|

|

Recent Articles

-

Latest Report Updates

Latest Report Updates

Feb 26, 2024

-

Check out the latest report updates on the website.

-

We Remain Bullish; Is This 1995 – The Beginning of a Huge Stock Market Run?

We Remain Bullish; Is This 1995 – The Beginning of a Huge Stock Market Run?

Feb 25, 2024

-

Image: Large cap growth stocks have trounced the performance of the S&P 500, REITs, and bonds since the beginning of 2023. We expect continued outperformance in this area of the market.

We’re now roughly four years past the depths of the COVID-19 meltdown, where equities collapsed in February and March of 2020. As the markets began to recover through 2020, our long-term conviction in equities only grew stronger. We think the biggest risk for long-term investors remains staying out of the market on the basis of what could be considered stretched valuation multiples. As we outlined heavily in the book Value Trap, valuation multiples hardly tell the complete story about a company and often omit key long-term earnings growth, cash flow dynamics, and balance sheet health considerations. We remain bullish on equities for the long haul, and we think the next couple years will be incredibly strong. Our best ideas can be found in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, High Yield Dividend Newsletter portfolio, ESG Newsletter portfolio, and via the Exclusive publication as well as options idea generation.

-

Booking Holdings’ Fourth Quarter Results Impacted By War in Middle East But Free Cash Flow Margins Remain Robust

Booking Holdings’ Fourth Quarter Results Impacted By War in Middle East But Free Cash Flow Margins Remain Robust

Feb 23, 2024

-

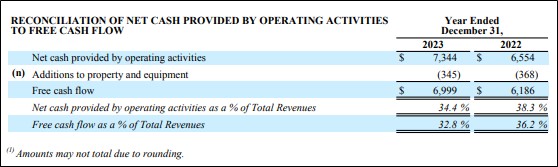

Image: Booking Holdings continues to put up robust free cash flow margins.

Booking Holdings is one of our favorite ideas, and we view shares as attractively valued on the basis of our point fair value estimate and quite attractive when considering the high end of our fair value estimate range. The pace of the company’s gross travel bookings and room nights booked continues to be robust, despite dislocations in its business associated with Israel, and the firm’s free cash flow generation continues to march in the right direction, with the company putting up fantastic free cash flow margins. We like Booking Holdings as an idea in the Best Ideas Newsletter portfolio, and we won’t be removing it anytime soon. Its new dividend implies a forward estimated dividend yield of ~0.96%.

-

Dividend Increases/Decreases for the Week of February 23

Dividend Increases/Decreases for the Week of February 23

Feb 23, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

|