Member LoginDividend CushionValue Trap |

The Turnaround at Novartis Has Begun

publication date: Feb 8, 2018

|

author/source: Alexander J. Poulos

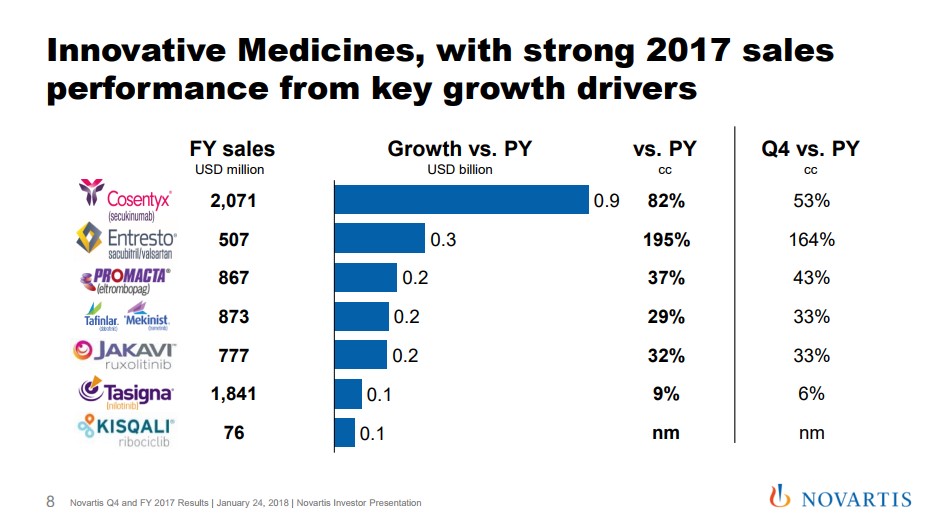

Image Source: Novartis We believe Novartis is poised to accelerate from the patent cliff caused by the loss of protection of Gleevec, its former top-selling product. The company has a stellar dividend growth history, and the market is anticipating a turnaround once it anniversaries the patent cliff. By Alexander J. Poulos Novartis Innovative Medicines We will begin our analysis of Novartis (NVS) by breaking down the European pharma giant into three distinct divisions to gain a better perspective of the various moving parts that make up this very innovative company. The Innovative Medicines division houses the patent protected molecules that make up the bulk of the group's revenues and an outsize portion of its profitability. The star of the show remains Cosentyx, an injectable interleukin-17 antagonist that can use to treat a host of inflammatory conditions. As a quick reminder, the anti-inflammatory segment remains the largest and fastest growing individual spend in specialty care. The category remains fiercely competitive with many of the best-known names in the sector battling for share.

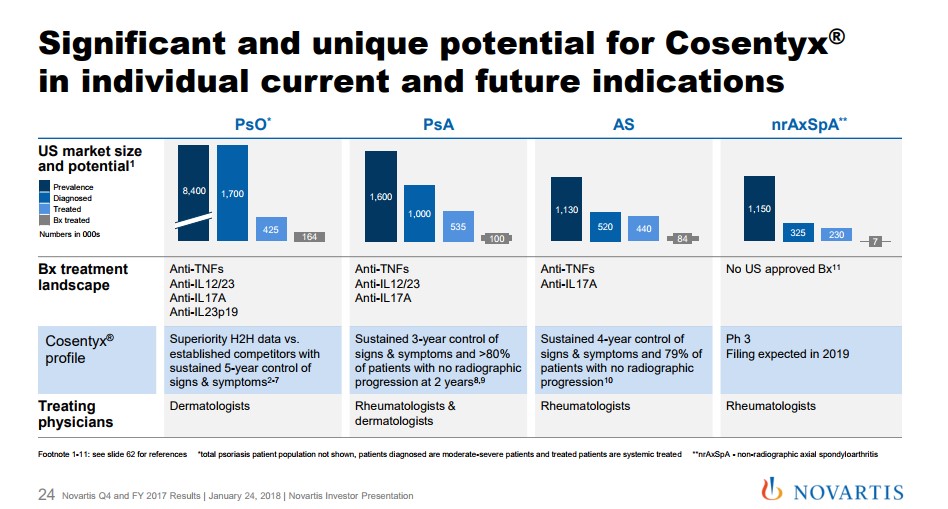

Image Source: Novartis We have remained perplexed by the relative lack of pushback on the part of payers as multiple new entrants with a superior clinical profile have thus far failed to make a significant dent in the overall growth trajectory of the category. We have seen what may perhaps begin the rationalization on price, as well-established products such as Celgene’s (CELG) Otezla have not performed as expected which has pressured the top line. In the case of Otezla, the continued growth of Cosentyx has taken share from the product which is a contributing factor to Celgene having to lower overall guidance. In the case of Novartis, early signs continue to point to sustained growth for Cosentyx as detailed by new Rx trend as the product has maintained share with the entrance of two additional players in the market. We remain impressed with the statement made on the conference call detailing growth in share versus Humira and Enbrel (the two longest-tenured products in the class) for spondyloarthropathy. Cosentyx has managed to gain market leadership versus these well-established products despite widespread clinician familiarity and significant first mover advantage. Clinicians feel the product is a superior choice with enhanced outcomes hence the market share growth.

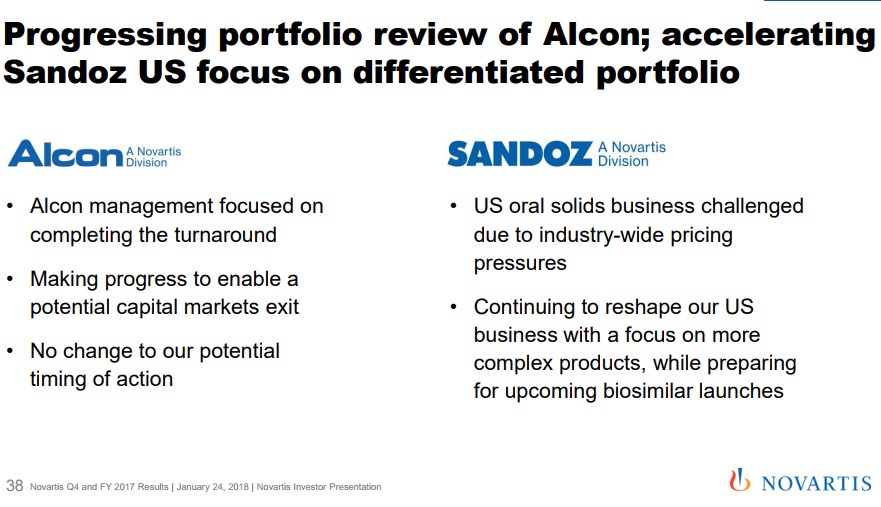

Image Source: Novartis

The growth trajectory for Cosentyx remains well-defined with a potential new market for non-radiographic axial spondyloarthropathy. Novartis remains on track for a filing for this indication in 2019. Let's keep in mind there are no approved treatments which would confer to Cosentyx a significant first-mover advantage, if approved. Cosentyx remains the primary, but by no means the only driver for the innovative medicine group. The second main cog remains the continued market-share acceptance and growth of Entresto for the treatment of heart failure. The cardiovascular space remains the largest individual group of patients, but the segment remains fiercely competitive with a host of generic products that remain very cost-effective. Novartis has struggled out of the gate to establish Entresto, but we feel the product is a very important part of the future. Management offered Entresto guidance for annual sales to at one point hit $3 billion assuming additional prescribing label advances off the current base of 507 million. A large portion of the initial tepid sales ramp was the widespread formulary exclusion that hampered initial uptake. Novartis has diligently worked to expand formulary access with Entresto, now covered by the vast majority of healthcare plans. We feel Novartis is on solid footing. With the lack of resources devoted by competitors to gain label expansion due to the loss of patent protection, it bodes well for future revenue growth assuming additional clinical trials bear fruit. We can envision a similar set-up as Cosentyx in the above mentioned non-radiographic axial spondyloarthropathy. Not to be outdone, Oncology is beginning to take on a large role at Novartis as continued growth of the established product suite helps plump the top line. Kisqali and Kymriah are in the early days of their growth trajectory after gaining approval in the second half of 2017. We remain impressed that a company of the size of Novartis continues to produce an innovative suite of products unlike some of the well-known slower growing American pharma outfits. Alcon The Alcon division has returned to growth after a management shuffle has reignited sales. We remain intrigued by management’s commentary for a potential divestiture of Alcon, an area that was not refuted in the recent conference call. The incoming CEO Vas Narasimhan remained committed to divesting the unit: Now on Slide 38, we're also progressing on the portfolio review of Alcon as well as accelerating our review and focus -- in Sandoz and focusing on a differentiated portfolio. With respect to Alcon, our management is focused on completing the turnaround, as you saw nicely in the performance in quarter 4. We're making progress towards a capital markets exit with dedicated teams working towards that, but there's no change on the timing of a potential action. We continue to guide toward the potential action in the first half of 2019. Quote Source: Novartis

Image Source: Novartis Based on our understanding of Novartis' product pipeline, we feel the area of diseases of the eye is no longer an area of focus, which in our view, augurs well for the divestiture of Alcon. As we have seen with recent divestitures of Baxalta and Bioverativ, a spin-off may be a lucrative endeavor for shareholders especially if our thesis for widespread M&A plays out. We will continue to monitor events at Alcon as we see a spin-off as a potential source of significant alpha. Sandoz The overall update for the generic drug division Sandoz confers with our long-held view of the overall dynamics of the generic drug sector. The oral dosage form—easily one of the least technically challenging therapies to produce remains in a deflationary cycle which continues to wreck the balance sheet of the industry. Sandoz is somewhat isolated from this due to its leadership in biosimilars which remains an area of focus. Sandoz remains uniquely positioned to profit from the patent protection of a wide swath of specialty drugs—it was referred to numerous times on the conference call as an area of future growth which bodes well for the overall health of the division. Thus far the pace of biosimilar approval has lagged our initial expectations as the FDA has shot down numerous attempts for a biosimilar to Neulasta to enter the marketplace. We anticipate the lack of quick approvals as a minor speedbump as cost-containment remains at the forefront of healthcare.

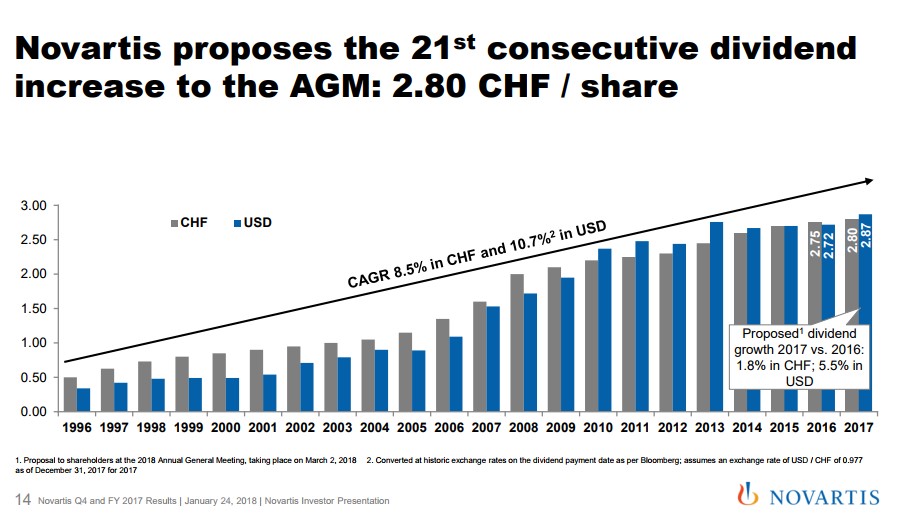

The Role of the Dividend Novartis continues to reward shareholders with a very competitive dividend of $2.87 per share which is payable to shareholders every April. Novartis follows in the tradition of European-based entities in paying out an annual dividend versus the quarterly payout that is common in the US. Due to currency fluctuations versus the Swiss Franc, the annual dividend has grown at a compounded rate of over 10% since 1996, a very appealing statistic for those seeking income. In conclusion, we remain fans of Novartis due to its innovative current and near-term pipeline combined with the potential for a spin-out of Alcon coupled with the generous current dividend. ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Alexander J. Poulos does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |