Member LoginDividend CushionValue Trap |

How Some Members Use Valuentum’s Investment Services

publication date: Mar 11, 2024

|

author/source: Brian Nelson, CFA

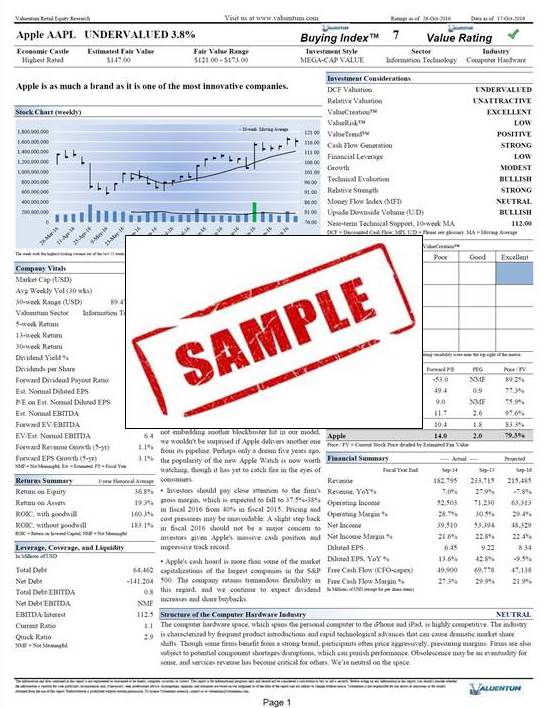

By Brian Nelson, CFA Thank you for your membership to Valuentum. We serve a wide variety of investors, including dividend growth investors, value investors, and pure Valuentum investors, among others. Many different types of investors and professionals use our research and financial analysis in a whole host of applications from individual stock-selection to the evaluation of closed-end funds to an overlay in a money-management setting and beyond. We wanted to make sure that you know that, if you're a dividend growth or income investor, that there are others that use our website to utilize the Valuentum process, fair value estimates and other metrics. Similarly, if you're a practitioner of the Valuentum system, I wanted to make sure that you are aware that we also serve income and dividend growth investors and that our research and analysis evaluates the health and long-term growth potential of a company's dividend. The Dividend Cushion ratio is simply a must-have in your investing toolkit regardless of what kind of investor you are. Many different strategies have significant benefits for many different types of investors. With that out of the way, let's get started. At Valuentum, we are restricted from making any specific and personal recommendations. We are not an advisor. On our website, we don't have buy, hold, or sell recommendations that you might find at brokerage firms either, for example (we're not a broker). This is not unique to Valuentum. Other investment research publishing companies are bound by these rules, too, so please don't ask us for buy or sell advice because we can't give it. Only your personal financial advisor knows what's best for you. That said, we add a ton of value with our research and analysis. In addition to a line-up of newsletter products, we offer our opinion of an investment via its attractiveness on the basis of the Valuentum Buying Index and the attractiveness of the company's valuation via our estimate of its fair value range, among other things. The Valuentum Buying Index is based on our research into the experiences of many of the most influential investors, from Benjamin Graham (margin of safety) and Warren Buffett (price versus value) to Peter Lynch (GARP, growth at a reasonable price), and many more. Importantly, on our website and in any correspondence, we can only tell you the goals of our process and newsletter portfolios and/or our opinion of the company's valuation and business fundamentals. We can't tell you what actions you should take because we're not aware of your risk tolerances, personal financial situation, and goals. We can only tell you what we think of a company's business fundamentals and our opinion of its valuation. We can never tell you to buy XYZ company right now, even though this may be what many members want. Do not ask us for personal financial advice because we can't and won't give it to you. It's perfectly reasonable, however, to assess what we're trying to do and see if that's a fit for you. Do the goals of the newsletter portfolios fit well with what you're looking for? Are you looking for the next incremental idea via our notification emails? Does an in-depth valuation process that covers both discounted cash-flow valuation analysis and relative valuation analysis meet your objectives? Do you want to utilize timeliness indicators in a value-based setting? Does the Valuentum Dividend Cushion ratio help you understand the strength and safety of dividend holdings in your income portfolio? Do you require underpriced ideas with strong dividend growth prospects? You choose your own path, and you decide what is best for you, and where necessary, seek help from a financial advisor that understands your individual personal needs. As you get familiar with our website, you'll find that our favorite investment ideas at any given time are always included in the simulated newsletter portfolios--the Best Ideas Newsletter portfolio, the Dividend Growth Newsletter portfolio, and the High Yield Dividend Newsletter--and the goals of the respective portfolios are as follows: The Best Ideas Newsletter portfolio seeks to find stocks that have good value and good momentum characteristics and typically targets capital appreciation potential over a longer-term horizon. << Subscribe to the Best Ideas Newsletter! The Dividend Growth Newsletter portfolio seeks to find underpriced dividend growth gems that generate strong levels of free cash flow and have pristine, fortress balance sheets, translating into excellent Valuentum Dividend Cushion ratios. << Subscribe to Our Dividend Growth Newsletter! The High Yield Dividend Newsletter portfolio seeks to find some of the highest-yielding stocks supported by strong credit profiles and solid business models, but not always robust traditional free cash flow. Ideas in this newsletter offer higher-yielding opportunities, but also much higher capital and income risk. << Add the High Yield Dividend Newsletter to Your Membership! The Best Ideas Newsletter portfolio seeks to find stocks that have both good value and good momentum characteristics and typically includes in the simulated portfolio each idea from a Valuentum Buying Index rating of a 9 or 10 (consider buying) to a rating of a 1 or 2 (consider selling). Just like a value manager may not include every single undervalued company in the market in his/her portfolio, not all highly-rated companies on the Valuentum Buying Index are included in the portfolio. We may tactically add to or trim existing positions in the portfolio on the basis of sector or broader market considerations, but we seek to capture a stock's entire pricing cycle (from being underpriced with strong momentum to being overpriced with poor momentum). The Best Ideas Newsletter portfolio puts the Valuentum Buying Index into practice. The Dividend Growth Newsletter portfolio seeks to find underpriced dividend growth gems that generate strong levels of free cash flow and have solid balance sheets, translating into excellent Dividend Cushion ratios. Stocks in the Dividend Growth Newsletter portfolio may have lengthy dividend growth track records spanning decades, but we focus most of our efforts on assessing the future safety and dividend growth potential of ideas. The High Yield Dividend Newsletter portfolio focuses on higher-yielding ideas relative to the Dividend Growth Newsletter portfolio, but perhaps ideas that may not have as strong of dividend growth qualities, mostly because they may already be paying out a rather hefty dividend yield. Whereas the cash flow statement and balance sheet are still very important considerations in the High Yield Dividend Newsletter, we put a greater focus on credit assessments and qualitative, subjective considerations given the riskier nature of such higher-yielding ideas, both with respect to income sustainability and subsequent valuation (share price risk). If one of the simulated newsletter portfolio's goals matches up to what you're looking for, that portfolio or the ideas within it and the content in that newsletter may be of interest to you. Some readers may phase into the positions of the portfolios over time and replicate the portfolios in their entirety, while others like to cherry-pick their favorite ideas out of them, perhaps focusing on the highest-weighted ideas. Others may wait for the next notification email to catch our thoughts on where we think incremental, tactical alpha can be generated in a portfolio setting. Others may like to monitor the Valuentum Buying Index rankings list and 'undervalued' list for even more ideas. The screens, which are generally updated weekly (sometimes periodically depending on scheduling), are always available on the left column of our website in an easy-to-download Excel file. Others like to overlay the Valuentum Buying Index ratings and Valuentum Dividend Cushion ratios with their own process to arrive at a combined strategy of their own preference. The uses of Valuentum's services are many and varied. We're not only a newsletter provider. We cover a lot of ground. You may have noticed that we also offer a full suite of products to financial advisers (gold level) that range from a more extensive Excel-based screening tool (the DataScreener) to 'Ideas' and 'Dividend' publications that are released on a quarterly basis. Since advisers have a wide variety of clients with different needs and goals, we offer them a wide variety of detailed information on stocks, their dividends, and ETFs. Our research product includes hundreds of stock reports, fair values, fair value ranges, associated commentary, as well as dividend reports with Valuentum Dividend Cushion ratios and expected dividend growth rates. For non-financial, operating companies, we also have an Excel-based three-stage discounted free cash flow valuation model backing every fair value range in our coverage universe. Some members subscribe to our service only to gain access to the detailed valuation infrastructure behind our fair value estimates. The models are available with a membership to the financial advisor (gold) level or institutional level plans. During the past few years, we've received quite a few questions on which membership plan may be most appropriate. The individual (silver level) premium plan is among the most popular among individual investors. It offers complete access to the website, Best Ideas Newsletter, Dividend Growth Newsletter, their respective newsletter portfolios, and notification emails ($29.99/month). Investors of all types can benefit from the advisor (gold) level plan at $49.99/month, which includes access to the quarterly publications (DataScreener, Ideas100, Dividend100) and discounted cash-flow valuation infrastructure (our valuation models; limited to 10/month). Many individual investors have upgraded their subscription to the gold level over the years. Everyone on any membership plan can add the High Yield Dividend Newsletter to their membership (it's purely an incremental add-on), and silver and gold-level members can add the Valuentum Exclusive or additional options commentary/ideas to their plans. The Exclusive publication is a part of the institutional (platinum) level membership. Perhaps needless to say, we are honored to be working with you! At any time, please don't hesitate to reach out to us! Now get started. We're glad you're here! Kind regards, Brian Michael Nelson, CFA ---------- A previous version of this article appeared on our website February 7, 2014. Valuentum is a publisher of financial information, and the newsletter portfolios are not real-money portfolios. All performance presented in them, including the Exclusive publication, is hypothetical and prepared by us. There is substantial risk associated with investing in any financial instrument. |