|

|

Recent Articles

-

Starbucks’ Turnaround Continues

Starbucks’ Turnaround Continues

Sep 25, 2025

-

Image Source: TradingView.

During the fiscal third quarter, Starbucks opened 308 net new stores, ending the period with 41,097 stores. The company ended the quarter with 17,230 stores in the U.S. and 7,828 in China. Consolidated net revenues beat expectations in the quarter, increasing 4%, to $9.5 billion, or a 3% increase on a constant currency basis. Its non-GAAP operating margin, however, contracted 660 basis points, to 10.1%. Non-GAAP earnings per share of $0.50 declined 46% over the prior year and missed expectations. The coffee giant ended the quarter with $17.3 billion in short- and long-term debt and $4.7 billion in cash and investments. Starbucks’ global same store sales have now fallen for six consecutive quarters, but we expect improvement as the company heads into fiscal 2026. Shares yield 2.9% at the time of this writing.

-

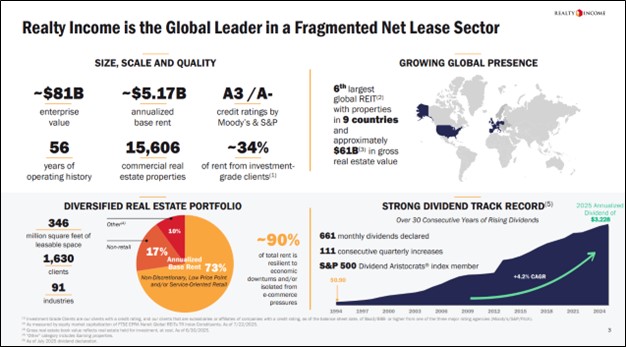

Realty Income’s Dividend Remains on Solid Ground

Realty Income’s Dividend Remains on Solid Ground

Sep 20, 2025

-

Image Source: Realty Income.

In June 2025, Realty Income announced its 111th consecutive quarterly dividend increase and its 131st increase since it was listed on the NYSE. The amount of monthly dividends paid per share increased 3.7% in the quarter, to $0.806, representing roughly 76.8% of its adjusted diluted AFFO. As of June 30, Realty Income had $5.1 billion of liquidity, including cash and cash equivalents of $800.4 million, while net debt stood at $28.5 billion. Looking to 2025, the company lowered its guidance for net income per share, but it increased the low end of AFFO per share to the range of $4.24-$4.28 from $4.22-$4.28 previously. Investment volume was increased to approximately $5 billion, up from $4 billion previously. Realty Income’s dividend remains on solid ground, and the REIT yields 5.5% at the time of this writing.

-

UPS May Cut Its Lofty Dividend

UPS May Cut Its Lofty Dividend

Sep 20, 2025

-

Image Source: TradingView.

Looking to 2025, UPS is not providing full year revenue or operating profit guidance due to the current macroeconomic uncertainty. The firm is working hard to become more efficient with $3.5 billion in expected expense reductions due to its network reconfiguration and Efficiency Reimagined initiatives. That said, UPS registers a Dividend Cushion ratio of 0.4, below parity, and its lofty dividend yield of 7.8% speaks to risk of a dividend cut. We like UPS but would not be surprised if it slashes its payout in coming periods. Buyer beware.

-

Verizon’s Debt Load is Too High for Our Income-Oriented Preference

Verizon’s Debt Load is Too High for Our Income-Oriented Preference

Sep 19, 2025

-

Image Source: TradingView.

Verizon’s cash flow from operations totaled $16.8 billion in the first half of 2025, up from $16.6 billion in the same period a year ago. Free cash flow was $8.8 billion in the first half of 2025, up from $8.5 billion in the first half of 2024. Verizon’s net unsecured debt at the end of the second quarter was $116 billion, roughly 2.3 times consolidated adjusted EBITDA. For 2025, management is targeting adjusted EBITDA growth of 2.5%-3.5% and adjusted earnings per share growth of 1%-3%. Cash flow from operations is expected to be between $37-$39 billion on the year, with free cash flow of $19.5-$20.5 billion. We like Verizon but can’t get familiar with its massive debt load. Shares yield 6.3% at the time of this writing.

|