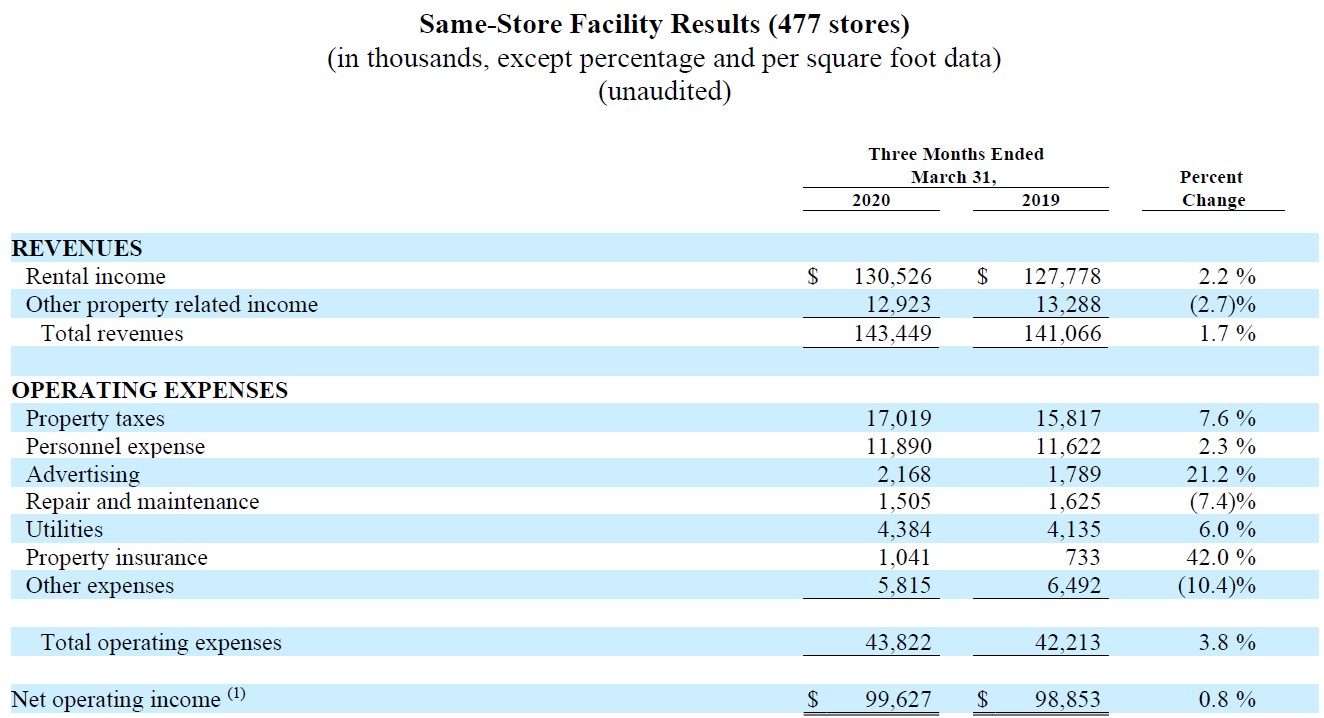

Image Source: CubeSmart – March 2020 Investor Presentation By Callum Turcan On May 7, High Yield Dividend Newsletter portfolio holding CubeSmart (CUBE)--5.0% yield--reported first-quarter 2020 earnings. The company pulled its full-year guidance for 2020 given the uncertainties caused by the ongoing coronavirus (‘COVID-19’) pandemic. We appreciate that the self-storage real estate investment trust (‘REIT’) remained comfortably free cash flow positive last quarter, which is one of the reasons why we like CubeSmart as a high yielding play in the REIT world. Quarterly Update As you can see in the upcoming graphic down below, one of the biggest operating expenses CubeSmart (and the self-storage REIT space at-large) faces is property taxes. Rising property values in major metropolitan areas in particular pushes up the assessed value of CubeSmart’s various self-storage facilities and the related land, resulting in material growth in this line item. Rental rate increases represent the main way to compensate for this dynamic. Maintaining high occupancy rates is another key factor.

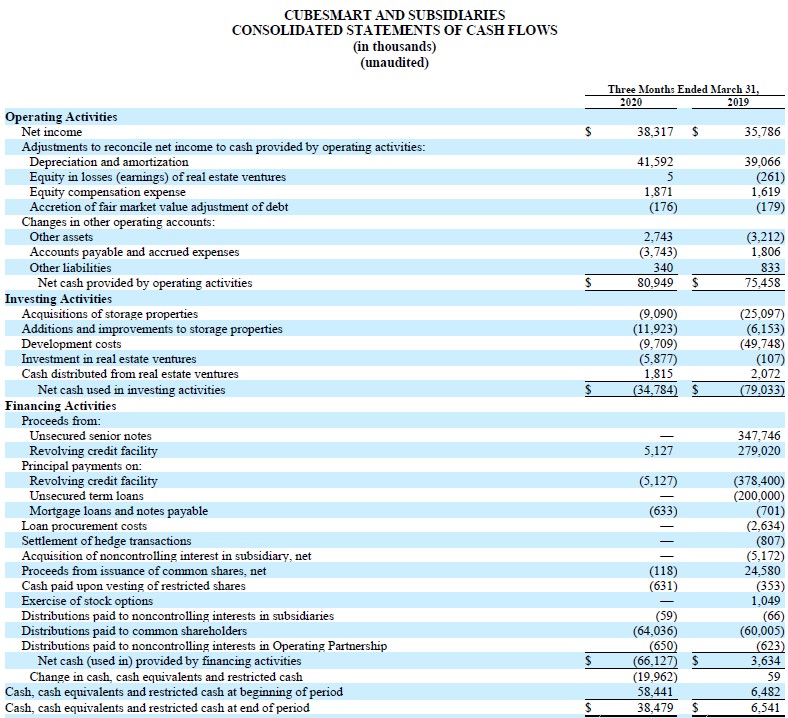

Image Shown: On a same-store basis, CubeSmart’s property taxes rose by almost 8% year-over-year during the first quarter of 2020. Image Source: CubeSmart – First Quarter of 2020 Earnings Press Release In the first quarter of this year, Cube-Smart was able to grow its same-store total revenues by almost 2% versus the same quarter the prior year, though a near 4% increase in its total operating expenses held down its same-store net operating income (‘NOI’) growth during this period. Going forward, the negative impact the ongoing coronavirus is having on rent collection will likely put a moderate amount of pressure on CubeSmart’s financials in the short term. Management noted this in CubeSmart’s earnings press release (emphasis added): Further, government stay-at-home orders have reduced rental volume as move-in and move-out activity declined in April compared to last year. At month end, same-store occupancy stood at 91.8%, down from 92.3% at the end of April 2019. Rent is due throughout the month on the anniversary date of a customer’s move-in. To date, 93% of April rents have been collected compared to last year, when approximately 98% of April rent was ultimately collected. Due to the uncertainty of the impact of the COVID-19 pandemic, the Company is withdrawing its previously issued 2020 guidance. However, please note that as most of the rent due in April 2020 was collected and in light of fiscal stimulus measures in the US, the sky is not falling. CubeSmart’s rental revenues and ultimately cash flow should hold up decently in the short-term and rebound in the medium-term as the US economy opens back up. While CubeSmart’s occupancy rate fell modestly year-over-year in April 2020, it was still well over 90% and additionally, from March 2020 to April 2020, CubeSmart’s occupancy rate was broadly flat according to management. CubeSmart launched its contactless rental service SmartRental which was available nationwide as of late-April to adjust to the “new normal” created by the pandemic. The REIT suspended rental rate increases in the interim (starting March 2020) to better allow for its customers to adjust to the pandemic, which will be reflected in its second and third quarter financials according to management (possibly beyond, though rental rate increases could resume if the US economy starts to recover by the end of this year). CubeSmart continued to grow the business last quarter by acquiring a new property in Texas for $9 million (by early-May 2020, CubeSmart had acquired three new properties this year for a total of $75 million according to its earnings press release). Additionally, CubeSmart acquired a 10% equity stake in the newly-formed 191 IV CUBE Southeast LLC (‘HVPSE’) joint-venture that acquired 14 facilities last quarter (two in Florida, eight in Georgia, four in South Carolina), with CubeSmart investing a little under $6 million in the joint-venture as part of that acquisition strategy. Turning to CubeSmart’s third-party management operation, the REIT added 66 new locations to its portfolio last quarter, bringing its total up to 707 third-party stores. We really liked the growth momentum at CubeSmart’s third-party management business last quarter. As it relates to CubeSmart’s payout coverage, that remained solid last quarter on a funds from operations (‘FFO’) basis. While an imperfect non-GAAP metric, FFO provides a useful tool for investors to gauge the relative strength of a REIT’s dividend coverage. In the first quarter of 2020, CubeSmart’s FFO payout ratio (dividend per share divided by FFO per share) came in at 80.5%, up from 80.0% in the same period last year. On both an adjusted and non-adjusted basis, CubeSmart’s FFO per share came in at $0.41 in the first quarter of 2020, up from $0.40 per share in the same quarter last year. Pivoting to CubeSmart’s cash flow statements, the self-storage REIT remained comfortably free cash flow positive last quarter. The firm generated $81 million in net operating cash flow and spent $22 million on items that we would classify as capital expenditures (‘additions and improvements to storage properties’ and ‘development costs’) as you can see in the upcoming graphic down below. During this period, the REIT spent $65 million covering its payout obligations (‘distributions paid to common shareholders’ and ‘distributions paid to noncontrolling interests in Operating Partnership’).

Image Shown: CubeSmart remained comfortably free cash flow positive last quarter, highlighting one of the key reasons we like the self-storage REIT space. Image Source: CubeSmart – 10-Q filing covering the first quarter of 2020

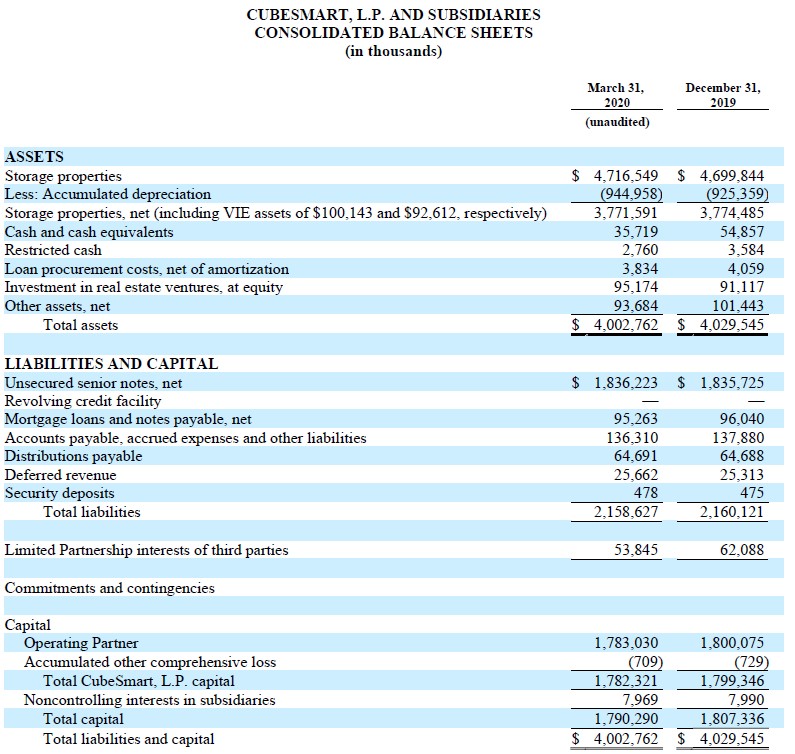

Balance Sheet Overview CubeSmart remains capital market dependent to fund its growth ambitions (such as its capital expenditures and acquisitions of properties), cover its dividend obligations, and refinance its debt maturities which means that the REIT must retain constant access to equity and debt markets at attractive rates. The REIT has an at-the-market equity issuance program that can be used to raise incremental amounts of capital, though no equity was issued under the program during the first quarter of 2020. Additionally, CubeSmart possess a revolving credit facility that’s due in June 2024 with $750 million in borrowing capacity. Given that CubeSmart’s investment grade credit rating stood at BBB/Baa2 at the end of March 2020, its interest rate on that revolver is 1.10% + LIBOR (inclusive of a facility fee of 0.15%). At the end of March 2020, the REIT had ~$749 million in borrowing capacity under that revolver, with ~$1 million in letters of credit posted against the facility, providing CubeSmart with ample access to liquidity as needed. As you can see in the upcoming graphic down below, CubeSmart had a material amount of debt outstanding and a modest amount of cash and cash equivalents on hand at the end of last quarter.

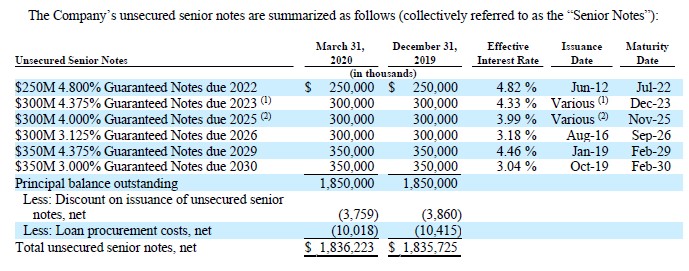

Image Shown: Like virtually all REITs, CubeSmart had a meaningful net debt position at the end of the first quarter of 2020. Image Source: CubeSmart – 10-Q filing covering the first quarter of 2020 CubeSmart’s debt maturity schedule is staggered, which we appreciate. In the upcoming graphic down below, please keep in mind that the REIT does not have any major senior notes maturing until July 2022 at the earliest.

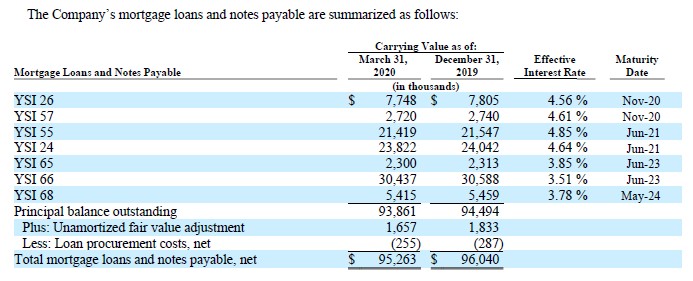

Image Shown: CubeSmart’s debt maturity schedule is staggered, making refinancing activities a more manageable task. Image Source: CubeSmart – 10-Q filing covering the first quarter of 2020 Pivoting to CubeSmart’s mortgage loans and notes payable, the firm has a small amount of that debt maturing in November 2020 as you can see in the upcoming graphic down below. That burden should be easy to handle via its cash on hand, revolving credit line, and ATM equity issuance program.

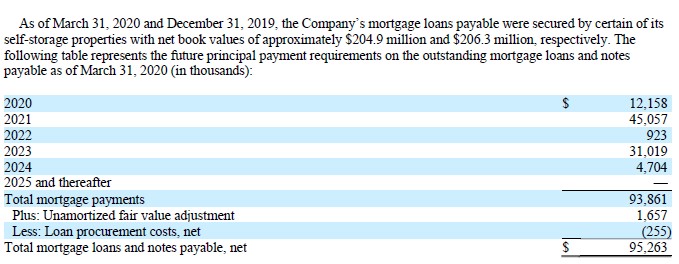

Image Shown: CubeSmart has a modest amount of mortgage loans and notes payable maturing in the fourth quarter of this year. Image Source: CubeSmart – 10-Q filing covering the first quarter of 2020 In the upcoming graphic down below, management highlights the size of the principal repayments of CubeSmart’s mortgage loans and notes payable, which are modestly different than the carrying value of that debt. CubeSmart’s $12 million in debt maturities this year could easily be refinanced with its revolving credit line, for example, as highlighted previously.

Image Shown: A look at CubeSmart’s future principal repayments as it concerns its outstanding mortgage loans and notes payable at the end of March 2020. Image Source: CubeSmart – 10-Q filing covering the first quarter of 2020 Here’s what management had to say about CubeSmart’s financial position during the REIT’s latest quarterly conference call: “And then in the second main area focus is on balance sheet strength. That's an area that we can provide quite a bit more certainty and confidence. We are extremely well positioned to weather this storm. We have an unsecured credit facility with $750 million of capacity at the end of the quarter and we have very little debt maturing through the end of 2021, only 3% or $56 million of our debt is coming due through the end of next year. In addition, at quarter and our leverage levels remain conservative at 39% debt to gross assets. Our debt to EBITDA was 4.9 times and our fixed charge coverage ratio was 5.5 times. So as many companies are dealing with major issues in addressing upcoming maturities, running their operations and paying their dividends, we're focused on how to position ourselves to be nimble and opportunistic taking our strong balance sheet and using it to grow our company as we come out of this and the quarters ahead.” --- Timothy Martin, CFO of CubeSmart On May 12, CubeSmart declared a $0.33 per share quarterly dividend (flat compared to its prior payout) that’s payable July 15 for shareholders of record on July 1. Given near-term headwinds and considering its FFO payout ratio is almost at 81% (in our view, FFO payout ratios of 80% or below provides for a solid buffer should exogenous shocks, like COVID-19, materialize), CubeSmart is unlikely to push through per share payout increases until the US economy starts to recover. That being said, given its sizable free cash flows, ample access to liquidity, and staggered debt maturity schedule, the REIT is well-positioned to keep making good on its dividend obligations during the pandemic. Concluding Thoughts We continue to like CubeSmart in the High Yield Dividend Newsletter portfolio, alongside its self-storage peer Public Storage (PSA). CubeSmart possess the financial flexibility to ride out the storm and continue making good on its dividend obligations. The REIT should be able to capitalize on the long-term upside the self-storage space in the US (and elsewhere) offers investors, as self-storage properties remain supported by secular growth tailwinds. ----- Related: UHAL, CAR, PSA, R, URI, CUBE, EXR, JCAP, VNQ, PSTG ---- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares of any of the securities mentioned above. CubeSmart (CUBE), Public Storage (PSA), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Vanguard Real Estate ETF is also included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment