|

|

Recent Articles

-

AT&T’s Dividend Coverage with Free Cash Flow Is Solid

AT&T’s Dividend Coverage with Free Cash Flow Is Solid

Jul 24, 2024

-

Image Source: AT&T.

Dividend coverage looks much better at AT&T these days. For the first six months of 2024, free cash flow was $7.7 billion, which comfortably covered the company’s cash dividends paid of $4.1 billion. Free cash flow after dividends was $3.58 billion for the first six months of the year, and management’s 2024 free cash flow guidance indicates a stronger back half of dividend coverage. AT&T has a huge net debt position, but free cash flow coverage of this 6.1% yielder is a sight to see. We’re considering the company for addition to the High Yield Dividend Newsletter portfolio.

-

Tesla’s Second Quarter Report Wasn’t Great

Tesla’s Second Quarter Report Wasn’t Great

Jul 24, 2024

-

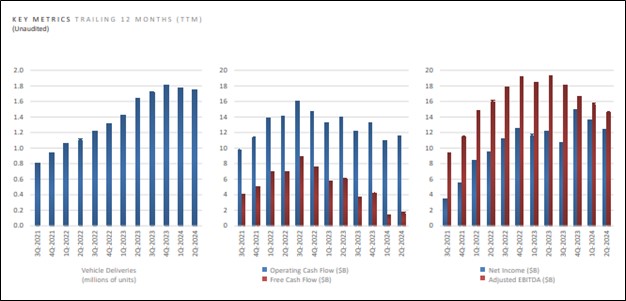

Image: Tesla’s trailing twelve-month performance across vehicle deliveries, operating and free cash flow, as well as adjusted EBITDA have faced pressure in recent quarters.

In short, Tesla’s second quarter report wasn’t great and was weighed down by reduced vehicle selling prices, restructuring charges, higher operating expenses due to AI projects, and lower vehicle deliveries, which fell 5% on a year-over-year basis in the quarter. Tesla continues to focus on “reducing COGS per vehicle, growing (its) traditional hardware business and accelerating development of (its) AI-enabled products and services,” and all eyes remain fixated on the timing of its Robotaxi deployment as well as the pace of Cybertruck deliveries. We remain on the sidelines with respect to shares.

-

Visa Continues to Expect Low Teens Earnings Per Share Growth for the Full-Year 2024

Visa Continues to Expect Low Teens Earnings Per Share Growth for the Full-Year 2024

Jul 24, 2024

-

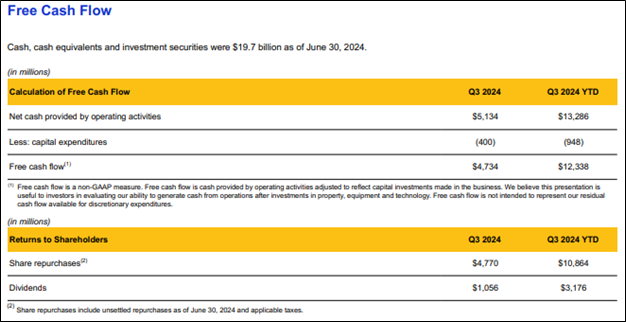

Image: Visa’s asset light business model throws off a lot of free cash flow, while the firm returns cash to shareholders via buybacks and dividends.

On July 23, Visa reported mixed fiscal third quarter results with the company missing expectations on the top line and the firm’s non-GAAP earnings per share coming in-line with the consensus forecast. We’re not reading too much into the company’s mixed fiscal third quarter results and remain fans of the company’s competitive positioning and asset light business model. For the fourth quarter, diluted class A earnings per share growth is expected in the high end of low double-digit growth, while low-teens growth is expected for the full-year 2024, in-line with its prior forecast.

-

Alphabet’s Free Cash Flow Faces Pressure in Second Quarter

Alphabet’s Free Cash Flow Faces Pressure in Second Quarter

Jul 24, 2024

-

Image: Alphabet’s shares have performed well so far in 2024.

Alphabet reported solid second quarter results with strong performance across its operating segments. In the quarter, Google Cloud revenue came in better than expectations, while YouTube ads missed only slightly. Alphabet now pays a dividend, and it continues to aggressively buy back stock. The company’s free cash flow faced pressure in the quarter due to investments to drive innovation, and while this may pressure ROICs in the coming periods, we still like Alphabet as an idea in the Best Ideas Newsletter portfolio.

|