|

|

Recent Articles

-

Costco’s Comparable Store Sales Deliver

Costco’s Comparable Store Sales Deliver

Jun 2, 2024

-

Image Source: Costco.

On May 30, Costco reported solid third quarter results for its fiscal 2024 period ended May 12. Net sales for the quarter increased 9.1% thanks to total company adjusted comparable sales performance of 6.5% and e-commerce growth of 20.7%. We like Costco’s business quite a bit, but shares are trading at quite the lofty earnings multiple (~50 times fiscal 2024 earnings expectations). We’d wait for a meaningful pull back in shares before taking interest in the name.

-

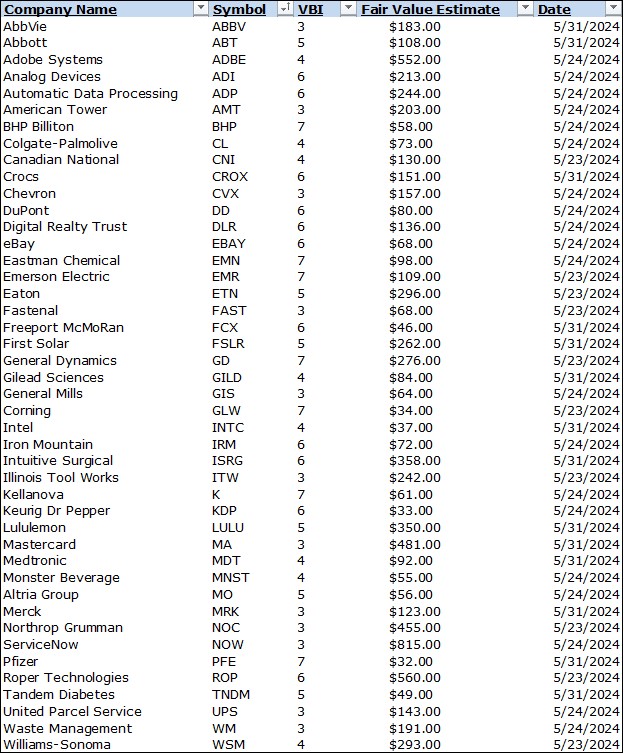

Latest Report Updates

Latest Report Updates

Jun 1, 2024

-

Check out the latest report updates on the website.

-

Dividend Increases/Decreases for the Week of May 31

Dividend Increases/Decreases for the Week of May 31

May 31, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

In the News: CRM, FL, DG, BBY

In the News: CRM, FL, DG, BBY

May 30, 2024

-

Image Source: Mike Mozart.

Salesforce issued a weaker-than-expected outlook for its fiscal second quarter 2025, and shares have been punished following the report. Foot Locker's bottom-line guidance for its full year pleased the Street, while Dollar General continues to benefit from increased store traffic. Best Buy's comparable store sales remain under considerable pressure, but the big box retailer is managing expenses well.

|