|

|

Recent Articles

-

PepsiCo Has Raised Dividends in Each of the Past 50+ Years

PepsiCo Has Raised Dividends in Each of the Past 50+ Years

Apr 23, 2024

-

Image: Pepsi’s shares continue to be choppy, but we like its consecutive annual dividend growth streak.

On April 23, PepsiCo reported solid first-quarter 2024 results that showed a beat on both the top and bottom lines. The beverage and snacks giant plans to return $8.2 billion in cash to shareholders during 2024, with dividends accounting for $7.2 billion and share buybacks the balance. We love PepsiCo’s consecutive annual dividend growth streak, and the firm continues to deliver where it counts.

-

Lockheed Martin’s Robust Backlog Speaks of Sustainable Strength

Lockheed Martin’s Robust Backlog Speaks of Sustainable Strength

Apr 23, 2024

-

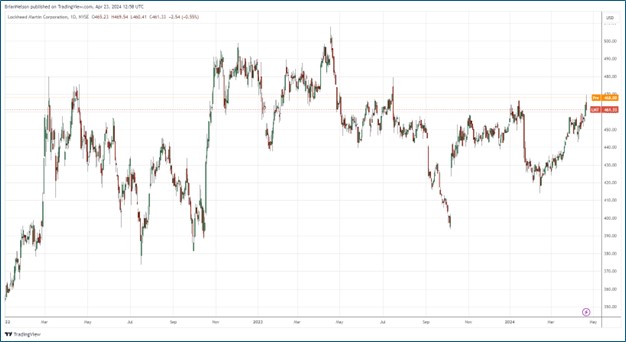

Image: Shares of Lockheed have been choppy, but its fundamentals remain strong.

On April 23, Lockheed Martin reported better-than-expected first quarter 2024 results. The company's total backlog of ~$159.4 billion speaks to sustainable strength in its operations, and we continue to like shares.

-

Verizon Is a Cash-Generating Machine But Its Debt Load Is Worth Watching

Verizon Is a Cash-Generating Machine But Its Debt Load Is Worth Watching

Apr 22, 2024

-

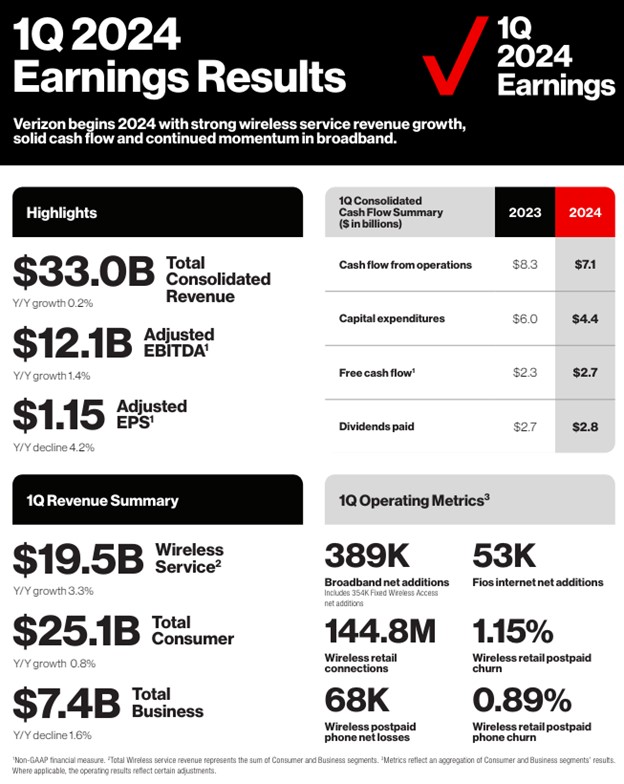

Image Source: Verizon.

We like the progress that Verizon is making, but the company’s large net debt position is something that we’re not particularly fond of. Shares yield ~6.6% at the time of this writing.

-

Procter & Gamble Raises Core EPS Guidance

Procter & Gamble Raises Core EPS Guidance

Apr 19, 2024

-

Image Source: P&G Q3 Earnings Presentation.

We like P&G’s long consecutive dividend growth track record (68 consecutive years), and its pricing strength was firmly on display during its fiscal third quarter. The company continues to target adjusted free cash flow productivity of 90% (operating cash flow as a percentage of net earnings), while it plans to pay $9 billion in dividends and buy back $5-$6 billion in common shares in fiscal 2024. Shares of P&G yield ~2.6% at the time of this writing.

|