|

|

Recent Articles

-

Chipotle Rallies, Long-term Outlook Remains Promising

Chipotle Rallies, Long-term Outlook Remains Promising

Feb 7, 2024

-

Image Source: Valuentum.

We’re huge fans of Chipotle’s long-term growth runway, and we think the continued rollout of Chipotlanes offers the firm the ability to expand into the valuable breakfast daypart, which we think will come eventually. Its digital initiatives continue to work out well, too, with digital sales accounting for 36.1% of its total food and beverage revenue in the fourth quarter. Looking out to all of 2024, Chipotle expects full-year comparable restaurant sales growth in the mid-single-digit range and to add 285-315 new restaurants. The high end of our fair value estimate of Chipotle stands at $3,022 per share, and we continue to like shares in the Best Ideas Newsletter portfolio.

-

Palantir’s Fourth-Quarter Results Showcase Strong Trends in Artificial Intelligence

Palantir’s Fourth-Quarter Results Showcase Strong Trends in Artificial Intelligence

Feb 6, 2024

-

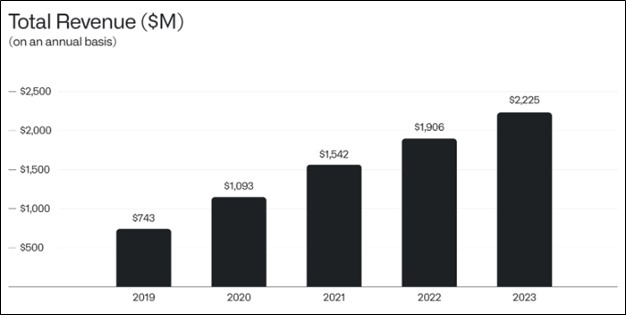

Image: Palantir’s revenue continues to march higher, and the company’s performance continues to showcase the growing strength in artificial intelligence. Source: Palantir.

We liked Palantir’s quarterly results, but we wanted to bring to members’ attention the commentary surrounding artificial intelligence [AI]: "Our results reflect both the strength of our software and the surging demand that we are seeing across industries and sectors for artificial intelligence platforms, including large language models, that are capable of integrating with the tangle of existing technical infrastructure that organizations have been constructing for years...The demand for large language models from commercial institutions in the United States continues to be unrelenting. Every part of our organization is focused on the rollout of our Artificial Intelligence Platform (AIP), which has gone from a prototype to a product in months. And our momentum with AIP is now significantly contributing to new revenue and new customers."

-

McDonald’s Facing Macro Challenges, Impacts from the War in the Middle East

McDonald’s Facing Macro Challenges, Impacts from the War in the Middle East

Feb 5, 2024

-

Image Source: Mike Mozart.

On February 5, McDonald’s Corp reported decent fourth-quarter results with strong revenue growth coming roughly in-line with consensus estimates and non-GAAP earnings per share exceeding the Street’s forecast. Though the firm noted that it is experiencing some macro challenges and that its operations continue to be impacted by the war in the Middle East, we like having McDonald’s as a core restaurant holding in the Best Ideas Newsletter portfolio in part because of its mostly franchised business model that handles inflationary pressures well and its strong and world-renowned brand name. The high end of our fair value estimate range of McDonald’s stands at $345 per share, and the company yields ~2.25% at the time of this writing.

-

Earnings Roundup: MO, EPD, SBUX, CLX, HON

Earnings Roundup: MO, EPD, SBUX, CLX, HON

Feb 4, 2024

-

Image: Starbucks’ international store growth potential remains robust. Image Source: Starbucks.

High-yielding tobacco giant Altria offered an outlook through 2028 that spoke to continued robust earnings and dividend-per-share expansion. Enterprise Products Partners, now a Dividend Aristocrat, is handling record volumes through its pipeline network, and the firm is investing heavily to drive improved long-term cash flow trends. Starbucks recently disappointed on a number of metrics, but the company's margin and earnings performance remains excellent, as is its international store growth opportunities. Clorox has recovered nicely from a recent cyberattack, and the firm is now forecasting adjusted earnings per share growth in fiscal 2024. We're monitoring its cash flow trends closely, however. Honeywell is targeting tremendous free cash flow growth in 2024 thanks to continued strength in its commercial aerospace operations.

|