|

|

Recent Articles

-

Dollar General's Business Model Challenged By Walmart’s Strength

Dollar General's Business Model Challenged By Walmart’s Strength

Sep 4, 2024

-

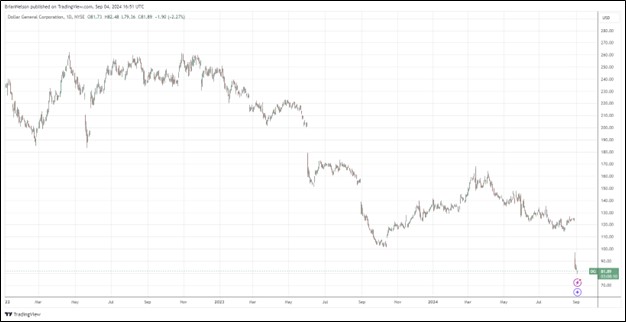

Image: Dollar General’s shares have been under considerable pressure the past couple years.

Dollar General cut its outlook for fiscal 2024. Net sales growth is now expected in the range of 4.7%-5.3% compared to its previous expectation of 6%-6.7%. Same store sales growth is now anticipated in the range of 1%-1.6%, compared to previous expectations of 2%-2.7%. Diluted earnings per share are now targeted in the range of $5.50-$6.20, compared to prior expectations of $6.80-$7.55. Shares of Dollar General plummeted on the news, and we see no reason to jump into the name, particularly given the competitive market environment, with Walmart likely gaining share.

-

Dick’s Sporting Goods Beats Second Quarter Numbers, Raises 2024 Outlook

Dick’s Sporting Goods Beats Second Quarter Numbers, Raises 2024 Outlook

Sep 4, 2024

-

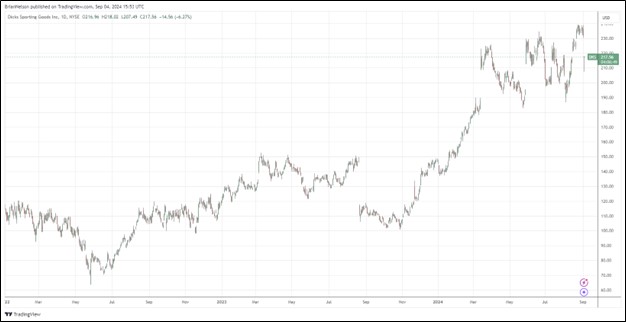

Image: Dick’s Sporting Goods has performed nicely since the beginning of 2022.

Looking to all of 2024, Dick’s Sporting Goods’ earnings per share is targeted in the range of $13.55-$13.90, up from $13.35-$13.75 per share previously, while net sales are expected in the range of $13.1-$13.2 billion (unchanged from last quarter), on comparable sales growth of 2.5%-3.5%, up from 2%-3% previously. We like Dick’s Sporting Goods’ quarter, and we’re fans of its raised outlook. The firm remains a holding in the portfolio of the Dividend Growth Newsletter.

-

NextEra Energy’s Outlook Looks Great

NextEra Energy’s Outlook Looks Great

Sep 3, 2024

-

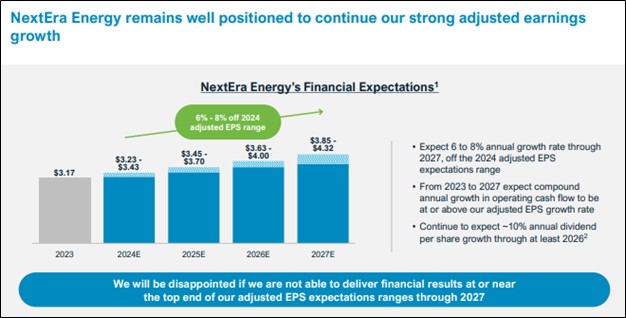

Image Source: NextEra Energy.

NextEra Energy reiterated its long-term financial expectations. “For 2024, NextEra Energy continues to expect adjusted earnings per share to be in the range of $3.23 to $3.43. For 2025, 2026 and 2027, NextEra Energy expects adjusted earnings per share to be in the ranges of $3.45 to $3.70, $3.63 to $4.00 and $3.85 to $4.32, respectively. NextEra Energy also continues to expect to grow its dividends per share at a roughly 10% rate per year through at least 2026, off a 2024 base.” As far as utilities are concerned, we like NextEra Energy, and the company continues to be a key position in the ESG Newsletter portfolio.

-

Campbell Soup’s Sovos Acquisition Helps Power Fiscal Fourth Quarter Results

Campbell Soup’s Sovos Acquisition Helps Power Fiscal Fourth Quarter Results

Sep 3, 2024

-

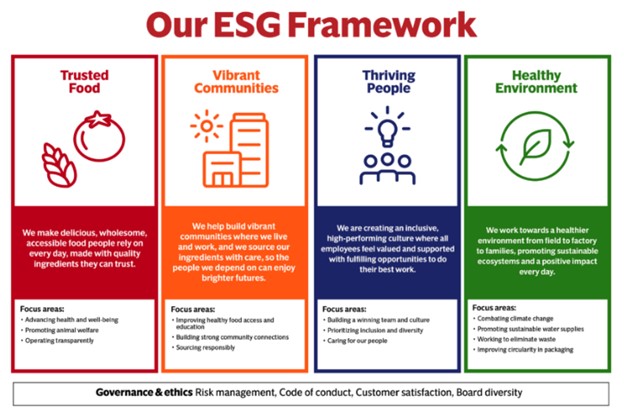

Image Source: Campbell Soup.

Looking to fiscal 2025, Campbell’s net sales are expected to expand 9%-11% thanks to a twelve-month contribution of Sovos Brands, offset in part by the divestiture of Pop Secret. Organic net sales are expected to be flat to up 2%, which reflects positive volume/mix compared to last year. Adjusted EBIT growth is targeted at 9%-11%, including Sovos and the impact of the divestiture of Pop Secret. Adjusted earnings per share growth is expected in the range of 1%-4%, inclusive of Sovos acquisition and Pop Secret divestiture, to $3.12-$3.22 (versus $3.23 consensus).

|