|

|

Recent Articles

-

Nvidia Shines in Second Quarter of Fiscal 2026

Nvidia Shines in Second Quarter of Fiscal 2026

Aug 27, 2025

-

Image Source: Nvidia.

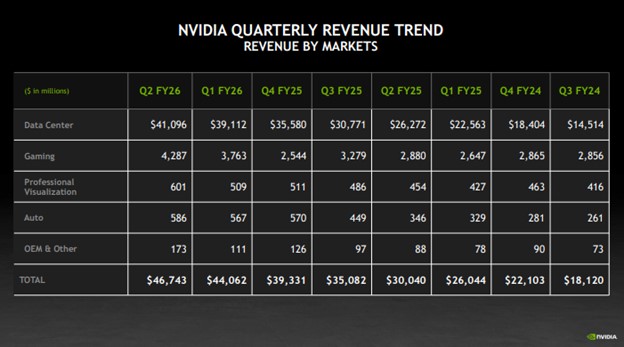

Looking to the third quarter of fiscal 2026, Nvidia expects revenue to be $54.0 billion, plus or minus 2%, an outlook that does not assume any H20 shipments to China. Consensus was at $52.76 billion. In the fiscal third quarter, GAAP and non-GAAP gross margins are expected to be 73.3% and 73.5%, respectively, plus or minus 50 basis points. The firm expects to end the year with non-GAAP gross margins in the mid-70% range. Nvidia continues to power the market higher, and while results weren’t as bullish as some were expecting, they were strong, nonetheless.

-

Dividend Increases/Decreases for the Week of August 22

Dividend Increases/Decreases for the Week of August 22

Aug 22, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Walmart Raises Outlook for Fiscal 2026

Walmart Raises Outlook for Fiscal 2026

Aug 21, 2025

-

Image Source: Walmart.

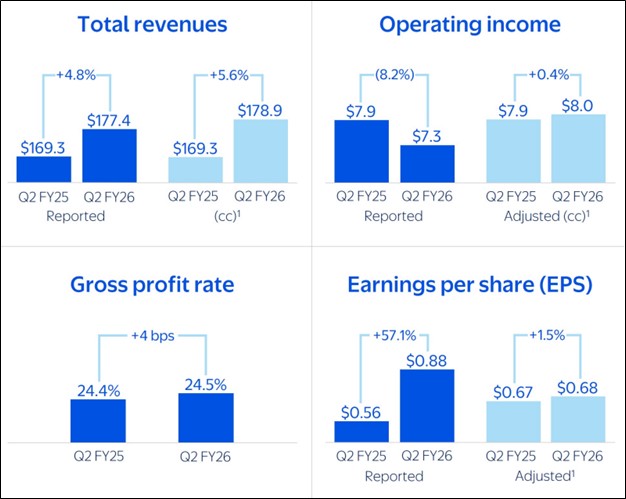

Looking ahead, Walmart issued guidance for the third quarter, with net sales expected to increase 3.75%-4.75% and operating income to increase 3%-6%. For fiscal 2026, the company raised its outlook for net sales growth to the range of 3.75%-4.75% (was 3%-4%) and adjusted earnings per share in the range of $2.52-$2.62 (was $2.50-$2.60) versus the $2.62 consensus mark. Walmart’s guidance for adjusted operating income growth of 3.5%-5.5% remained unchanged. We liked the guidance revisions at Walmart, but we remain cautious on the tariff impact on its business given an unchanged adjusted operating income growth target, despite a better top-line view. The high end of our fair value range stands at $113 per share.

-

Home Depot’s Comps Turn Positive in Second Quarter

Home Depot’s Comps Turn Positive in Second Quarter

Aug 19, 2025

-

Image Source: TradingView.

At the end of the second quarter, Home Depot had $2.8 billion in cash and cash equivalents, while total debt stood at $52.3 billion. For the six months ended August 3, net cash provided by operating activities was $9 billion, down from $10.9 billion in the year-ago period. Looking to guidance for 2025, management expects total sales growth of approximately 2.8%, with comparable sales growth of roughly 1% for the comparable 52-week period. It expects to add approximately 13 new stores. Home Depot’s guidance for 2025 calls for a gross margin of 33.4%, with an adjusted operating margin of roughly 13.4%. Adjusted diluted earnings per share is expected to decline 2% from $15.24 in fiscal 2024. Though Home Depot’s second quarter wasn’t blockbuster, it was good to see comparable store sales inflect. Shares yield 2.3% at the time of this writing.

|