|

|

Recent Articles

-

Phillips 66 Records Strong Free Cash Flow in Second Quarter

Phillips 66 Records Strong Free Cash Flow in Second Quarter

Jul 30, 2024

-

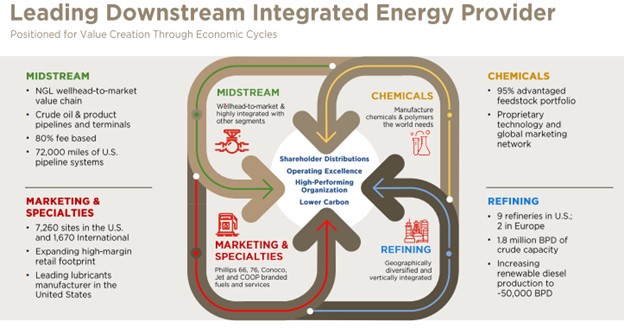

Image Source: Phillips 66 Investor Update.

We like Phillips 66’s investment prospects. The company recently raised its mid-cycle adjusted EBITDA target to $14 billion by 2025. It has a strong investment-grade credit rating of A3/BBB+, with a net debt-to-capital ratio target between 25%-30%. Maintaining capital discipline is par for the course for Phillips 66, as it has generated 12% average ROCE since 2012. The company targets returning more than 50% of operating cash to shareholders, too. Its shares yield 3.3% at the time of this writing.

-

McDonald’s Speaks of Cautious Consumer But Traction with $5 Meal Deal

McDonald’s Speaks of Cautious Consumer But Traction with $5 Meal Deal

Jul 29, 2024

-

McDonald’s second quarter results weren’t great. Comparable store sales and consolidated operating income fell during the period, but McDonald’s lapped a very strong second quarter of 2023, which included a double-digit comp. Diluted earnings per share also declined at a mid-single-digit pace. That said, however, McDonald’s $5 meal deal is gaining traction, and we think it is part of the solution for lower guest counts driven by its recent strategic pricing actions. McDonald’s hasn’t been a strong performer in the Best Ideas Newsletter portfolio of late, but we remain optimistic on its prospects in the current inflationary environment. Shares yield 2.6%.

-

3M Looks to a Brighter Future, Shares Rally 20%+

3M Looks to a Brighter Future, Shares Rally 20%+

Jul 28, 2024

-

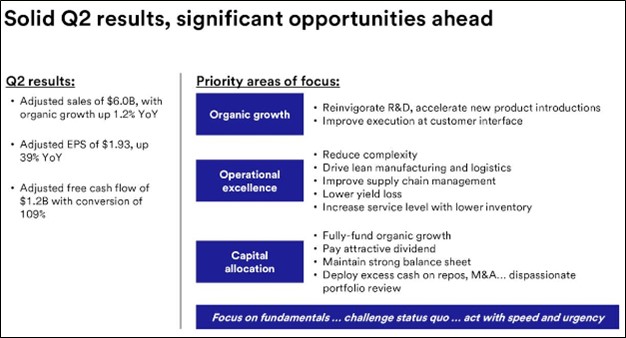

Image Source: 3M’s second quarter results were better than feared.

3M’s stock rallied more than 20% following its second quarter earnings report, as the firm works to put settlements for faulty earplugs and PFAS pollution as well as its spin-off of Solventum behind it. With most of its troubles in the rear-view mirror, 3M can now focus more of its efforts on organic performance, which was solid in the second quarter, despite some portfolio/geographic shifts in its ‘Consumer’ division. 3M’s free cash flow conversion remains robust, and its net debt stood at a manageable ~$3 billion at the end of the quarter. Shares of 3M yield 2.2% at the time of this writing.

-

Dividend Increases/Decreases for the Week of July 26

Dividend Increases/Decreases for the Week of July 26

Jul 26, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

|