|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of July 19

Dividend Increases/Decreases for the Week of July 19

Jul 19, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Crown Castle’s AFFO In Excess of Cash Dividends Paid

Crown Castle’s AFFO In Excess of Cash Dividends Paid

Jul 18, 2024

-

Image: Crown Castle’s shares look to be bottoming, and the firm’s AFFO is expected to remain well above cash dividends paid during 2024.

Crown Castle reiterated its outlook for 2024 that it issued on June 11. It expects site rental billings of $5.74-$5.78 billion, site rental revenues in the range of $6.317-$6.362 billion, adjusted EBITDA between $4.143-$4.193 billion, and AFFO per share in the range of $6.91-$7.02. Though Crown Castle’s full year performance reveals pressure, the company’s AFFO remains in excess of its annual dividend rate of $6.26, and with a dividend yield of ~5.9%, we think it makes the cut for inclusion to the High Yield Dividend Newsletter portfolio.

-

Domino’s Suspends Long-term Global Net Store Growth Guidance

Domino’s Suspends Long-term Global Net Store Growth Guidance

Jul 18, 2024

-

Image: Domino’s shares have done well since the beginning of 2023, but visibility into its long-term global net store growth has become murky given problems at one of its master franchisees.

Domino’s quarterly results and free cash flow performance weren’t poor by any stretch, but the firm disappointed investors with respect to its updated global net store growth forecast. The company noted that it will come up 175-275 stores short of its international store growth target in 2024, and it temporarily suspended its guidance that previously called for 1,100+ global net stores annually over the period 2024-2028. It now expects 825-925 net new stores in 2024. We didn’t like the news, but we remain fans of Domino’s long-term story and are keeping the idea as a holding in the Best Ideas Newsletter portfolio.

-

Taiwan Semiconductor Impresses in Second Quarter, Gives Strong Outlook

Taiwan Semiconductor Impresses in Second Quarter, Gives Strong Outlook

Jul 18, 2024

-

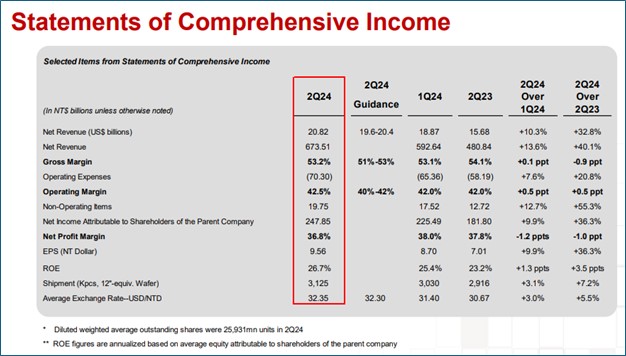

Image: Taiwan Semiconductor reported better-than-expected second quarter results.

Though Taiwan Semiconductor is exposed to geopolitical uncertainty, perhaps exacerbated by former President Donald Trump’s latest comments about how Taiwan should pay the U.S. for national defense, the company’s outlook remains robust, in our view. Taiwan Semiconductor remains one of our favorite ideas in the ESG Newsletter portfolio.

|