|

|

Recent Articles

-

Visa Expects Low Double Digit Earnings Growth for Fiscal 2026

Visa Expects Low Double Digit Earnings Growth for Fiscal 2026

Oct 29, 2025

-

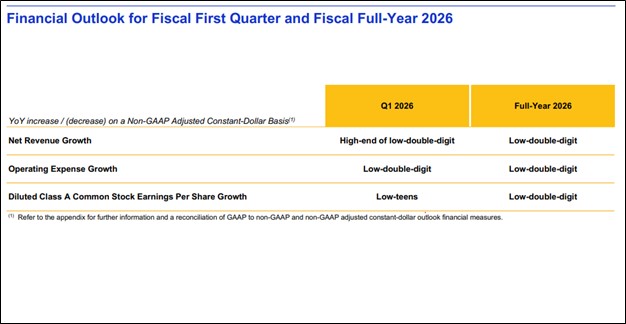

Image Source: Visa.

For the 12 months ended September 30, Visa hauled in $23.1 billion in cash flow from operations and spent $1.5 billion in property, equipment, and technology, resulting in free cash flow of $21.6 billion, or 53.9% of total revenue. Visa ended the year with cash and cash equivalents and investment securities of $19 billion and total debt of $25.2 billion. The company returned $6.1 billion in share buybacks and dividends in the quarter, and the board of directors increased its quarterly cash dividend 14%, to $0.67 per share. For full year fiscal 2026, management expects low-double-digit growth in net revenue, operating expense, and diluted earnings per share. We continue to like Visa as an idea in the Best Ideas Newsletter portfolio.

-

UnitedHealth Group Raises Full Year 2025 Earnings Outlook

UnitedHealth Group Raises Full Year 2025 Earnings Outlook

Oct 28, 2025

-

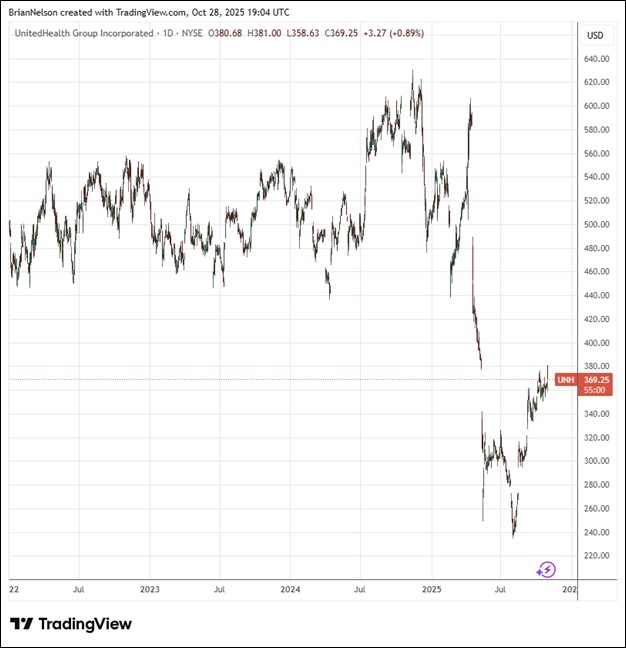

Image Source: TradingView.

UnitedHealth Group continues to work through an elevated cost environment: “The year-over-year increase (in the medical care ratio) of 470 basis points was primarily driven by the previously described significantly elevated cost trends, as well as the ongoing effects of the Biden-era Medicare funding reductions and changes to the Part D program from the Inflation Reduction Act.” Looking to 2025, UnitedHealth Group raised its adjusted earnings guidance to at least $16.25 per share. We continue to include UnitedHealth in the newsletter portfolios.

-

What Is Gold Really Worth?

What Is Gold Really Worth?

Oct 28, 2025

-

Image: Gold prices have surged since 2020, and they recently hit an all-time high.

What is the yellow metal really worth? Let's discuss the greater fool characteristics of the price of gold.

-

Thinking Slow: 3 Research Blind Spots That Changed the Investment World

Thinking Slow: 3 Research Blind Spots That Changed the Investment World

Oct 28, 2025

-

Image Source: EpicTop10.com.

We have to be on high alert about how our minds work. PBS recently delivered a four-part series examining how easily our minds are being hacked, and why it is so important to "think slow." When it comes to the active versus passive debate, does the analysis suffer from parameter risk? With respect to empirical, evidence-based analysis, does the analysis have the entire construct wrong? When it comes to short-cut multiples, are we falling into the behavioral trap of thinking on autopilot?

|